How to calculate tax on cryptocurrencies

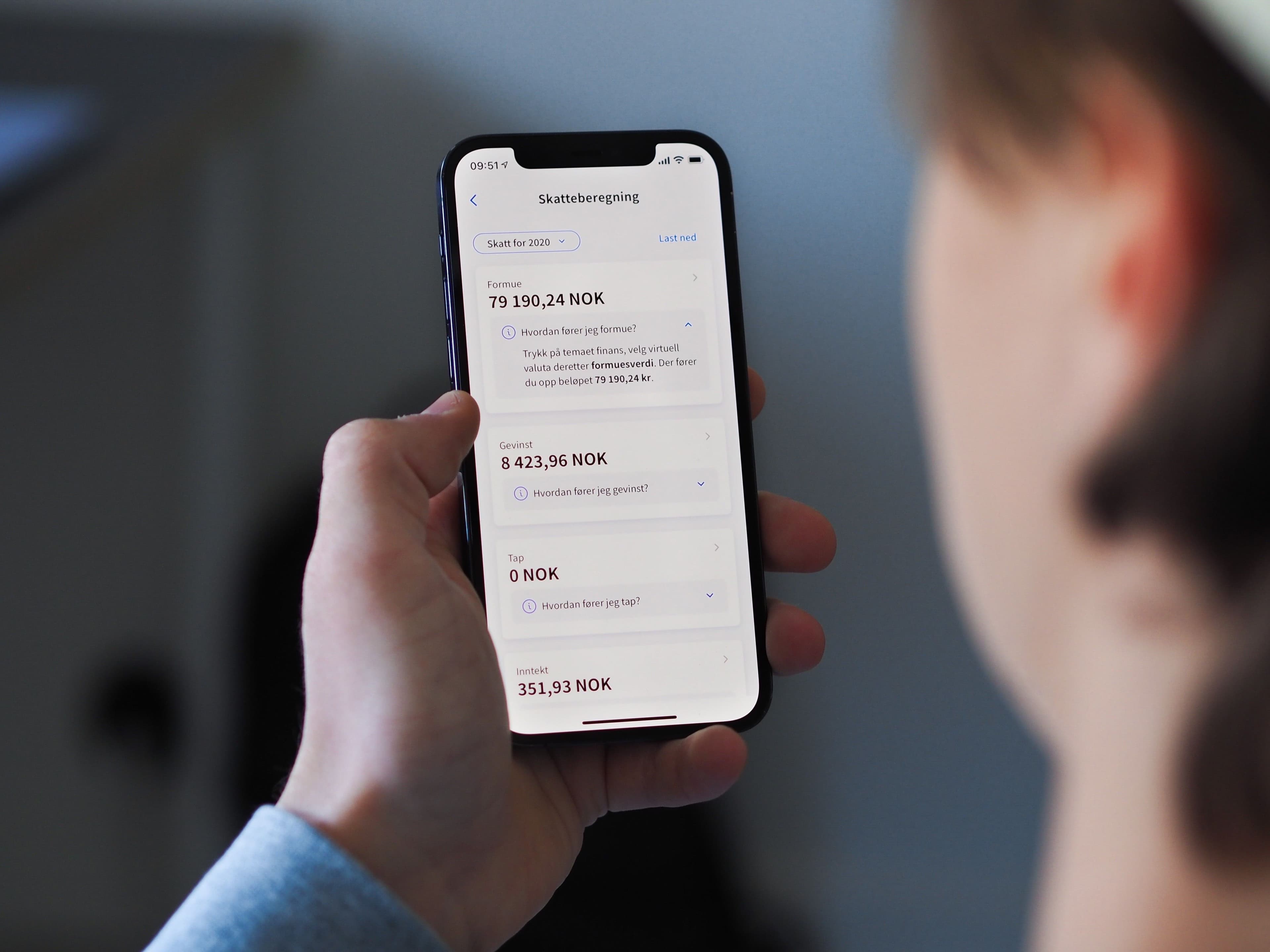

To make it easier for you to calculate taxes on cryptocurrency, we offer tax calculation for all our customers. Now you can easily get your calculations of income, profit and loss (and wealth, for Norwegian customers), and enter into your tax return.