Crypto history - How did we get here?

In this article, we'll take you through the history of cryptocurrency, from its humble beginnings, huge rise, and the events of the last few years. After reading this article, you will be "up-to-date" on how we ended up where we are today, and perhaps also have some thoughts on where we are going next.

Who invented crypto?

Many will probably answer that "Satoshi Nakamoto", the anonymous developer of Bitcoin, invented crypto in 2008, but the idea of cryptocurrency actually has its roots further back in time, and there have been several people who have contributed to the rise of cryptocurrency.

The idea of cryptocurrency was born back in 1983, when computer scientist David Chaum created an anonymous cryptographic and electronic money system called eCash. This system was tested through a company called DigiCash in the 1990s, but was never a great success. In 1998, the Chinese programmer Wei Dai described a system he called "b-money" and a little later the American Nick Szabo launched the "bitgold" concept.

31. October 2008 - Bitcoins “whitepaper” is published.

As the very first cryptocurrency, Bitcoin was launched in a 9-page academic document. "Bitcoin: A Peer-to-Peer Electronic Cash System", was written by an unknown person named "Satoshi Nakamoto". Bitcoin is a digital currency based on a decentralized and untrustworthy system. The idea was first spread to an email list of particular interest in 2009 and spread to tech-interested early users who began discussing Bitcoin online.

2010 - Bought pizza with bitcoin

On May 22, 2010, a developer and early bitcoin user bought two pizzas online and paid with 10,000 bitcoin, which was equivalent to approx. 300 kroner at that time. Since then, the exchange rate has skyrocketed, and with today's exchange rate (January 2022), it is worth over NOK 3.6 billion! The day is remembered today as "Bitcoin pizza day" and is marked every year (humorously) by many in the crypto industry.

2011 - The emergence of altcoins (alternative currencies to bitcoin)

Based on blockchain technology and the infrastructure of bitcoin, in 2011 other cryptocurrencies were developed and introduced, such as Litecoin (LTC). Both Bitcoin and Litecoin are available for trading with us. If you are curious about how this works, you can read about how to buy cryptocurrency here.

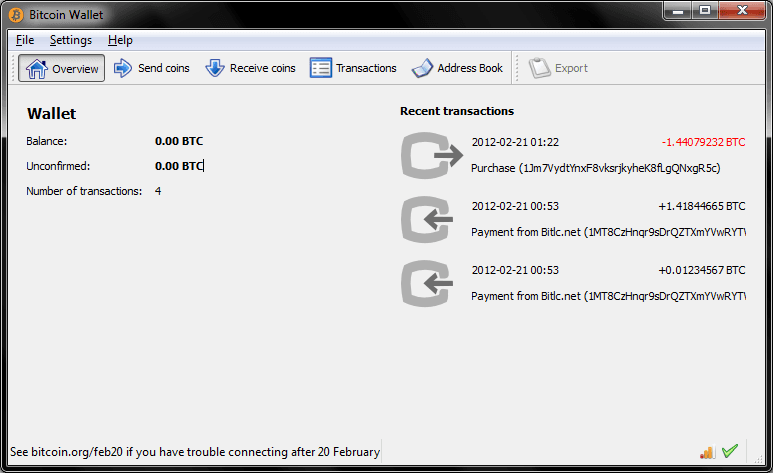

2012 - Bitcoin adoption increases and the crypto community is growing.

Crypto is no longer just a niche for a small group of self-proclaimed geeks. Interest in Bitcoin and cryptocurrency is spreading to Silicon Valley and other investment circles. The community is beginning to attract more people with a finance background and is taken seriously by entrepreneurs.

Facebook's co-founders Tyler and Cameron Winklevoss invest large parts of the profits from Facebook in Bitcoin and with it become among the largest Bitcoin owners to date. Their story would later be told in the book "Bitcoin Billionaires".

Several of the companies that have shape the crypto industry were founded at this time (for example Coinbase).

In 2012 Ethereum's founder Vitalik Buterin worked as a writer for "Bitcoin Magazine".

2013 - Cyprus Banking Crisis Helps Trigger Bitcoin Bullrun, BTC surpasses $1000 and Ripple (XRP) launches

Cyprus is going through a financial crisis as a result of the domino effect triggered by the 2008-09 crash. To pay off the debt, the authorities solve this by confiscating around half of the money in all bank accounts with over $100,000 in value. People are shocked that their money can just be "confiscated" from their account in this way by authorities and banks. Many no longer feel that the banks look after their money and are angry at having to pay for the mess their politicians and banks have made. News of the events spreads quickly and creates a new interest in a decentralized currency like Bitcoin.

With increased media coverage and interest in bitcoin, the currency is experiencing tremendous growth from under $ 100 dollars in January to surpass $ 1000 later in 2013.

Ripple launches its cryptocurrency XRP, also based on bitcoin technology, with a focus on improving international transactions such as the transfer of values between different countries.

In the summer of 2013, a man cleans his desk and throws away a broken PC including the hard drive that contains 7500 bitcoin. So if anyone wants to go on a treasure hunt for a hard drive with bitcoin worth over 500 million Norwegian kroner, garbage dumps in Newport (Wales) are a good place to start. There have been several such cases and people have been searching (desperately) for old hard drives or passwords for such.

In autumn 2013, the illegal online marketplace "Silk Road" is also shut down and the owner arrested by the FBI. Silk road was used by many to buy cannabis and other illegal goods, and an early usecase for Bitcoin was as a means of payment on Silk Road. One can assume that the stigma that crypto is "only for criminals" originates from this story. Crime is a problem that must be fought, and here in Firi we work with the AML regulations to fight money laundering. At the same time, research shows that only a small percentage of all crypto transactions are linked to crime.

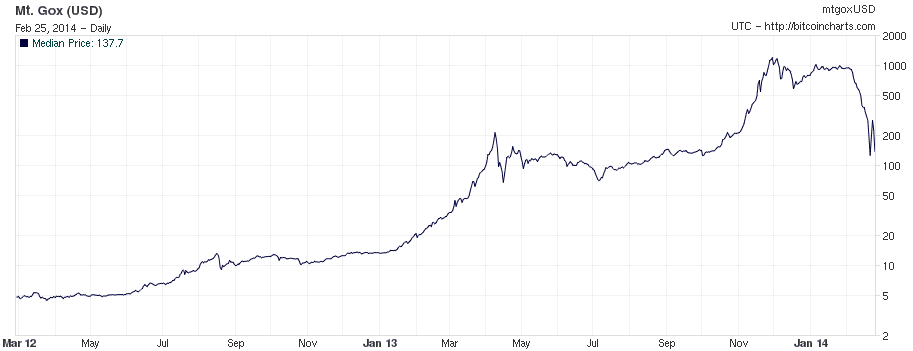

2014 - The crypto exchange Mt.Gox is hacked and shakes the market

After a bull market with a dramatic price increase through 2013 and into 2014, the bubble finally bursts when the stock exchange Mt.Gox gets into trouble.

The Japanese cryptocurrency exchange Mt.Gox, which accounted for over 70% of all bitcoin trading in the world, is hacked and goes bankrupt. This resulted in large losses, although a large part of the stolen values were recovered. With increased doubts about the security of cryptocurrency, the price of bitcoin falls and ends the year 2014 at around $ 300. Several other former crypto companies are also experiencing problems, and there is an increased focus on security and seriousness in the crypto industry. In retrospect, it has become more and more common for crypto exchanges to insure the values they hold, and for security routines to become much stricter. So do not worry, we take safety seriously to prevent such incidents from recurring.

Read more about how we secure bitcoin and other cryptocurrencies here.

2015 - Ethereum introduces smart contracts and Tether launches its stablecoin

In early 2014, at the annual Bitcoin conference in Miami, 19-year-old bitcoin enthusiast Vitalik Buterin introduces his plans for Ethereum. He has assembled a team of smart developers and Ethereum will be launched as a new platform in 2015. Ethereum is based on the technology on which bitcoin is built, but instead of being just an alternative currency, Ethereum will be a platform that allows for building decentralized applications and applications (dapps) at the top of the blockchain. So you can build whatever you want, and these programs will store their data and functions on the Ethereum blockchain. The currency ether (ETH) becomes the internal currency of this system, as it is used to both participate in and control the network. The concept of "smart contracts" is introduced. (Simply explained programs on the blockchain that enforce a contract). For example, one could now automate contracts that have to do with loans, trade, supply chain, insurance or anything else.

Tether (USDT) is launched as a stablecoin (stable currency) that is to be pegged to the value of the US dollar. This is how you can create crypto-versions of traditional currencies so that those who trade can exchange bitcoin for tether instead of having to sell it for US dollars. After Tether, several other stack coins have appeared, including DAI (link to dai) which you can buy at Firi.

2016 - Ethereum undergoes a "hardfork" after hacker attacks on the DAO smart contract

.

In 2016, Ethereum DAO (Decentralied Autonomous Organization) was subjected to a hacker attack. The hackers found a loophole in the smart contract that caused 3.6 million ether to be stolen using a so-called recursive attack.

Ethereum DAO (Decentralized Autonomous Organization) had raised more than $ 150 million from more than 11,000 investors, making it one of the largest crowdfunding campaigns in history. In a short time, the hackers had stolen ethereum worth around 50 million USD (based on the value of the time).

The whole episode ended with Ethereum choosing to run a so-called hardfork that contains code changes that essentially create a new blockchain. The counterattack moved ether from the address of the hackers to a new address controlled by Ethereum DAO.

This became the subject of much discussion and disagreement (even today), because this was in direct conflict with one of the crypto-environment's important ideals which says "code is law". In other words, what happens on the blockchain is finite and should not be able to be changed or rolled back. Part of the strength and essence of blockchain technology lies in the fact that no one from outside should be able to change the blockchain.

The majority in Ethereum decided that an exception had to be made, and Ethereum was thus divided into two, where they got a new "fork" which reversed the hacker attack. But there were also those who disagreed, and Ethereum lives on to this day, both as Ethereum Classic (the blockchain that contains the money that was stolen) and Ethereum.

2017 - “Bullrun”, new all time high and “altcoin mania”.

In 2017, bitcoin experienced incredible growth, from just over $ 900 in January to just under $ 20,000 in December, then cooled down and ended the year with a price tag of around $ 16,000. Crypto "bullrunet" continued further into January 2018 with Ethereum and other altcoins that went completely to heaven. Ethereum went from around $ 7 in January 2017 to a peak of over $ 1400 in January 2018 and made the early Ethereum investors insanely rich in a very short time. In the wake of Ethereum's launch where they made a so-called ICO (Initial coin offering) where they sold ether to early investors, a whole bunch of new cryptocurrencies gradually appeared that also collected money through an ICO, and it all developed into a full "ICO Mania ”with various altcoins, a big bubble that the world had never seen before. This bubble finally burst in January 2018 where many of these projects crashed and lost up to 90% of their value in a short time. Many coins never came back from this crash, and some of the projects were shut down.

2018 - The great cooldown and The Lightning Network

In 2017, most people could make good money on the rise of the many different cryptocurrencies, regardless of whether one invested in good or bad projects. But whether they really got to keep the money depended on whether they managed to sell out in time. Many also lost a lot of money because they bought at the top and were with the crash all the way down again.

The market experienced a severe cooling in 2018, and there were large price falls on all cryptocurrencies. The price of bitcoin at the end of 2018 was around $ 4000.

The good news this year, however, was the introduction of the "Lightning Network", which will make bitcoin transactions both faster and cheaper.

Another good news was that in the middle of this extreme downturn we chose to continue with Firi (formerly MiraiEx), which we started at the end of 2017. So that today there is a Nordic cryptocurrency exchange where Norwegians can buy and sell bitcoin (BTC) , Ethereum (ETH) and other cryptocurrencies for Norwegian kroner.

Warnings against cryptocurrency

In the years 2017 and 2018 crypto started to gain a lot of public attention, and the major mainstream media wrote a number of cases about cryptocurrency in this period. The great cooling of 2018 fueled the critics who were eager to judge cryptocurrency as little more than a scam or a “tulip mania”. Many actors went public with warnings against investing in cryptocurrency.

In Norway, the bank Nordea banned its employees from buying cryptocurrency, several public figures predicted that the bitcoin price would fall to zero.

The price of bitcoin, and other cryptocurrencies, fell further in November and finally found a bottom at the end of 2018. Nevertheless, despite falling prices and a hard year, the players in the crypto industry continued to build and innovate.

2019 - Firi launches the first registered Norwegian crypto exchange

2019 was a very rich content for us in Firi. Following the registration with Finanstilsynet in January, we launched the cryptocurrency exchange and fully invested in Norway.

Firi (formerly MiraiEx) was well received by the market, and experienced good growth in user base and number of transactions. It was not only our users who welcomed us. Both The Factory and Angel Challenge took us into their programs to help us grow and raise external capital, which we did.

2019 - New price increase and "mini bullrun" for Bitcoin.

After a decline in prices and less interest in 2018, the year 2019 started with low prices and a "bear market" that reached the bottom. From February 2019, price developments began to point upwards again, and new optimism for cryptocurrency began to build up. Moreover, even though prices had been low, people had not stopped building and innovating. Many smart people had been working hard all over the last year, and many of the crypto innovations such as Defi, NFTs, Gaming, Metaverse and so on were further developed.

In May 2019, Facebook also announced that they were planning their own cryptocurrency "Libra", which was later met with skepticism by US senators and also by many in the market. The plan was later postponed and downgraded, but still lives under the name "Diem".

In 2019, moreover, a strange story reaches the media when a Canadian crypto exchange named Quadriga announces that their CEO Gerald Cotten has been found dead on holiday in India. Cotten put on access to a large sum of money and only he had the password to the crypto wallet. There is speculation that he may have forged his own death, and today it remains a mystery what really happened in India. This story again highlighted the importance of a focus on professionalism and security routines for the crypto exchanges, and that it is the players who take this seriously who will survive and succeed in crypto. We at Firi take safety seriously!

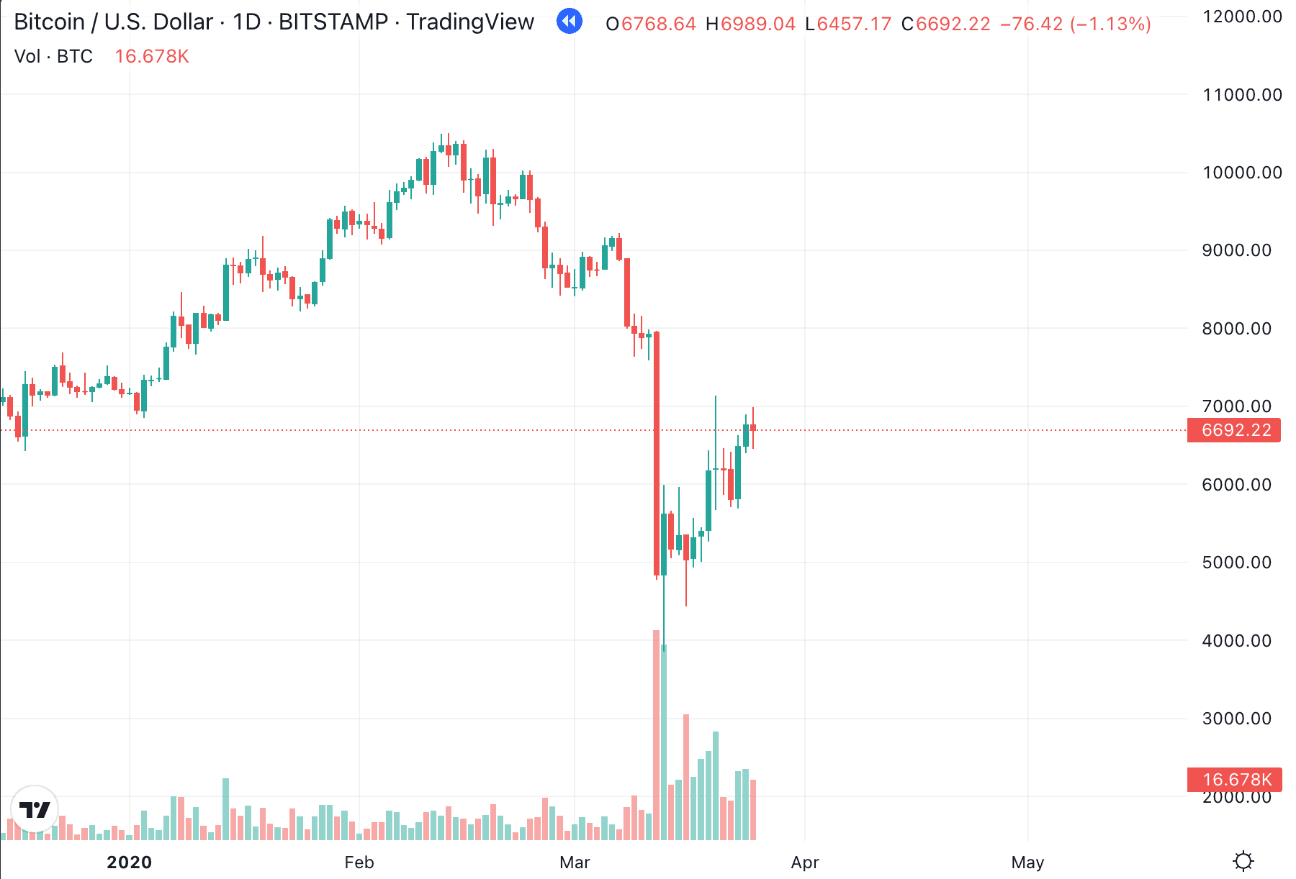

2020 - Bitcoin is still alive, and the corona crisis kicks off the biggest "bullmarket" of all time

After being declared dead over 350 times in the last decade, bitcoin turns out to be the best investment in 2010 - 2020. In 2020, optimism rose again as a new Bitcoin halving approached in May 2020. The halving has historically been the starting point for Bitcoin's "bull markets" because the halving cuts the number of new bitcoins mined by half. When only half as many new bitcoins come on the market, while demand is the same (or in this case rising) then it will create a positive pressure on the price.

Bad news came from China in early 2020. The corona virus had spread to a worldwide pandemic, and unrest began to spread in the financial markets. It culminated in a major price slump in all the major markets. Both stocks and cryptocurrencies experienced a huge crash, and the price of Bitcoin dropped all the way down to around $ 3000 in early March. Bitcoin was again declared dead.

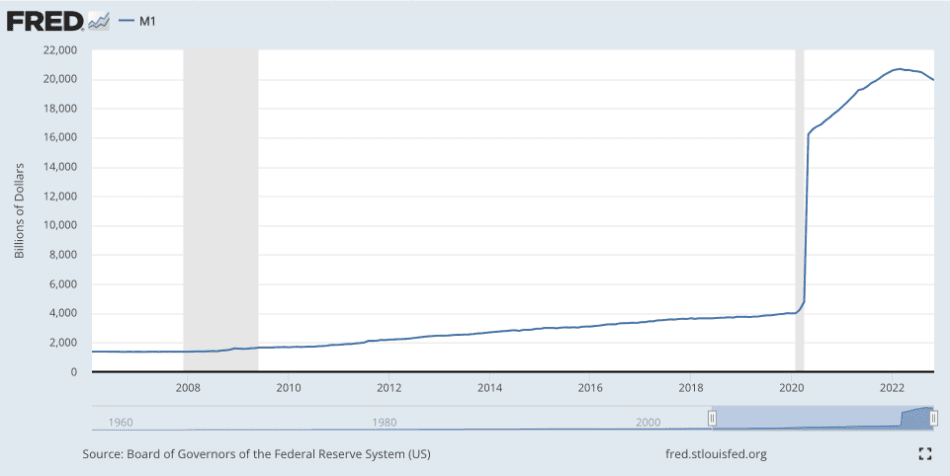

But what happens when the whole world has to shut down, people have to stay at home and the authorities in the world's leading nations do not really have enough money on the books? Yes, they are starting to print money.

Jerome Powell in the US Federal Reserve, and his colleagues in other countries, started printing money to keep the economy going and stimulate the financial markets. Never before in modern times has so much money been printed as in 2020 and 2021, which has contributed to the world's financial markets going from a major crash to the largest ever price increase, creating a giant bubble. The US S&P500 index, for example, continued to set all-time highs throughout the second half of 2020, throughout 2021 and into 2022.

Many of these currencies also found their way into crypto and Bitcoin. As mentioned, Bitcoin had halved in May 2020 and both the development and adoption of crypto has had enormous growth. Adoption began to be seen from large and respected players in finance, and one well-known investor after another began to publicize his enthusiasm for crypto. When the stimulus measures from the world central banks started, it gave the growth in Bitcoin and crypto an extra strength, and this has taken us into the historical growth we have today. In the autumn of 2020, Michael Saylor, the head of the listed American company Microstrategy, announced that they had bought Bitcoin for over $ 250,000,000 and after this several other well-known companies came out with similar news, including Elon Musk and Tesla.

Since halving in 2020, more niches in crypto have also emerged and created new opportunities for investors. The summer of 2020 is remembered as the "Defi Summer" because the emergence of decentralized finance (DeFi) led to wild price increases in many new DeFi cryptocurrencies. Projects such as Compund Aave, Maker, Yfi, Chainlink, Uniswap and Sushiswap had an extreme price development and climbed into the list of the largest cryptocurrencies.

2021 - New heights, mainstream adoption, Memecoins, NFTs and Metaverse.

2021 started the year with a continuation of the upswing in 2020. During 2021, Bitcoin set an all time high of around $ 69,000 in November before the price fell again towards the end of the year.

But 2021 was also the year crypto really went "mainstream" and the increase in new users exploded from January onwards. In addition to the fact that Bitcoin and Etherum have had good price developments, it has been seen in particular that altcoins have again received a lot of attention.

Elon Musk may have made his mark on the year in particular. In addition to revealing his interest in Bitcoin and crypto, Musk began talking hotly about the memecoin Dogecoin (DOGE) in several of his twitter messages. Dogecoin was started as a parody, and uses a well-known internet meme with a Shiba Inu as its trademark. But DOGE works technically and can actually be used as currency. Elon Musk amused himself with Dogecoin in his Tweets, and it resulted in DOGE becoming one of the most traded cryptocurrencies almost overnight and the price exploding. In the wake of DOGE, a wave of "dogecoin copies", such as Shiba Inu (SHIB) and the like, quickly emerged, and it all developed into a "memecoin mania". Many of these were unfortunately junk projects without any fundamental use, and many felt this was an unfortunate trend for crypto.

We also experienced a large price correction from the top in April / May where the market overheated and attention was again seen around the energy use of Bitcoin and other cryptocurrencies. China and other governments "cracked down on crypto", but only with a temporary effect. Nevertheless, crypto-adoption sim continued strong growth. There is so much to write about and it will be difficult to include everything that happened in 2021 because this year was really historic for crypto, and maybe also in a world context.

Here are just a few of the things that happened in 2021:

- Many of the world's largest financial institutions went heavily into crypto

- A number of crypto companies went public.

- El Salvador adopted Bitcoin as a national currency, mined bitcoins with volcanic energy and announced plans for a "Bitcoin City"

- China banned crypto mining, and mining moved in record time to the United States, Kazakhstan and a number of other countries

- Memecoin mania exploded. Some millionaires overnight, while others lose everything.

- The increase in crypto scammers is worth mentioning. So-called "rug-pulls" happen daily, and new investors must learn to take care of themselves.

- NFTs are emerging as a new trend in cryptocurrency, and are developing into a leading field in blockchain.

- Ethereum gets scaling problems as a result of its own success. The "NFT boom" is an important reason for this.

- The website opensea sets new records both in price of "digital art" and in trading volume on the Ethereum network.

- Other L1 cryptocurrencies ("Ethereum competitors") achieve great success because users move from ethereum to other networks that are not overloaded. Binance Smart Chain, Solana, Terra, Avalanche and more are growing rapidly

- Crypto-gaming is taking off and the "meta-verse" is a trend carried forward by the crypto industry

- Digital properties in the "meta-verse" are sold for millions online.

- Facebook announced that they will change their name to meta and focus on the "metaverse" trend

- "Web3" is emerging as a new concept. The new internet will be built on the blockchain

- Several leading crypto investors are joining the list of the world's richest.

- Firi will be one of Norway and the Nordic region's fastest growing companies

2022 - A new "bear market"

After an eventful year in 2021, both in the stock market and in the cryptocurrency market, the party came to an abrupt end at the beginning of 2022. The year started with speculation as to whether the bull run would continue after a short correction, but it gradually became more and more clear that the top had been passed. More and more investors sold out of stocks, cryptocurrency and other risky investments.

After the enormous money printing of the last two years, record high prices in the financial markets, the shutdown of the economy and the pandemic, the global economy was challenged with high inflation, and fears of hyper inflation. The American central bank, and their colleagues in other countries, had to increase interest rates and tighten monetary policy. In practice, this meant that interest rates, which had been at record lows to stimulate the economy, had to be sharply adjusted upwards. We will not go into more detail here, but one can simply say that the American central bank popped the bubble in the financial markets.

In 2022, the prices of a number of well-known investments fell well over 50% from the peak in 2021.

Bitcoin (BTC) -65%

Facebook (META) -64.43%

Tesla (TSLA) -67.8%

Warner Bros Discovery (WBD) -60.33%

Netflix (NFLX) -51.31%

The selling pressure in the markets was a trend that continued throughout the year. This also revealed problems in the crypo market with players who had taken far too great a risk and now ended up in trouble because of the falling prices.

Terra Luna collapsed in May

When Terra Luna collapsed it was considered the biggest crypto crash ever with an estimated loss of around $60 billion. The "stablecoin" TerraUSD was no longer stable, and the fear that other stablecoins would also suffer the same fate shook the entire global crypto market. Many lost money on Luna or in connection with the bankruptcies that came in the wake of this collapse.

We won't go into detail on why the collapse started here, but it started with TerraUSD, Terra's stablecoin, losing its 1:1 value against the dollar, which set off a domino effect of selling. TerraUSD and Terra's own cryptocurrency LUNA were closely linked. And when they crashed it created a liquidity crunch throughout the crypto market. The Luna coin went from an all-time high of around $119 to less than a fraction of a penny.

The crash bankrupted, among other things, the crypto-investment fund "Three Arrows Capital" and many other lenders. In June, Celsius paused withdrawals due to "extreme market conditions", and this news caused crypto prices to fall further. Then a month later, Celsius ended up filing for bankruptcy. Another company, BlockFi, had to be bailed out by FTX with a cash injection of $400 million. Little did the market know that FTX, which at the time seemed stable, would create an even bigger scandal when they collapsed a few months later.

November - FTX and their sister company "Alameda Research" go bankrupt

November was a heady month in crypto. But what really happened to FTX?

FTX was one of the world's largest crypto exchanges in terms of trading volume and was valued at $32 billion earlier in 2022. However, when customers, following speculation on Twitter about FTX's solvency, became uncertain about the solvency of FTX, they began withdrawing their values from the platform.

FTX was caught with their pants down, when it turned out that they have used their customers' funds for lending and other activities. This works just fine as long as the customers keep the funds on the platform. But when customers want to withdraw their money and there is not enough money there, the collapse becomes a fact.

After FTX applied for bankruptcy protection on 11 November, at the same time as manager Sam Bankman Fried announced his resignation, the investigation into what had happened began. It was soon revealed that a number of illegal activities had taken place in FTX and their sister companies and Sam Bankman Fried was later arrested and charged with fraud.

A number of Norwegians succeeded in moving funds from FTX to Firi and elsewhere before it was too late, but many still have funds that are now blocked at FTX.

It is important to emphasize that Firi does NOT take risks with your values. We do not touch your funds unless you specifically ask us to do so.

2023 & Beyond..

2023 has already proven to be an eventful year for crypto. During 2023, we have already seen the market rise sharply during the first months of the year. We also got a decision in the long-running lawsuit between the SEC and Ripple. This is an issue that is important to the entire crypto market, and .

Last, but not least, we have seen that the biggest players on wall street, such as Blackrock, Fidelity, JP Morgan Chase and more, have seriously embraced crypto. In particular, there has been a lot of talk about listed bitcoin funds (so-called ETFs) that Blackrock and others have applied to launch. If you don't know these companies very well, that's understandable, but we recommend you do a few google searches to find out more. Blackrock, for example, is the world's largest asset manager, and manages roughly 6 times as much assets as the Norwegian oil fund. These are really the biggest players in finance we're talking about, and that says a lot about how far Bitcoin, and cryptocurrency in general, has already come.

We are very proud to be a part of the crypto industry and are excited to follow the development further. The past few years have been fantastic and we believe this is just the beginning. Where do you think the road will take us next in 2023 & beyond? Feel free to follow us on social media and share your thoughts!

If you want to know more about how to invest, you can read more here abouthow to buy cryptocurrency.

Sources:

Gemini

The DAO (Wikipedia)

MicroStrategy (Wikipedia)

Quadriga Fintech Solutions (Wikipedia)