DAO. An organization without centralized management.

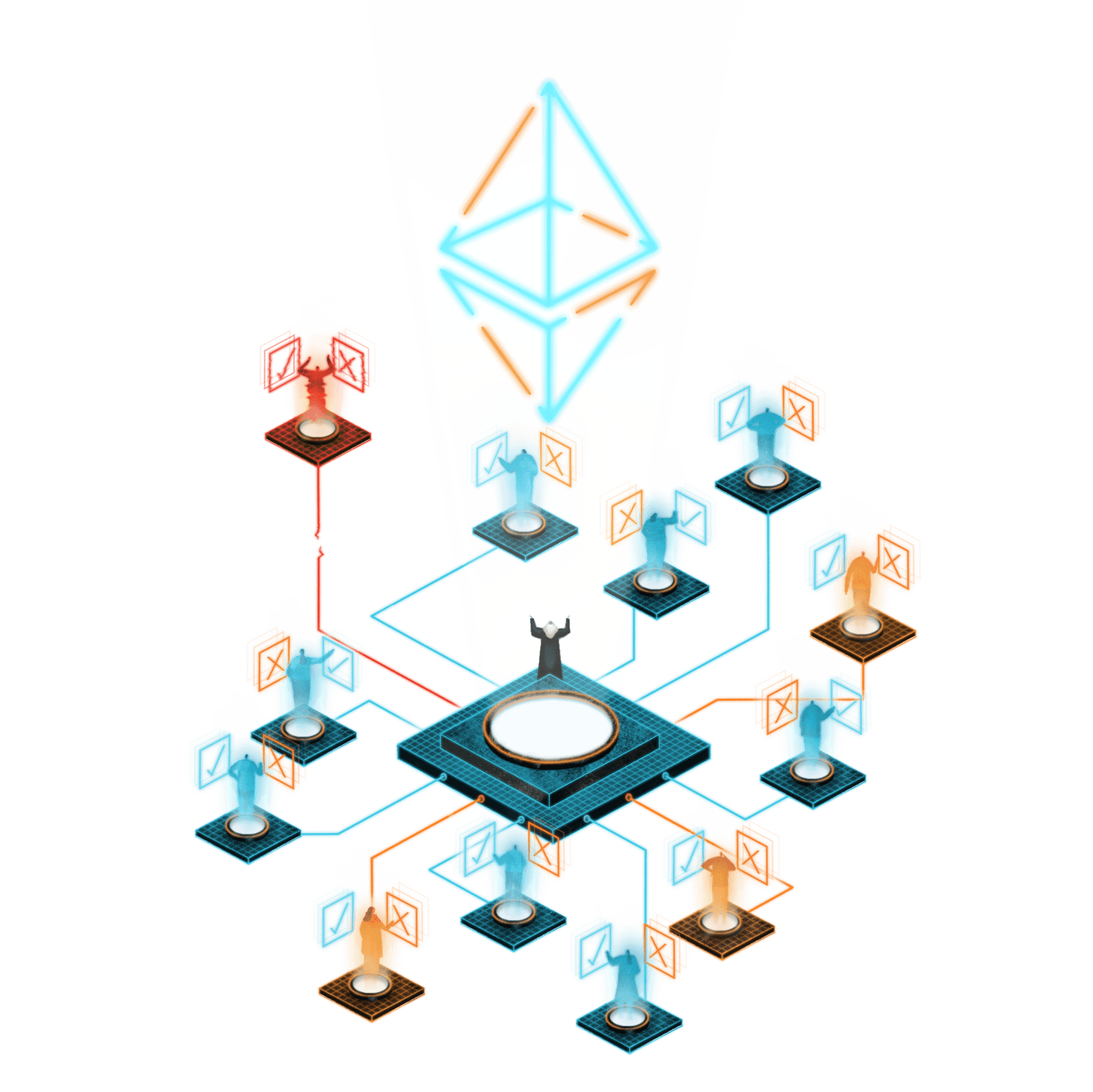

DAO stands for Decentralized Autonomous Organization. An organization run by a community, where trust is established through a smart contract. DAOs do not have a CEO or a board. It is owned by the members and makes decisions based on proposals that the DAO owners vote on.

The history of decentralized autonomous organization (DAO)

Software eats the world. Marc Andreessen said so in 2011. Marc co-authored Mosaic, the first popular browser, in 1997. Today he is a co-founder of a16z, one of the world's most prominent venture capital firms.

Software is eating the world, and software has begun to eat organizations. Decentralized autonomous organization has established itself as one of the most popular ways to collaborate and build organizations on a decentralized structure. Security and tools have improved a lot in the last two years, and DAOs are a good candidate to be the hottest crypto trend in 2022.

Early examples of DAOs

The OG DAO, Bitcoin.

When you look at the history of DAOs, it has not always been clear that it would be as popular as it is today. The Bitcoin network is the earliest example of a DAO. Bitcoin is not a DAO by today's standards, but has scaled through agreements in the network from day one. The network must agree when the Bitcoin network wants to change the protocol.

Dash

An open source cryptocurrency. The network made a "fork" from the Bitcoin protocol in 2014. Dash has a decentralized way of making decisions and is the first DAO that we know of by today's standards. DASH is operated by a subset of their users called "master nodes". Anyone with 1000 Dash Coins (DASH), the protocol's original cryptocurrency, can become a master node owner.

Dash has changed its name several times since 2014 and was first called Xcoin.

The success and failure of "The DAO"

In May 2016, some of the members of the Ethereum community started "The DAO". They intended to run DAO as a venture capital firm for crypto- and decentralized organizations. DAO raised money in a unique way. They made a wallet, and everyone who sent ETH to the wallet received DAO tokens in return.

The fundraiser was successful and they raised the most prominent crowdfunding ever with 12.7 million ETH ($ 150 million at the time).

June 7, 2017 DAO was hacked. 3.6 million ETH ($ 70 million at the time) were stolen. The hacker found a loophole in the code. He was able to ask the DAO to give Ether back several times before the smart contract could update the balance sheet.

An important note is that the loophole was not in the Ethereum code, but in the application built on top of Ethereum.

The crazy and successful idea, The constitution DAO

The constitution DAO was founded in 2021 and raised $ 47 million to purchase an original copy of the US Constitution in just five days. They lost the bidding round, but still showed the potential for global digital fundraising.

How is a DAO built?

DAO is structured differently from traditional organizations that we are used to. It has maximum transparency. It does not care where you live as long as you have internet access and there is no need for a third party.

Lives on the blockchain.

All DAOs are uploaded to a blockchain. The most popular blockchain today is the Ethereum blockchain. Due to high gas taxes on Ethereum, we have seen increased use of Ethereum in two block chains such as Polygon.

You can read more about how blockchain technology works in this article.

The most important benefit of uploading your organization to a blockchain is transparency. Everything you do on a blockchain is tracked and stored. Everyone can see who owns tokens in DAO, how they spend their money and what decisions are made.

Tokens.

Instead of shares in a company, you have tokens in a DAO. The ownership consists of token holders. Tokens represent your ownership in DAO and give you the right to propose and vote on decisions. A traditional company has a centralized decision-making process; DAOs let the members decide, and this gives everyone the opportunity to influence.

Digital Wallets.

In a DAO there are two types of wallets

- The owners wallets

- The DAOs wallets

Wallets are used to store, send and receive tokens. It is a program that interacts with the blockchain. Each wallet has one private and one public key.

The private key is like a key to a safe. You can actually look at it as your private digital bank account. The only difference is that you are the only one who has access to it.

The public key can be compared to your bank account number. This key can be shared with anyone you want. Anyone can send transactions to them. It is public on the blockchain, so everyone can see your wallet's transactions when interacting with the blockchain.

The owner's wallets are wallets that own tokens in a DAO.

DAO wallets are where the DAO receives its money, makes payments or invests. You can call it the organization's bank account.

All decisions, changes and use of funds are 100% transparent like everything else on the blockchain. This makes it easier to invest and difficult to hide important information for members.

Controlled without centralized management

Hvordan beslutninger tas og utføres er forskjellig i en desentralisert organisasjon. DAO-er administreres av kode. Du jobber for en protokoll. Du stoler på koden og fellesskapet, i stedet for en sentralisert ledergruppe.

Smart contracts.

This is a big issue since smart contracts are fundamental in most of what we do on the blockchain. We will not discuss all about smart contracts in this article, but explain how they work in a DAO.

To understand how smart contracts work, we need to understand what they are:

A "smart contract" is simply a program running on the blockchain. It is a collection of code (its functions) and data (its state) located at a specific address on the Ethereum blockchain.

Smart contracts are a type of account. This means that they have a balance and can send transactions over the network. However, they are not controlled by a user. Instead, they are distributed to the network and run as programmed. User accounts can then interact with a smart contract by submitting transactions that perform a function defined on the smart contract. Smart contracts can define rules as regular contracts and enforce them automatically via the code. Smart contracts cannot be deleted and their interactions are irreversible.

Perhaps the best metaphor for a smart contract is a vending machine, as described by Nick Szabo. With the right inputs, a specific outputs are guaranteed. "

- Ethereum.org

Smart contracts formalize rules in DAOs, examples can be:

- Voting Network consensus

- Financial decisions

- Compensation Grants

- Financing Token distribution

- Assign roles

Smart contracts set the governance structure in a DAO.

Governance structure.

Each DAO needs a governance structure. How DAO is governed is defined by the smart contract. If you do this process incorrectly, the DAO will fail.

The management provides a structure that the token holders have agreed to follow. Rules for changes or actions are coded into the smart contract. When someone wants to make a move in DAO, the token holders vote for it.

In the governance structure, you decide what percentage of DAO should be represented and what percentage must agree on the proposed decision.

An example might be if DAO wants to compensate someone for a job, they need:

- 50% of the network will vote

- 51% must agree

- 7 days voting period, so people have time to vote

If the token holders reach an agreement, the compensation will be paid as agreed.

Summary:

DAOs have endless possibilities. It is still early days, and it is unclear how DAOs will be regulated. I see more advantages than disadvantages. It makes global collaboration with like-minded people possible. It has a built-in financial structure that no one has the authority to access without the members' approval. The governance structure gives everyone in DAO the opportunity to vote through proposals and voting. In short, I see it as an effective and safe way to work with like-minded people both nationally and globally.

About the author: Sander Andersen; Norwegian technology entrepreneur, and founder of Finpeers.

You can also find @Sanderandersenn on Twitter