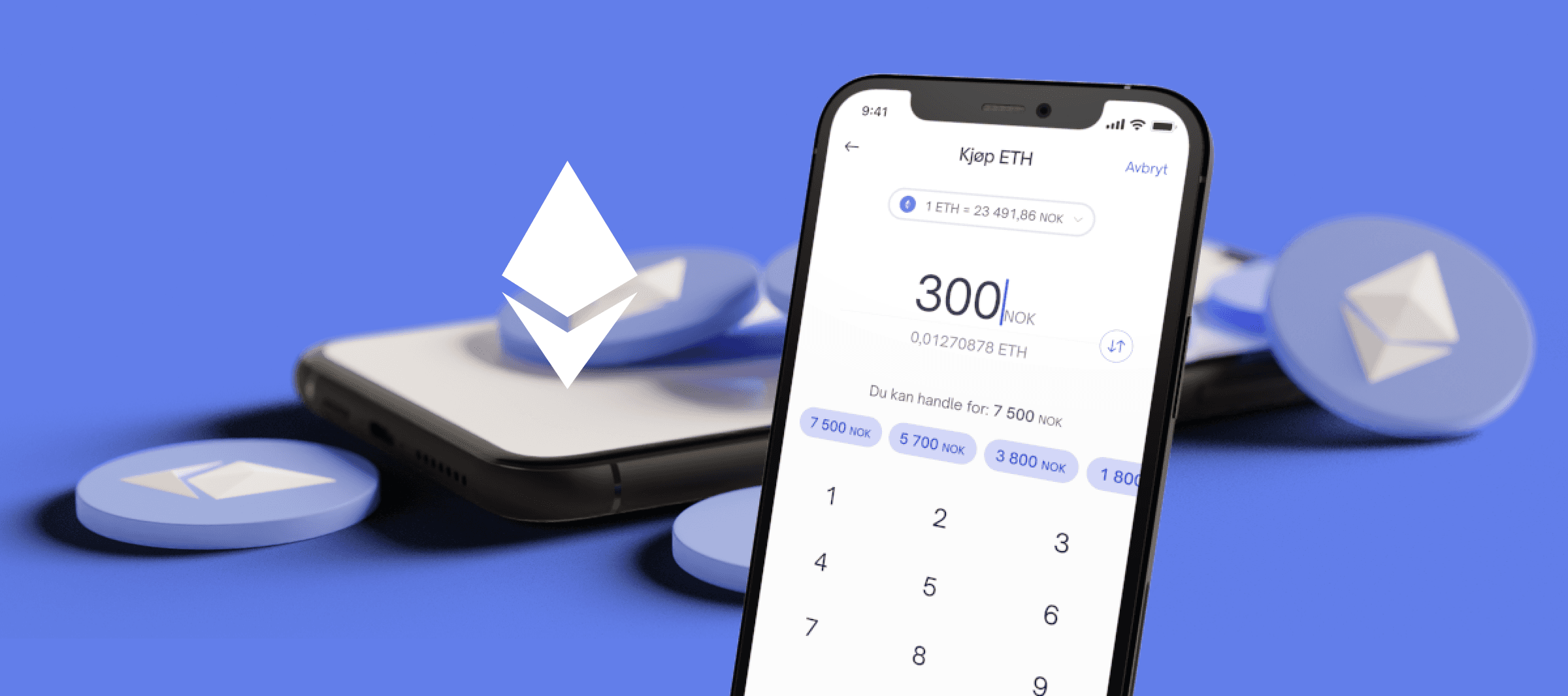

Ethereum is an open, global network built on blockchain technology. Just as Bitcoin lets you send and receive bitcoin, Ethereum allows you to send and receive ether (ETH). But while Bitcoin was created primarily as a digital currency, Ethereum was designed as a more flexible platform: a blockchain that makes it possible to build applications, systems, and contracts directly on the network.

In its early years, new ETH was created through mining, where computers consumed large amounts of electricity to secure the network. After the upgrade known as The Merge (2022), Ethereum now uses Proof of Stake (PoS):

- Participants (validators) lock up ETH as collateral (staking).

- Validators are randomly chosen to confirm transactions and create new blocks.

- They earn ETH rewards for acting honestly — but risk losing their stake if they try to cheat.

Today, there are about 120 million ETH in circulation. The supply grows more slowly than before, thanks to staking and the fee-burning mechanism introduced in the EIP-1559 upgrade.

Smart Contracts and dApps

What truly sets Ethereum apart is its support for smart contracts: small programs that run on the blockchain.

- A smart contract is an agreement written in code that automatically executes once the conditions are met.

- It follows simple logic: “If X happens, then do Y.”

- Example: If you buy a ticket, the contract automatically sends it to you as soon as your payment is confirmed — without a third party involved.

By combining many smart contracts, developers can build decentralized applications (dApps). These range from games and art marketplaces to banking and insurance systems — all without intermediaries.

Other Cryptocurrencies Built on Ethereum

Ethereum is also famous as the platform where many other cryptocurrencies are created:

- ERC-20 tokens: The standard for new cryptocurrencies on Ethereum. They can serve as voting rights in a project, a means of payment, rewards, or security. Some tokens are useful — while others exist mainly for speculation.

- ERC-721 tokens: The standard for NFTs (Non-Fungible Tokens), unique digital assets like artwork, collectibles, or in-game items.

Because Ethereum provides a shared infrastructure, developers don’t need to build a new blockchain for every project. Instead, they can leverage Ethereum’s existing security and scale.

Comparison with Traditional IT

You can think of Ethereum like an operating system such as Windows or iOS:

- Microsoft or Apple provide the base system.

- Other companies build apps and programs on top of it.

- The more apps that exist, the more valuable the base system becomes.

In the same way, Ethereum offers a common platform where developers can create their own apps and tokens, while still benefiting from the standards and security of the Ethereum network.

Ethereum is much more than just a cryptocurrency. It is a global network where:

- Transactions and information are stored securely and in a decentralized way.

- Smart contracts and dApps can run without banks or intermediaries.

- New cryptocurrencies and NFTs can be created using shared technical standards.

This flexibility makes Ethereum one of the most important platforms in the entire crypto ecosystem — and one of the reasons it is still considered the “foundation of Web3.”