Firi Weekly: One 'Crypto Week' Later

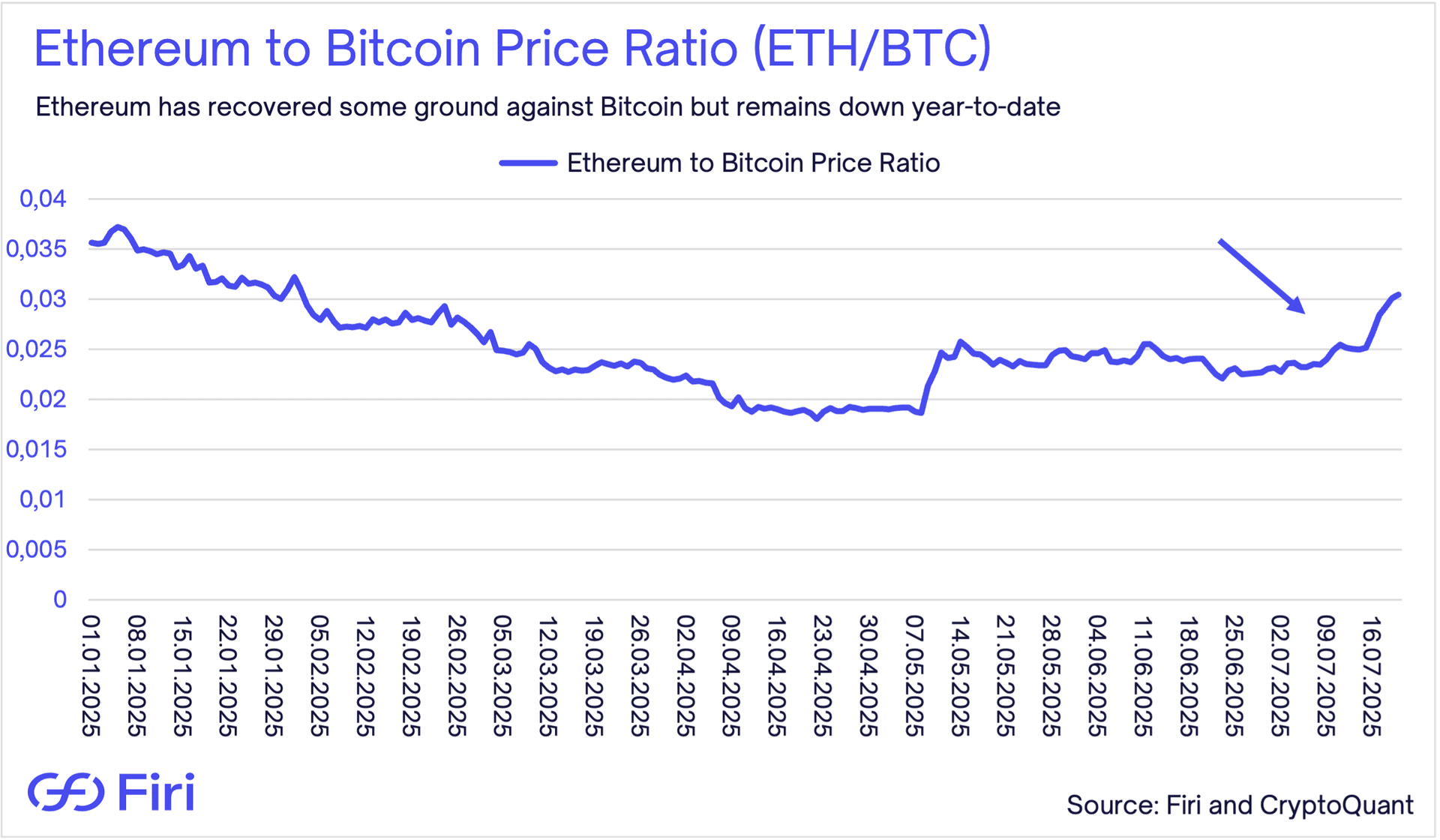

- Crypto Week Triumph:

- Trump signs GENIUS stablecoin act into law as House passes two additional major crypto bills, marking a watershed moment for U.S. digital asset regulation.

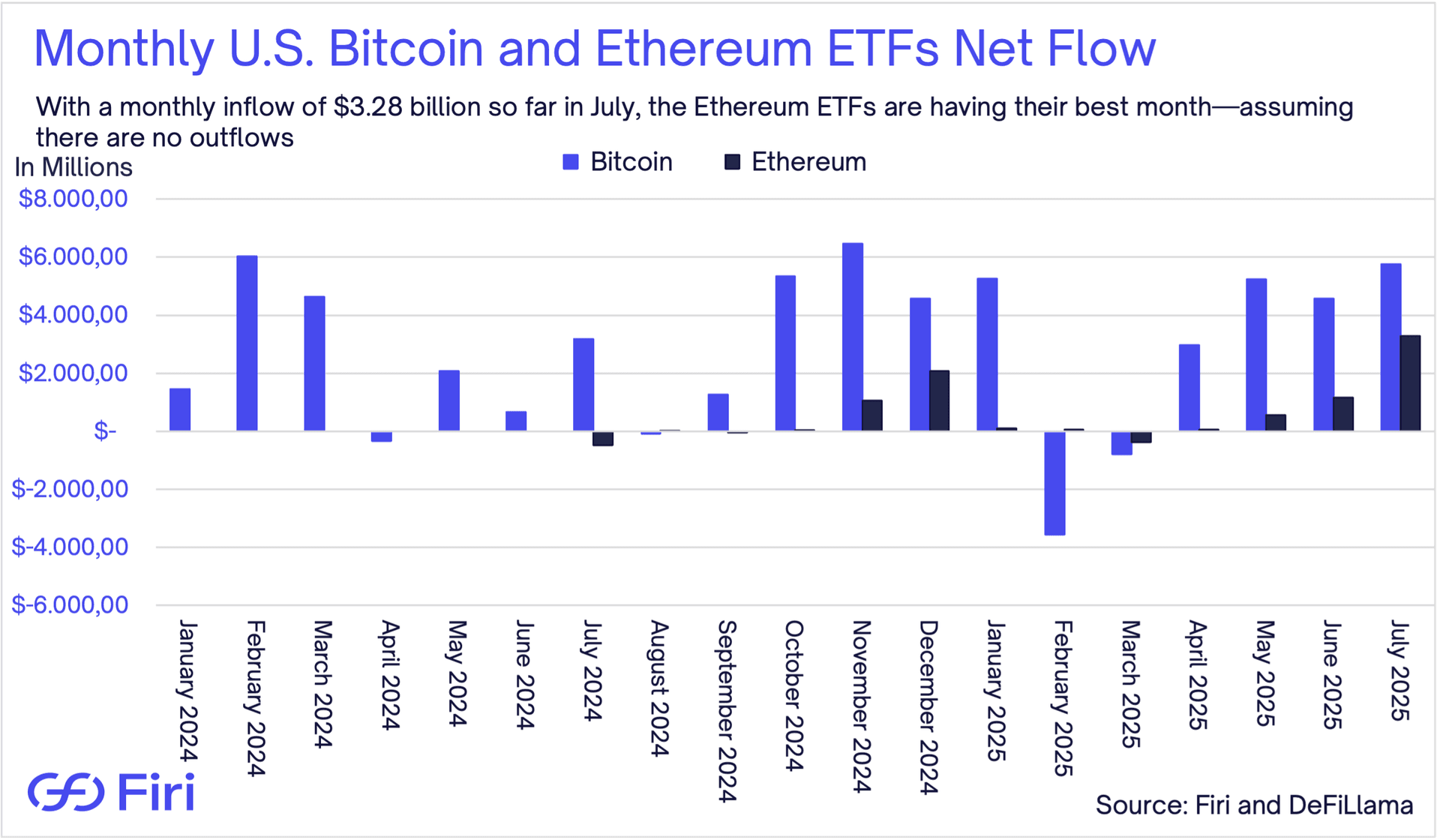

- Ethereum ETFs Break Records:

- July's $3.28 billion inflows set to make it the best month ever for Ethereum ETFs, surpassing December 2024's $2.08 billion milestone. Meanwhile, BlackRock's ETF files for staking the underlying Ether.

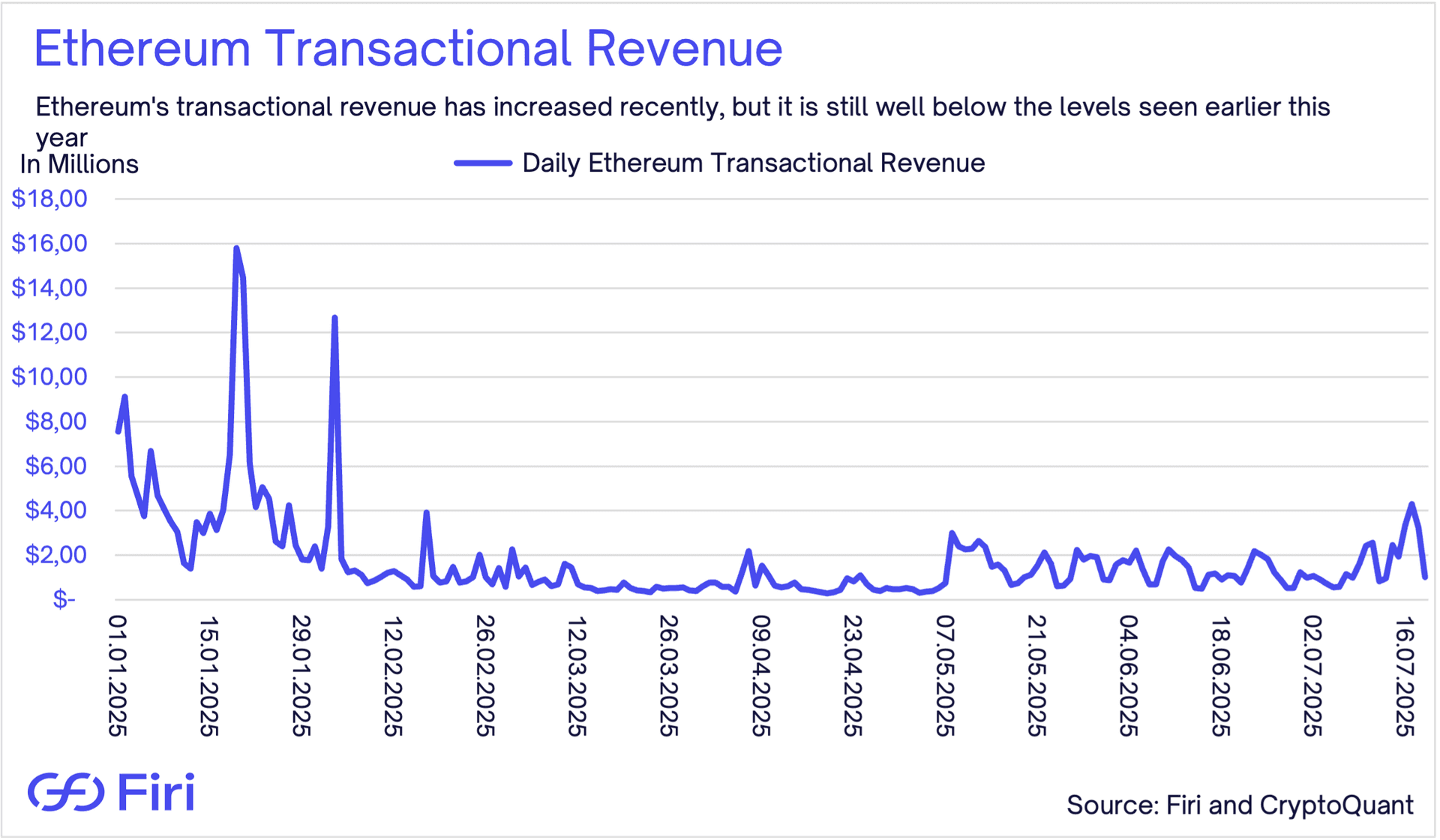

- Network Revenue Concerns:

- Ethereum transaction fees remain well below early-year highs despite price rally, signaling reduced network activity and less Ether burning.