Firi Weekly: All-Time High Ahead of U.S. ‘Crypto Week’

- Bitcoin Breaks Records:

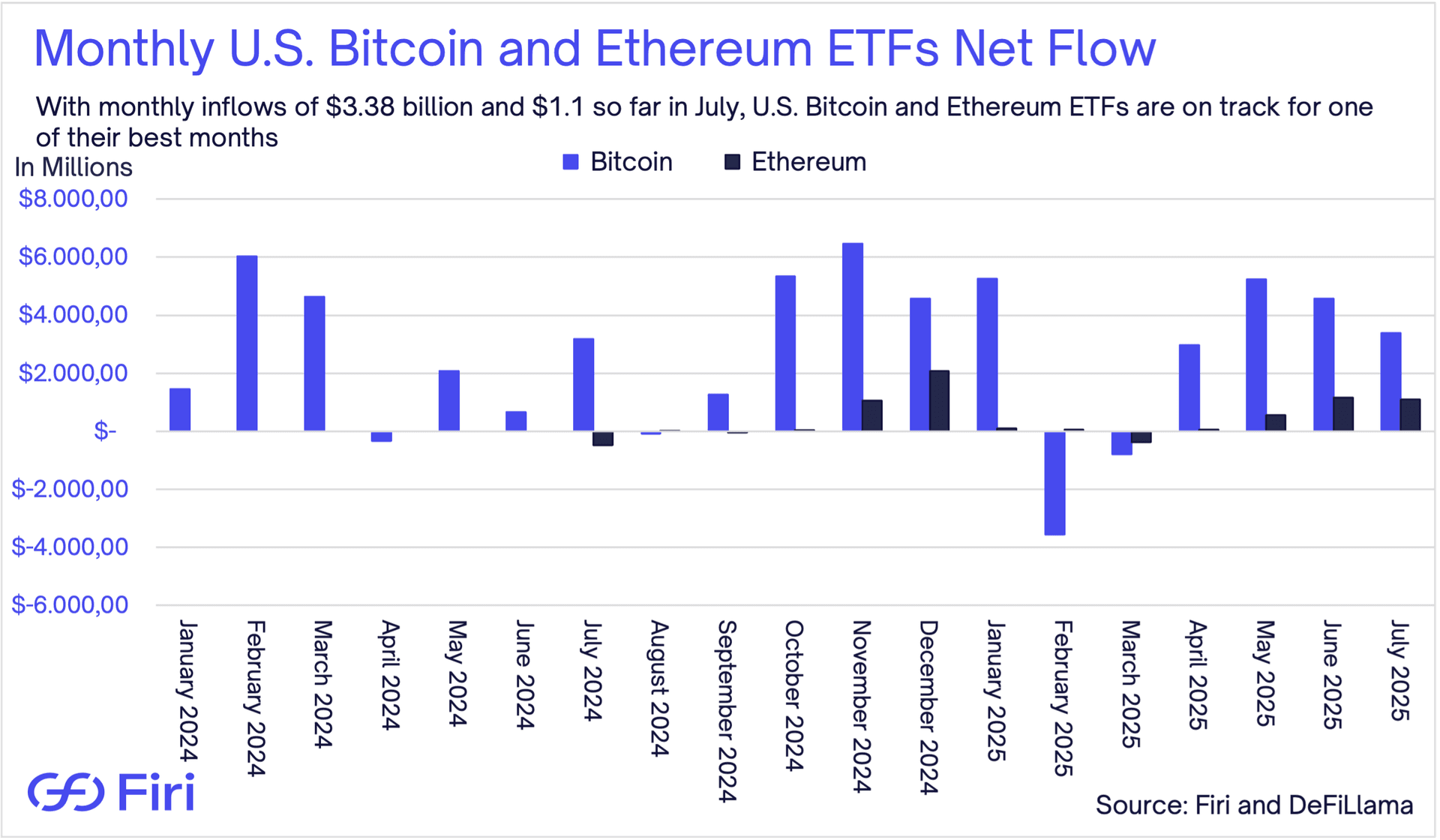

- Bitcoin soars to new all-time high of $122,900 as tech stocks rally and exchange-traded funds (ETFs) see massive $3.38 billion July inflows.

- Trump's Tariff Bombshell:

- European Union (EU) and Mexico face 30% tariffs by August 1st, escalating trade tensions as European leaders scramble for solutions.

- Memecoin Mania:

- Pump.fun raises eye-popping $600 million in just 12 minutes, highlighting crypto market's speculative fever.

- Congress Goes Crypto:

- U.S. House launches "Crypto Week" with stablecoin regulation and cryptocurrency markets bills on the agenda, signaling regulatory breakthrough.