Firi Weekly: Tariff-ic Uncertainties

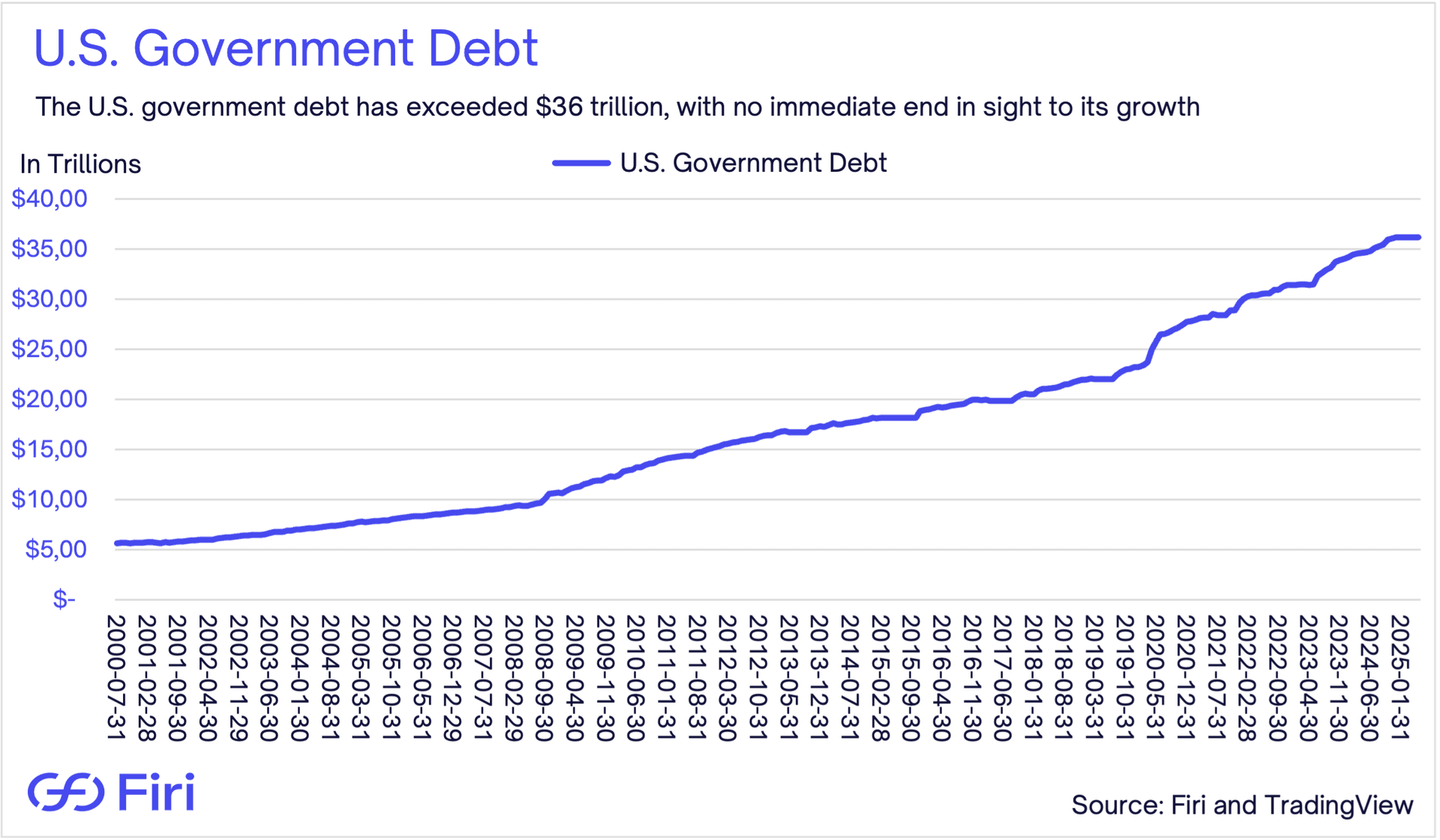

- Legislative Bill Misses Crypto Relief:

- Trump's "Big Beautiful Bill" passes without the crypto tax reforms the industry hoped for, though its macroeconomic impact will ripple through digital asset markets.

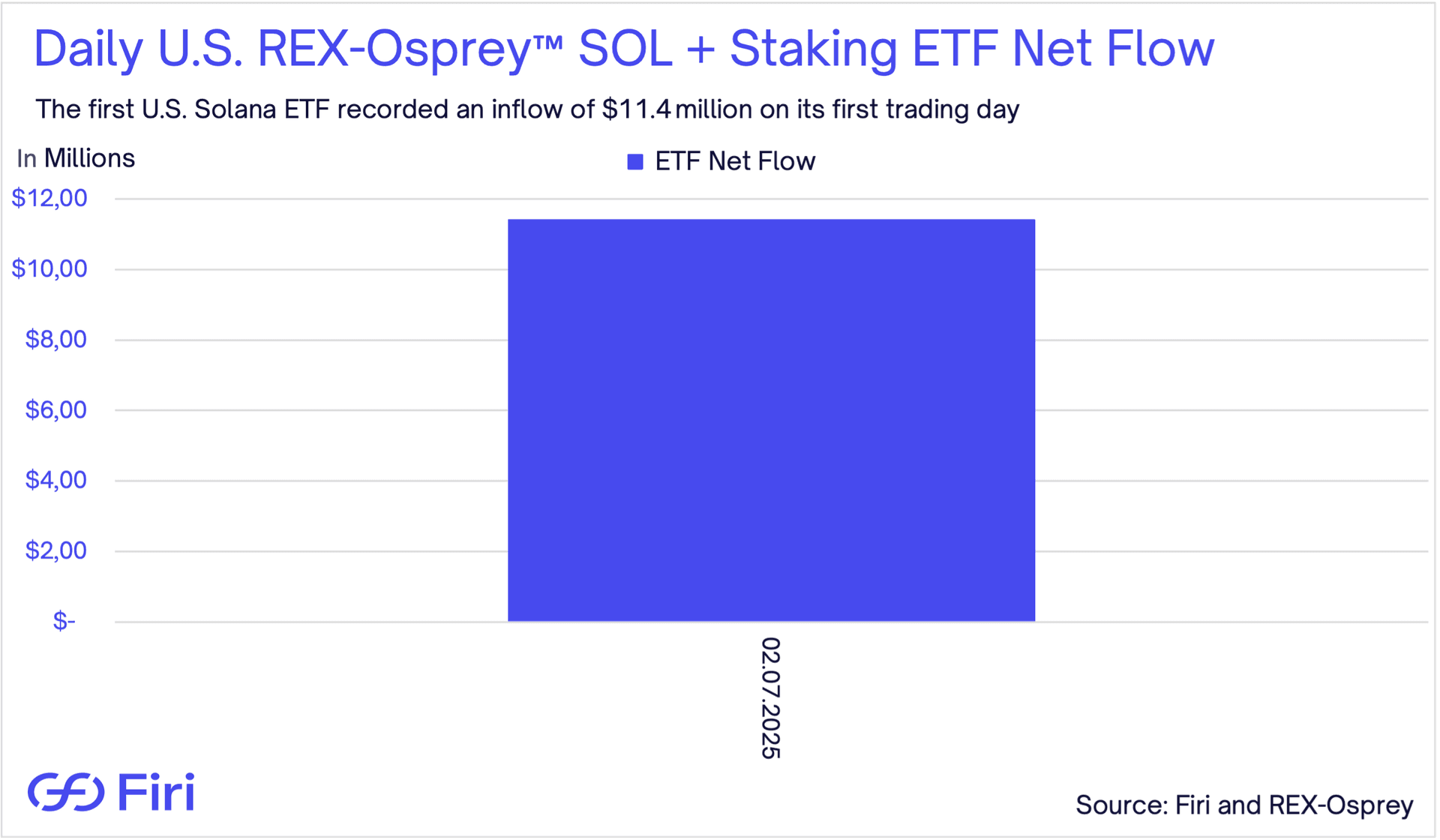

- Crypto Goes Banking:

- Circle and Ripple file for national bank charters as crypto firms push deeper into traditional finance territory.

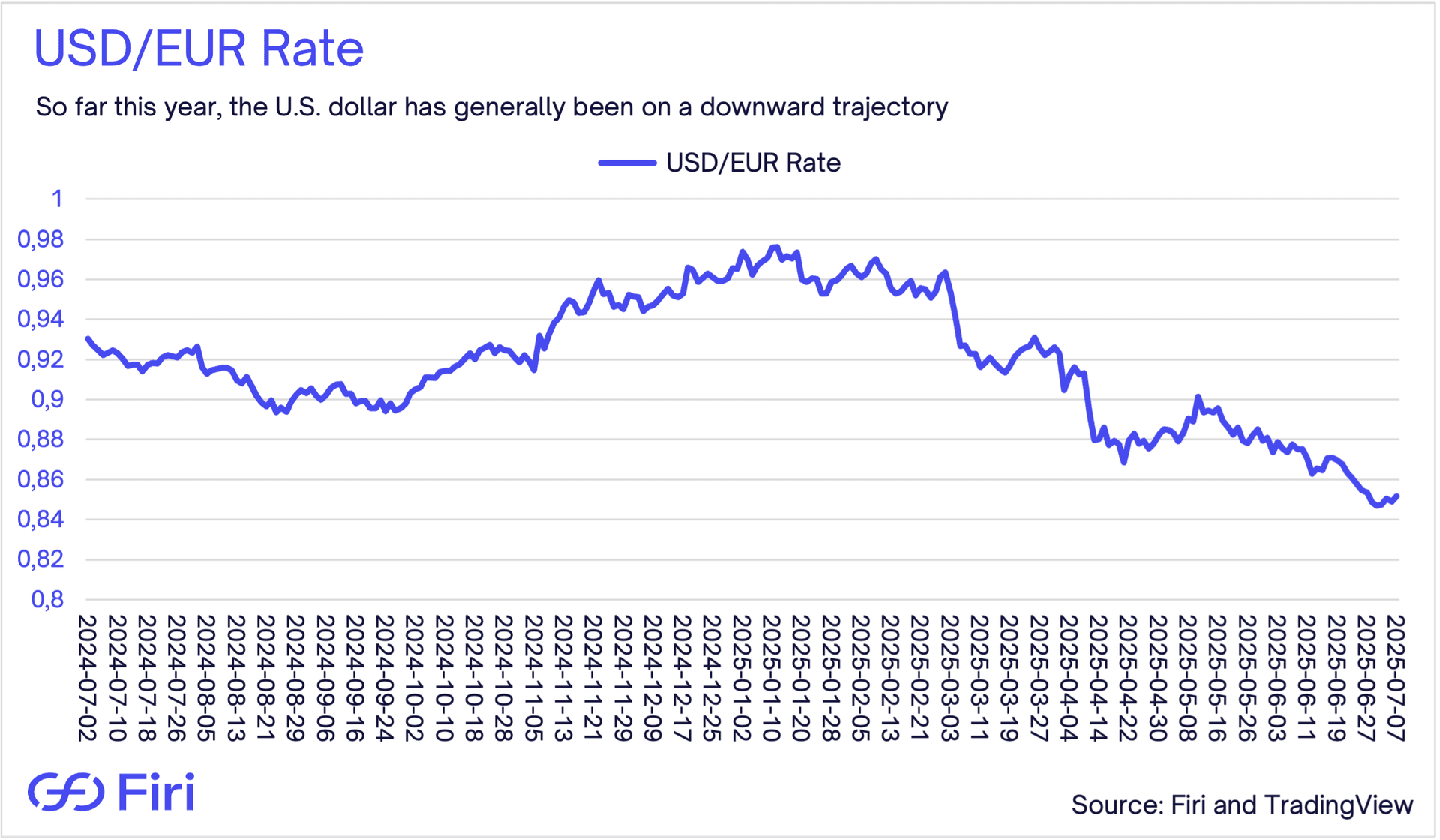

- Tariff Deadline Looms:

- Markets brace as Trump's 90-day tariff pause expires Wednesday. Few countries have secured trade deals to avoid new levies.

- Ancient Bitcoin Awakens:

- A mysterious $8.6 billion transfer of 80,000 bitcoins dormant since 2011 marks the largest "Satoshi Era" movement ever recorded.