Tips when investing in cryptocurrencies

Investing in cryptocurrency has yielded good returns in recent years, but the market is still characterized by large fluctuations. How should one manage to time the prices, and when is it best to buy crypto?

Smart measures that can ensure a good return on investment in cryptocurrency

There is a lot of focus on finance and the stock market in these turbulent times, with pandemics, recessions, falling oil prices, power crises and volatile / fluctuating stock prices. As Norway's largest and most popular platform for saving and investing in cryptocurrencies, we want to share information about alternative options for shares and funds, so that you can get a good return on your savings.

When it comes to cryptocurrency, it is important to be aware that we are still in the start-up phase. The market is still young, and the development is lightning fast. New protocols and projects are launched every single day, and only time will tell what survives.

Create an account and get started with crypto investing today!

Diversification - Do not put all the eggs in the same basket

This is rule number one. You have probably heard the phrase "do not put all your eggs in one basket", a good rule of thumb that is about diversification and risk diversification in an investment portfolio.

It may be that you have invested a share in real estate, a little in gold and bitcoin, and the rest in technology stocks. You have chosen to put the eggs (your values and means) in different baskets, and it is unlikely that all your eggs will break (lose value) if you should be unlucky and lose one basket in the ground. You have thus managed to spread your risk, with a diversified portfolio.

What are altcoins?

Altcoins are simply explained as "non-Bitcoin" cryptocurrencies. These are "alternative cryptocurrencies".

Although the crypto market largely follows the price of bitcoin, it would be wise to spread the investments here as well. Buy some bitcoin, maybe some ether and for example ada, and you have spread your risk here as well. Of course, you can also spread the portfolio over even more altcoins, thus increasing your chances of joining the journey if one of your coins gets a huge boost. BUT, investing in altcoins generally involves a greater risk than investing in Bitcoin.

It is worth noting that altcoins at times, or completely, follow Bitcoin's price development. This often means that when Bitcoin rises 1%, a typical altcoin rises 3%. But it also means that when the price of Bitcoin falls, the prices of altcoins fall even more. The reason why the price of altcoins rises or falls faster has to do with two things: the market cap (Market Cap) and the trading volume. That is, the value of all coins of the relevant currency is much smaller than Bitcoin, and that there are fewer people who buy and sell these cryptocurrencies. This means that less money is needed to change the price in a positive or negative direction.

Some altcoins will also be popular for a period before they then lose progress, prices fall again and they trend towards zero. It is therefore important to do basic research before investing in altcoins. The altcoin projects that manage to establish a "use-case", have a solid following and a good business plan has a greater chance of surviving and becoming bigger in the long run.

This is what we should know about altcoins offered by Firi

We can not guarantee the price development of cryptocurrency, and you are responsible for your investments, but all coins listed with Firi go through a selection process where we look at the basics. We will never list cryptocurrencies that are junk or where fraud is suspected.

Saving in crypto - Dollar-Cost Averaging (DCA)

In the same way that we can spread risk in industry, geography and the market, we can also spread risk over time. Since few people are able to predict where the market is heading at any given time, regardless of whether it is the cryptocurrency, housing or stock market, it is rarely wise to be stressed about potential future ups or downs.

With a savings agreement where you invest a fixed amount each month, you will even out the purchase price and thus increase the probability of a good return. Even if your portfolio will decline in value in times of recession, with this plan you will buy yourself up at reasonable prices, and thus get a faster / larger rise when the market turns. This investment strategy is very popular and is called dollar cost averaging (DCA).

Return on various portfolios over the last 5 years

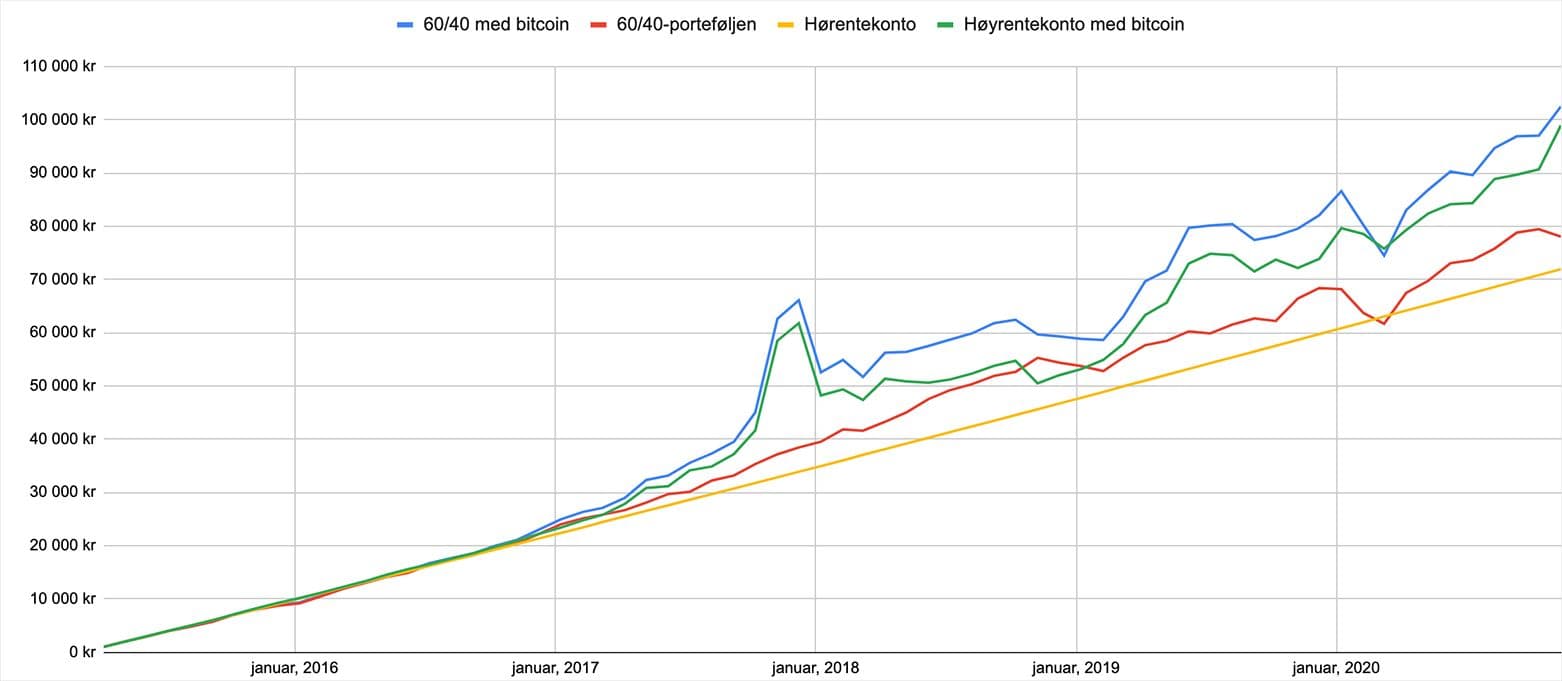

Below we see a graph that compares the returns on 4 different portfolios over the last 5 years, with a savings agreement of NOK 1,000 a month.

- The 60/40 portfolio: 60% in the Nordnet Index Fund and 40% in the high-interest account (2% interest).

- 60/40 with bitcoin: 57% in Nordnet Indeksfond, 3% in bitcoin and 40% in high-interest accounts (2% interest).

- High interest rate account: 100% in high interest rate account with 2% interest.

- High interest rate account with bitcoin: 97% in high interest rate account (2% interest rate) and 3% in bitcoin.

What we want to illustrate is that even a small exposure in bitcoin can have a positive effect on the return on a portfolio, as long as you have a good strategy and think long-term. Even if you had bought in during the upswing in 2017, and participated in the entire downturn in the cryptocurrency market in the following years, you would still have made a big profit today.

Be patient and think long-term with crypto investing

It is impossible to predict which way the market will go. You can of course do a lot of research, technical analysis and follow closely what is happening in the market, but in the end it will be coincidences that help to influence the price. This is impossible to predict.

Historically, as has been said, it has proved worthwhile to hold on to cryptocurrency. Although a decline can go far beyond the value of the portfolio, it is important not to panic. There are many who get upset when they see red numbers, and want to sell to limit the loss. But then we see that the same people will often buy in again when the market has taken hold, and then preferably at a higher price. This is a sure way to lose money.

Do not invest more in crypto than you can afford to lose

This rule should be followed slavishly by anyone who invests in cryptocurrency (or other things for that matter). It is important not to be too affected by short-term ups and downs, both for your wallet and your mental health. If you look at the money you have invested in cryptocurrency that has been lost from the start, you do not need to lose your night's sleep if we enter a period of decline.

If you have a plan for long-term savings, price fluctuations are also irrelevant. You have plans to leave the money several years ahead, so the course today has little to say. Historically, we see that investments in bitcoin and other cryptocurrencies have paid off, even though the market has occasionally been down over 80%. Then it's important to keep a cool head and wait for better times.

Create an account and get started with crypto investing today!