The run-up to the highs and the year-end pullback in the crypto market reflected a familiar mix of risk sentiment, adoption, macroeconomics conditions, and geopolitics.

On the supportive side, demand in the crypto market during the year was particularly boosted by publicly traded companies accumulating digital assets and by traditional investors gaining exposure through the U.S.-listed Bitcoin and Ethereum exchange-traded funds (ETFs).

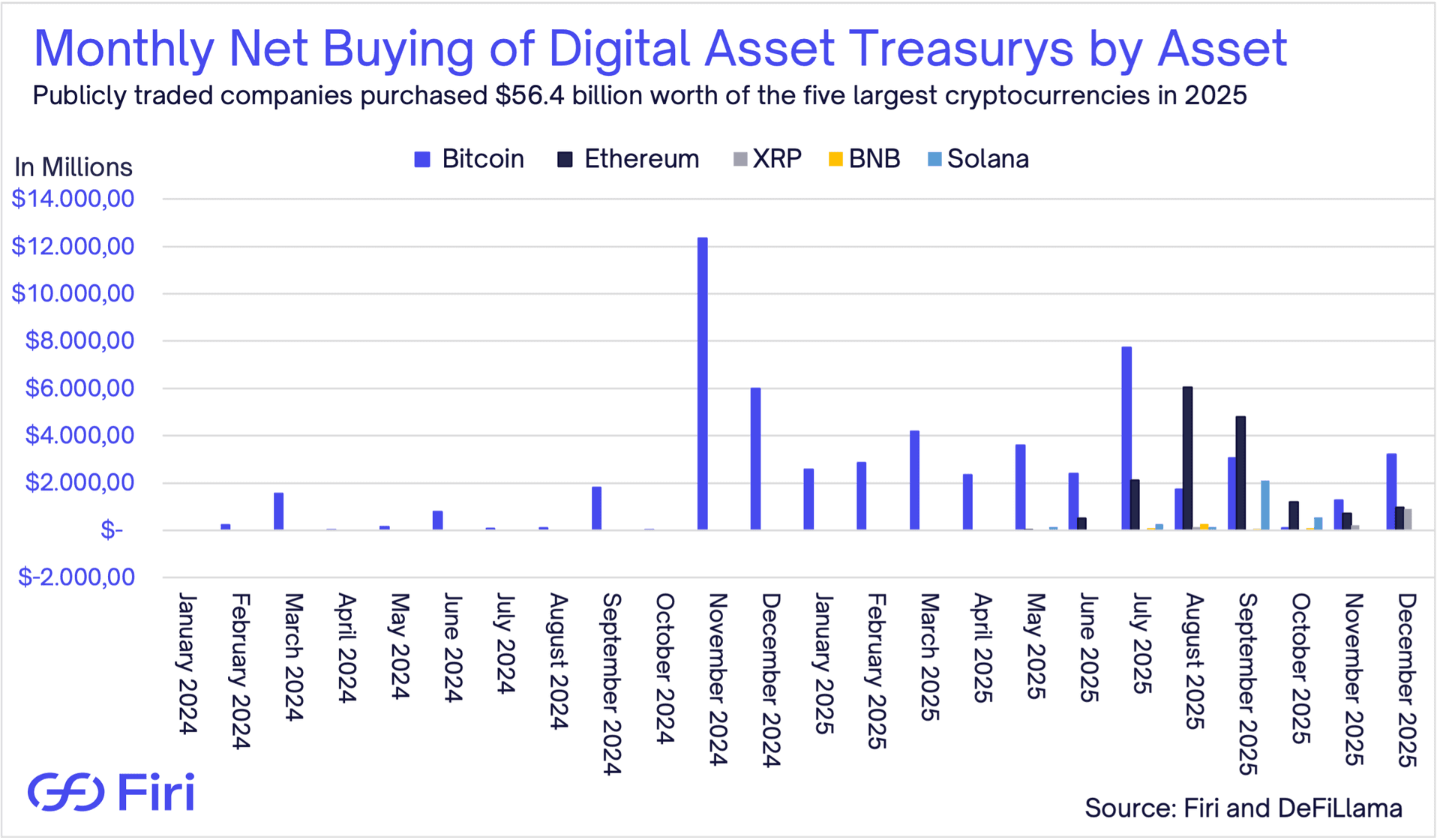

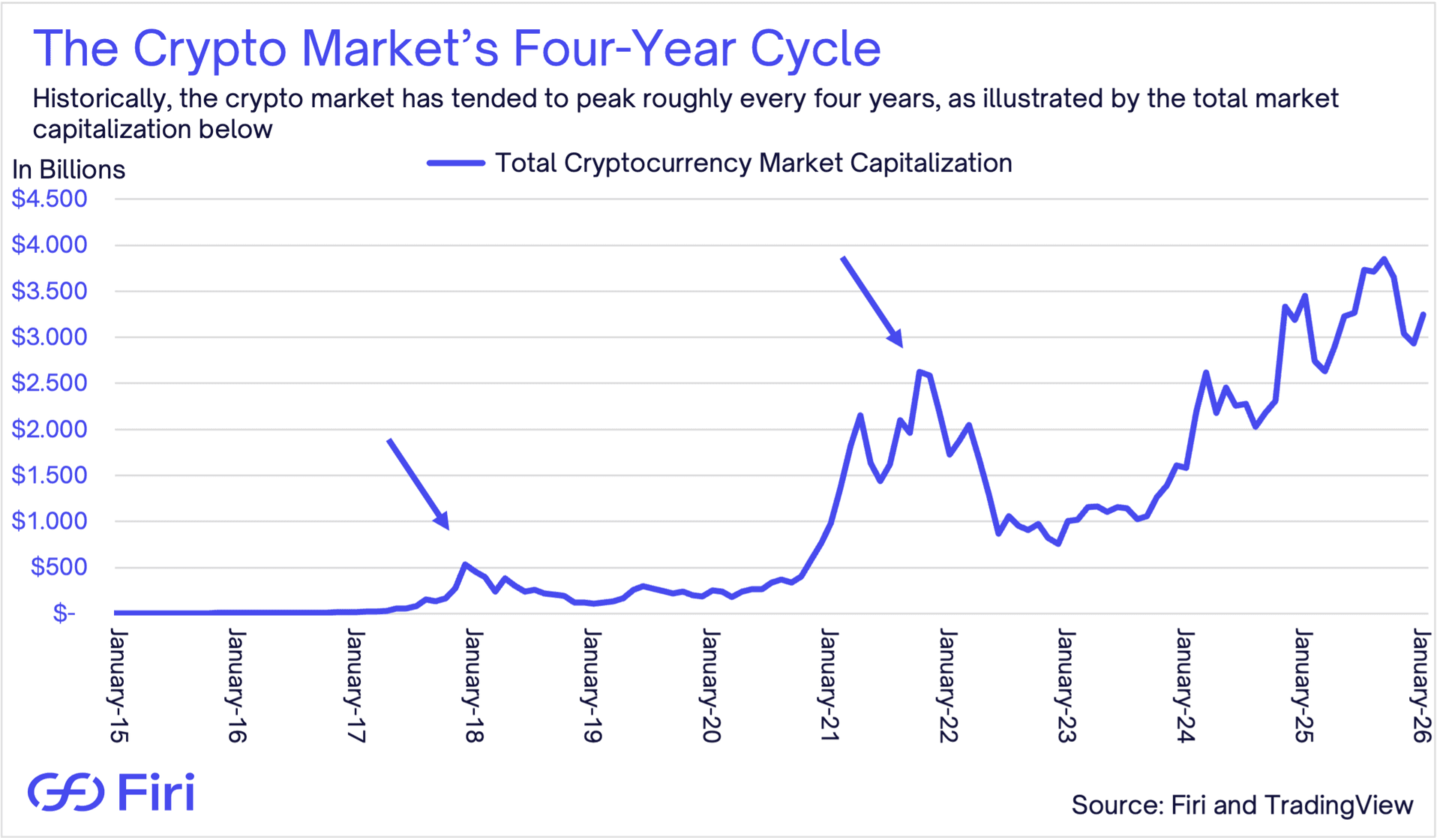

Many of the corporate buyers fall into what are often called Digital Asset Treasury (DAT) companies, where the core playbook is to raise capital with the explicit aim of building large crypto positions, most often in Bitcoin. Based on our estimates, these firms acquired roughly $56.4 billion worth of the five largest cryptocurrencies, including Bitcoin, Ethereum, XRP, BNB, and Solana, in 2025, compared with roughly $23.0 billion the year before.

Chart 1: Monthly Net Buying of Digital Asset Treasurys by Asset

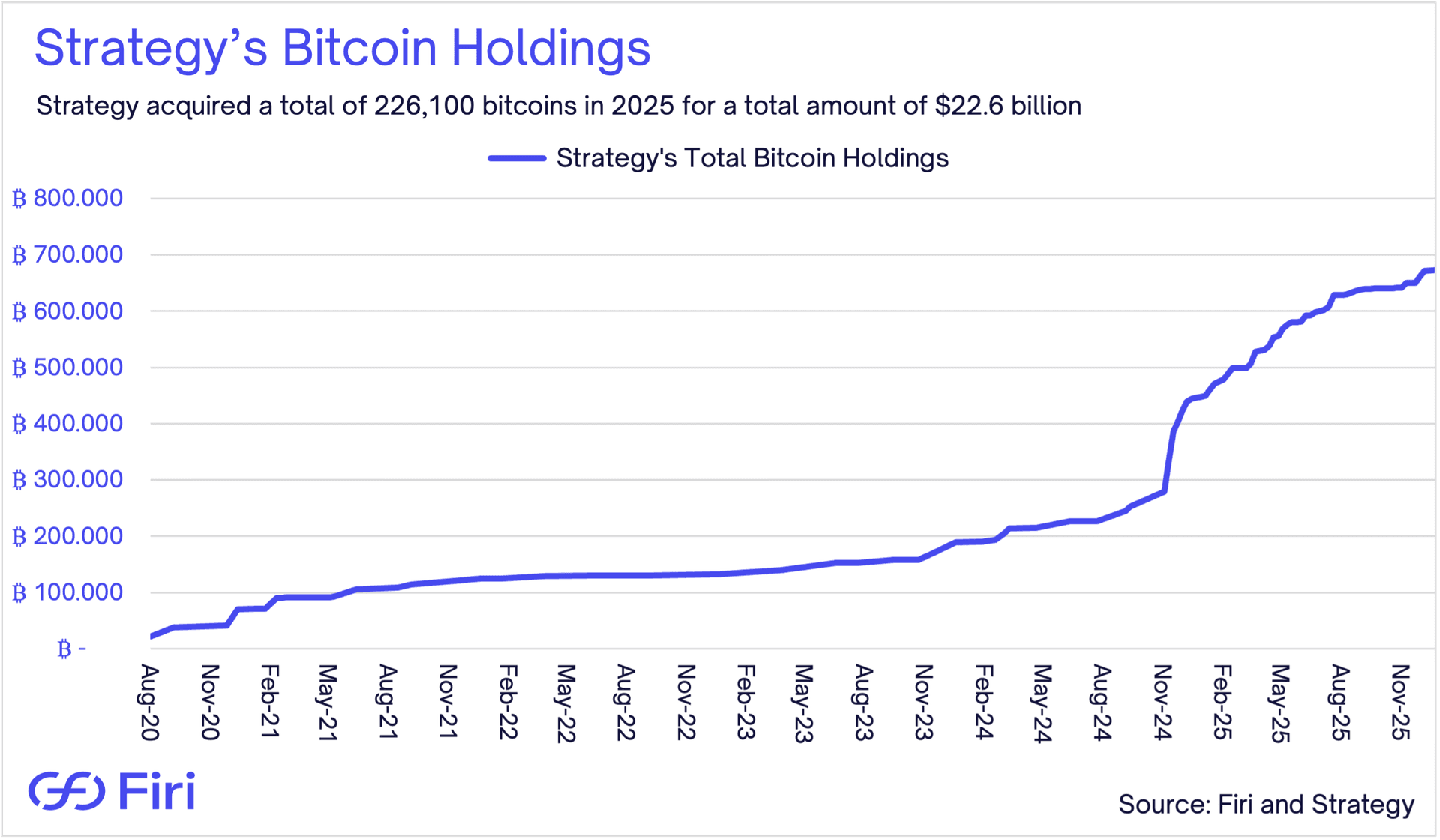

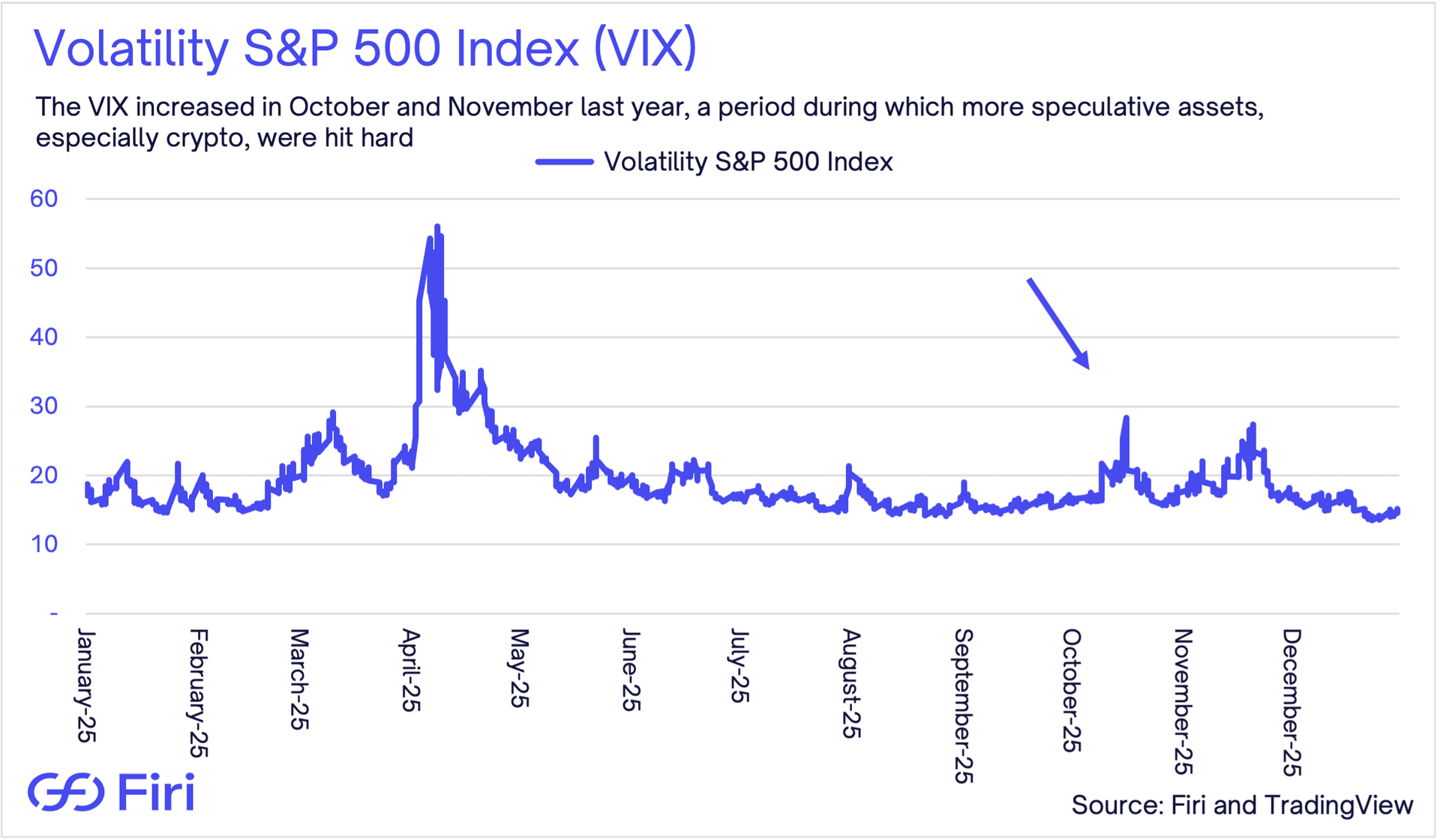

Within this cohort, the largest player remained Strategy, previously called MicroStrategy. Strategy acquired a total of 226,100 bitcoins in 2025 for a total amount of $22.6 billion, down from 2024, when it acquired 257,250 bitcoins for $21.9 billion.

By the end of 2025, Strategy held 672,500 bitcoins, worth about $58.9 billion, versus 446,400 bitcoins at the end of 2024, worth about $41.6 billion at that time. The year-end holdings of 2025 represent roughly 3.36% of all bitcoins in circulation.

Chart 2: Strategy’s Bitcoin Holdings

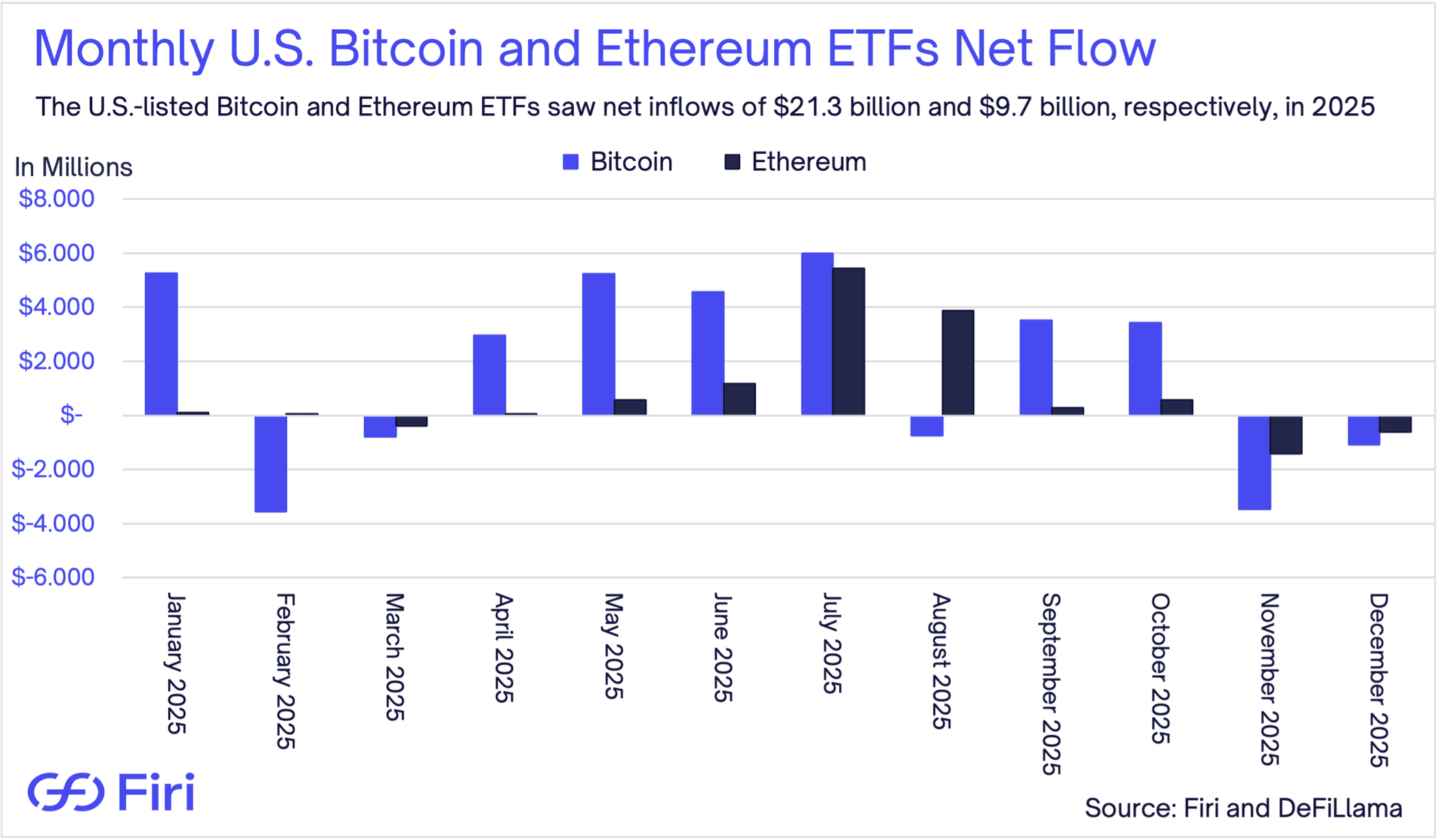

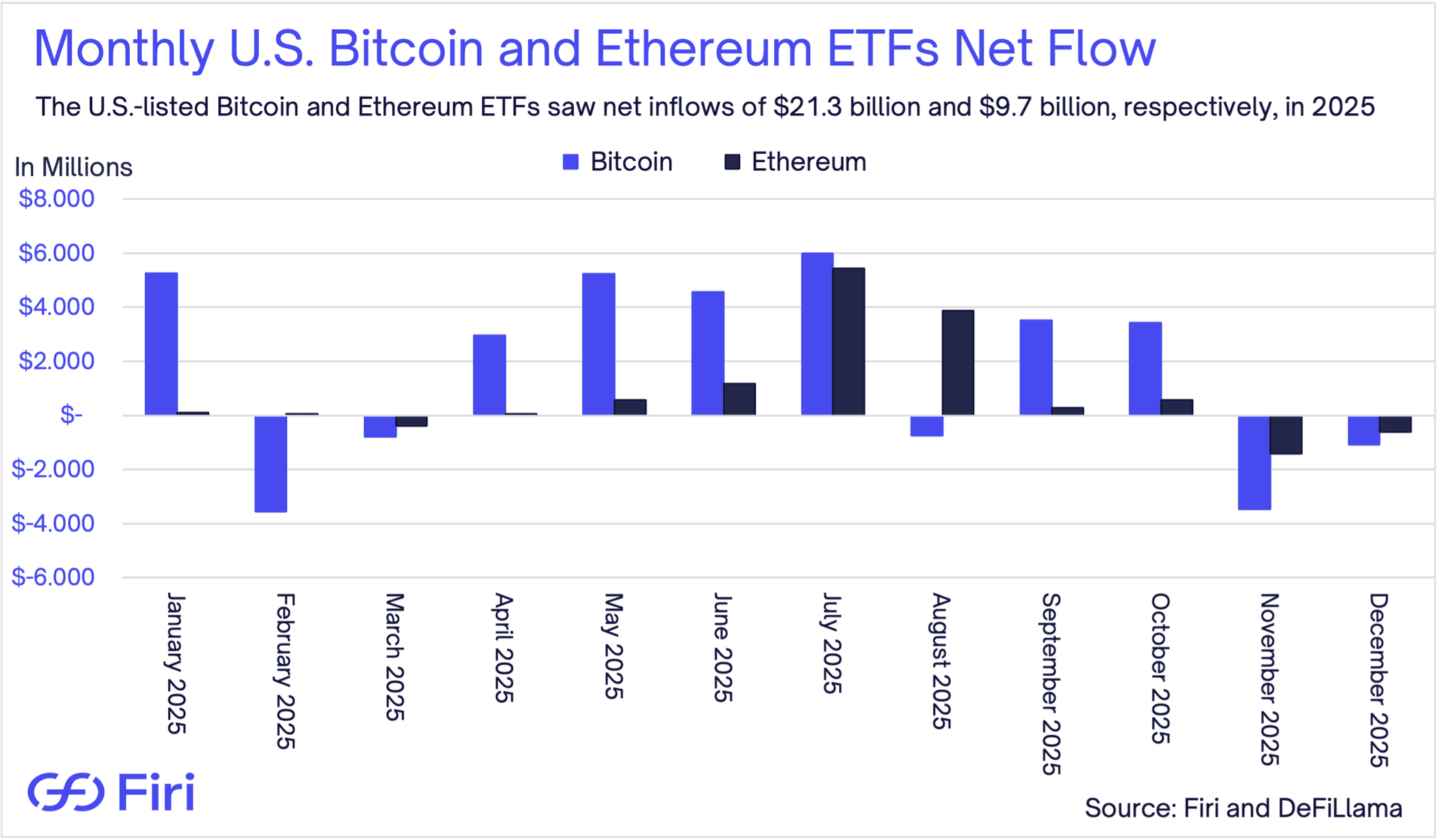

Alongside corporate accumulation, the relatively new U.S.-listed Bitcoin and Ethereum exchange-traded funds (ETFs) were also an important driver, with net inflows of $21.3 billion and $9.7 billion, respectively, in 2025.

Much of that demand likely came from more traditional investors who prefer a regulated ETF wrapper to holding crypto directly. The flows of these ETFs also tracked price action closely. For example, the funds posted net outflows in the final two months of the year, a period when both Bitcoin and Ethereum also struggled.

Chart 3: Monthly U.S. Bitcoin and Ethereum ETFs Net Flow

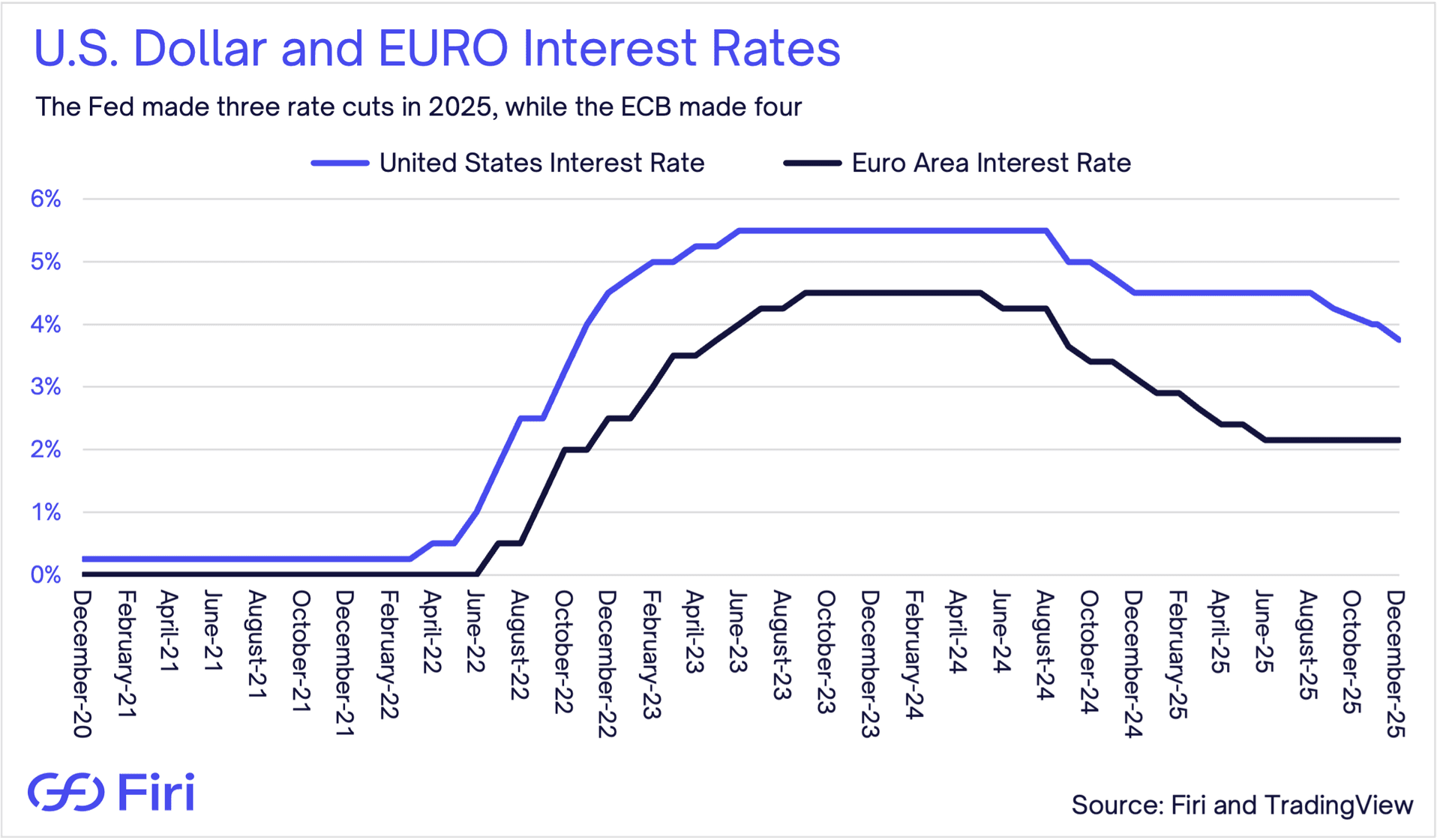

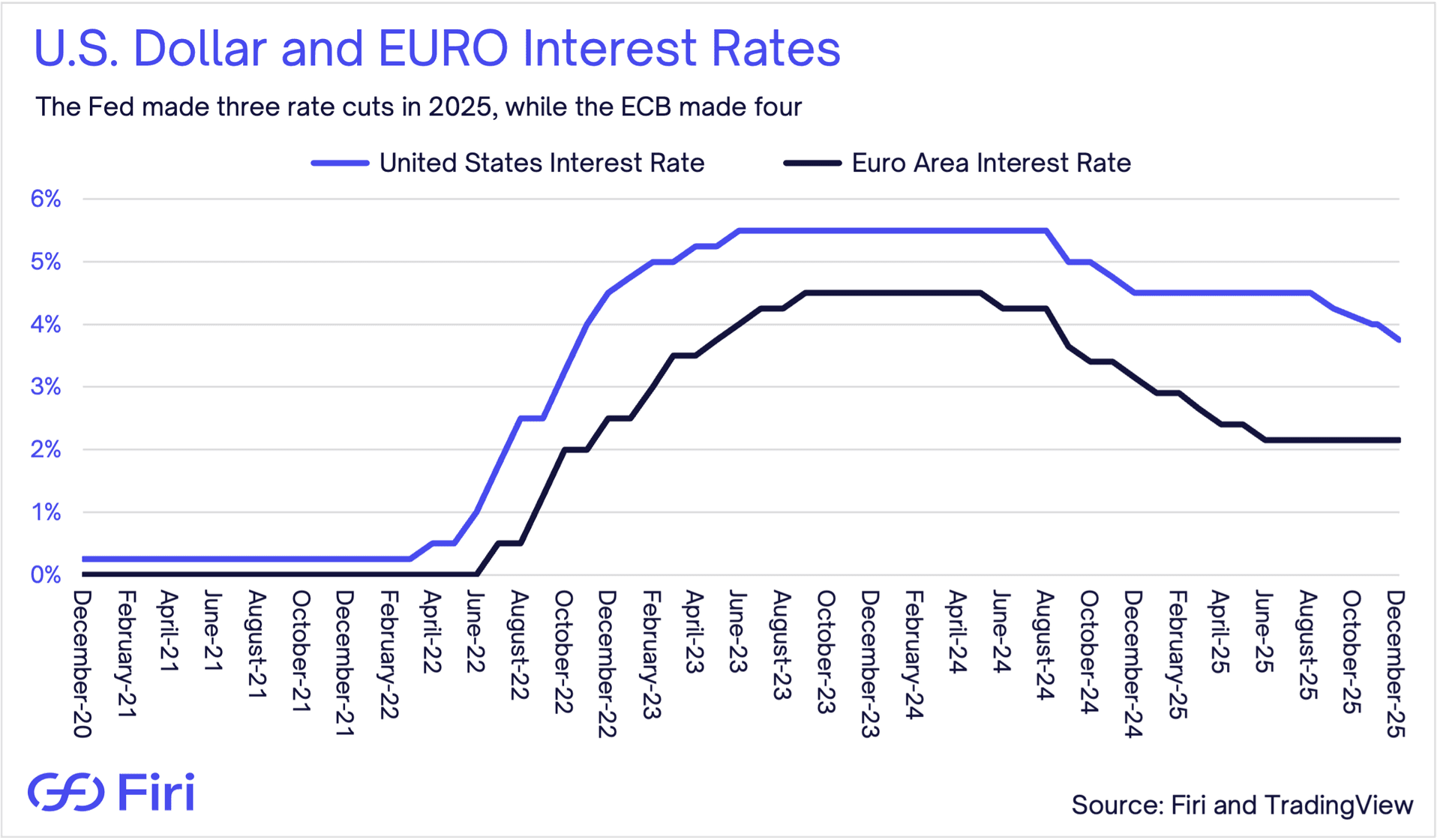

One additional tailwind for prices, particularly in the autumn, was the shift in U.S. monetary policy. The Federal Reserve (Fed), the U.S. central bank, cut its policy rate for the first time in 2025 in September by 0.25 percentage points (0.25%), and followed up with further cuts of the same size in both October and December.

Chart 4: U.S. Dollar and EURO Interest Rates

Earlier, the European Central Bank (ECB), the euro area’s central bank, lowered the euro interest rate four times, also by 0.25% each time. In broad terms, lower rates reduce the reward for holding cash and can improve the relative appeal of higher-risk assets, including digital assets.

Beyond the adoption trends we discuss later, these dynamics are, in our view, the main reasons the crypto market held up as well as it did through much of 2025. Still, the market tone shifted after mid-October, and prices weakened into year-end.

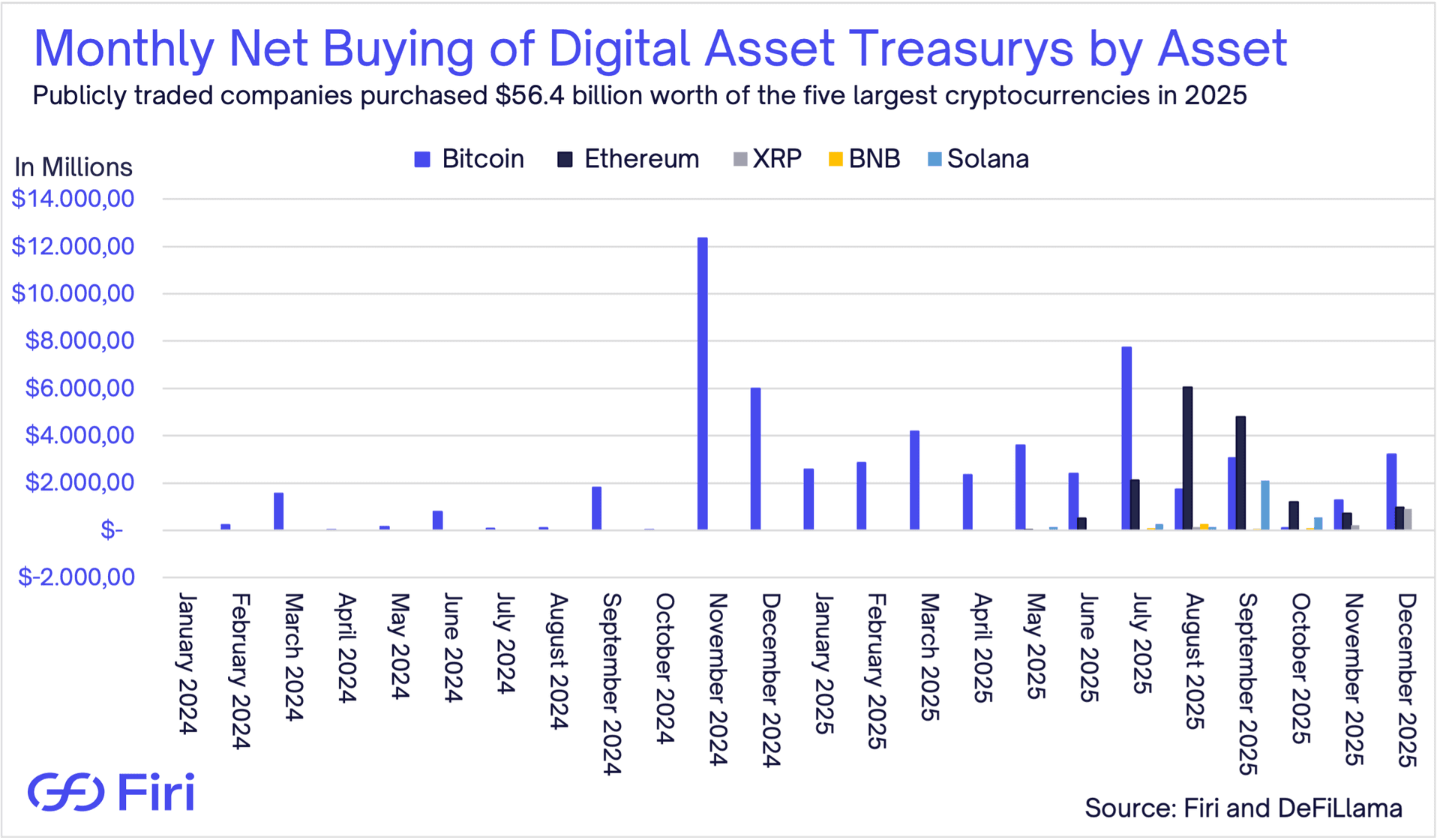

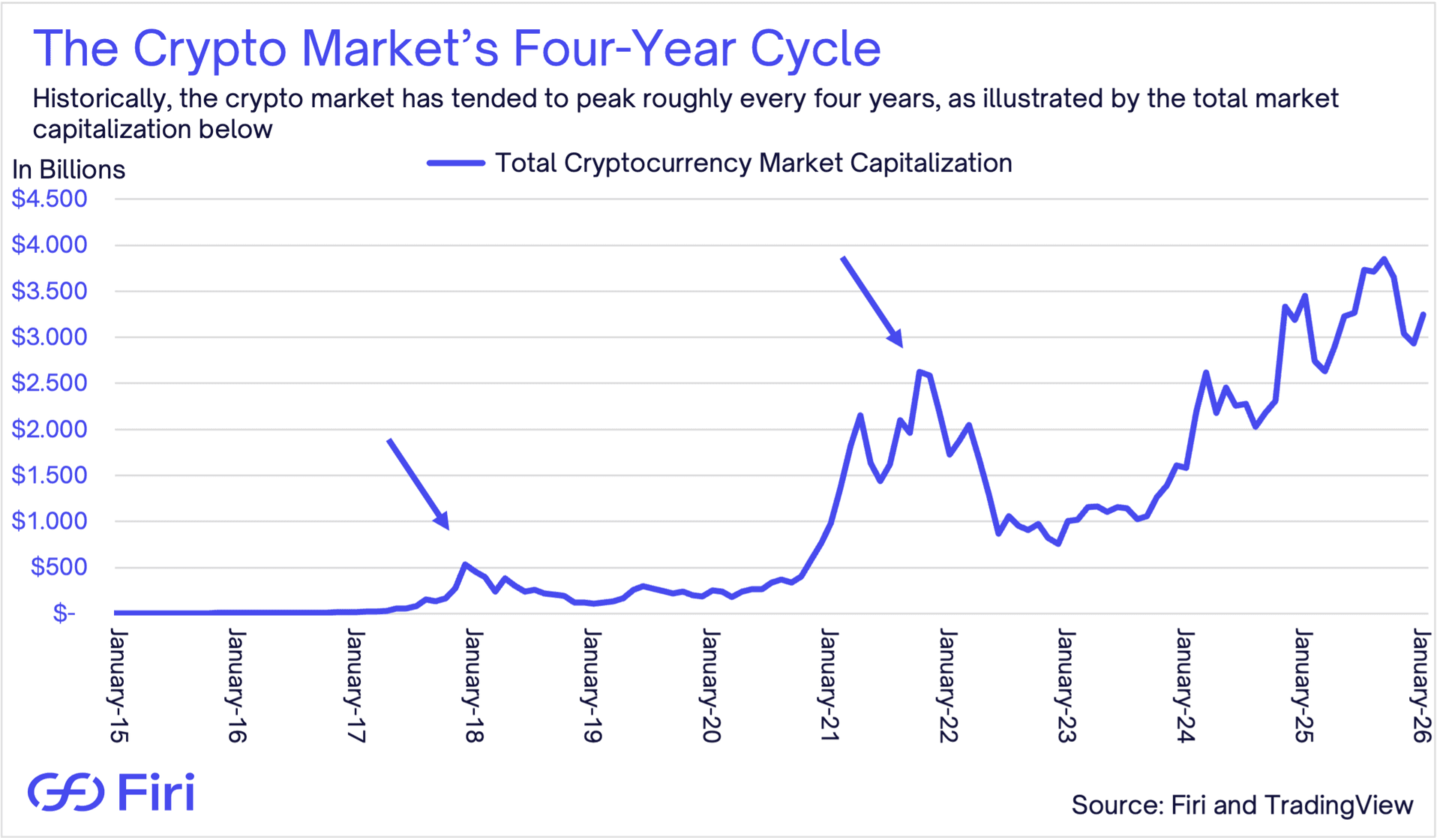

A key driver of the subsequent decline was likely the market’s continued belief in a so-called four-year cycle. In past crypto cycles, the market has often peaked roughly every four years, then spent an extended period consolidating or declining.

By late 2025, a growing share of participants appeared to believe the cycle’s high was already behind us, assuming the four-year cycle still holds. Whether that view is right is sometimes secondary. Once enough of the market trades as if the top is in, sentiment softens, positioning turns defensive, and selling pressure builds.

Chart 5: The Crypto Market’s Four-Year Cycle

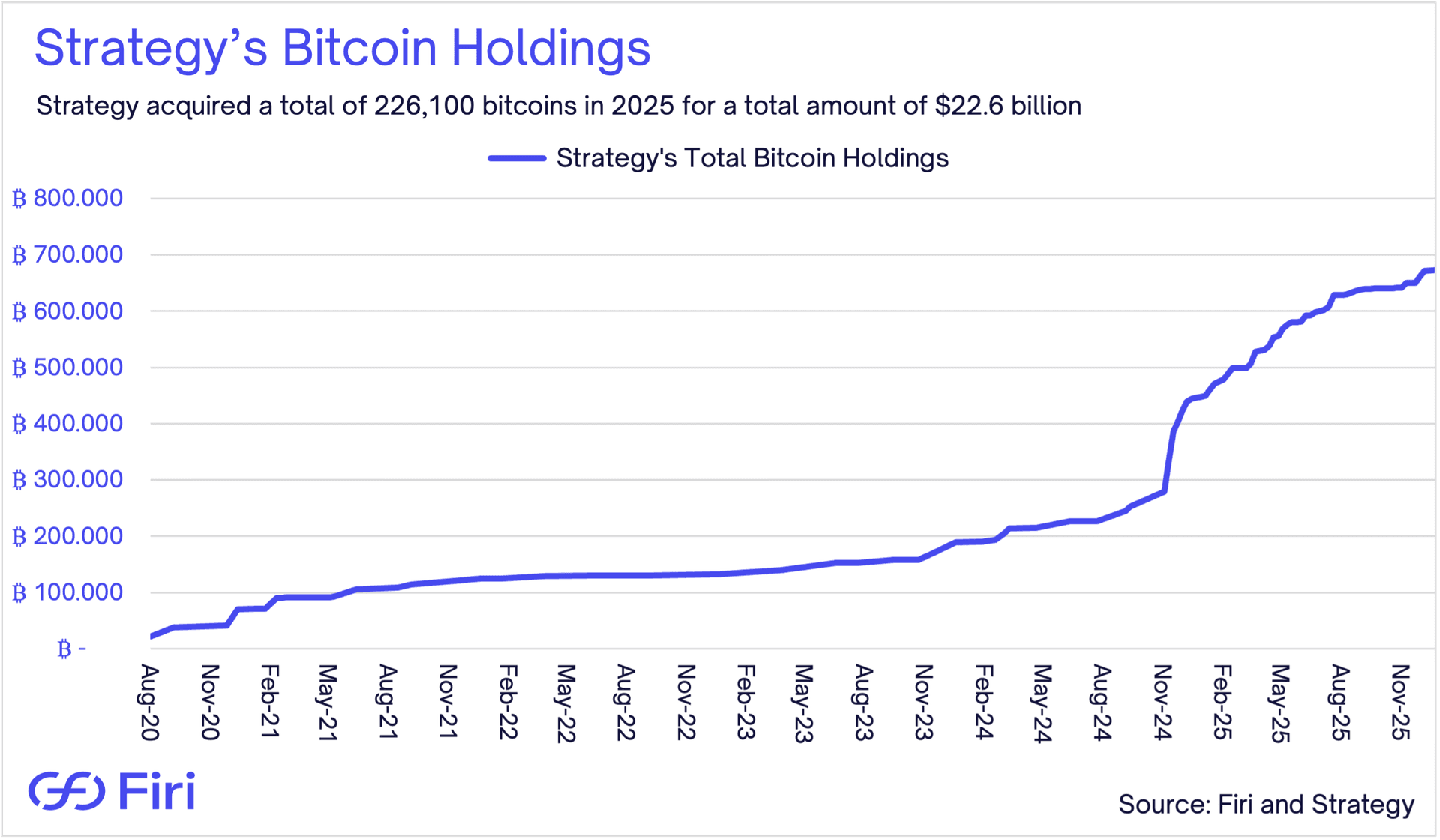

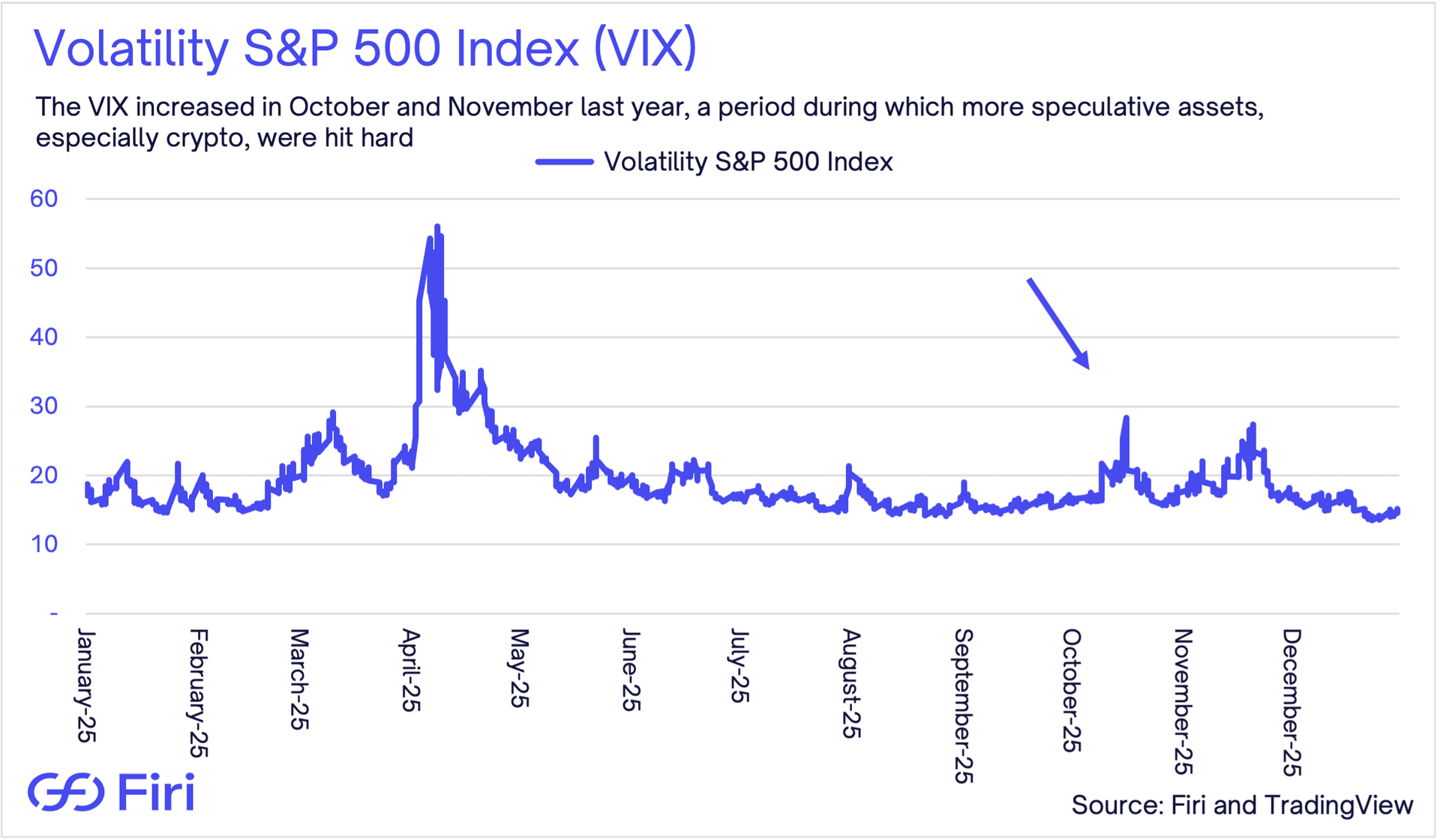

The overall risk sentiment across asset classes also deteriorated late in the year. We see that in the Volatility S&P 500 Index, commonly called the VIX. The VIX measures the market’s expected volatility derived from S&P 500 options and is widely treated as a fear gauge for U.S. equities. In 2025, the VIX rose in October and November, and that kind of risk-off impulse often spills into crypto.

Chart 6: Volatility S&P 500 Index (VIX)

The fear backdrop in equities, and in crypto as well, appeared driven by several factors, including concerns about the sustainability of the AI-linked equity rally, U.S.–China tensions, particularly around tariffs, and uncertainty tied to the record-long U.S. government shutdown.

There was also a more crypto-specific concern around corporate treasury vehicles. When the market capitalization of these firms, including Strategy, trades near or below the value of their crypto holdings, they can have a financial incentive to sell assets to support redemptions or otherwise close the valuation gap. For example, Strategy traded at or below the value of its Bitcoin holdings for much of late last year. Even if actual selling remains limited, as it largely did last year, the perceived overhang can still weigh on sentiment.

It is also worth remembering that 2025 started with a high hurdle. Sentiment still reflected post-election euphoria after Donald Trump’s victory in the U.S. presidential election, which likely pulled forward optimism and made it harder for crypto to deliver incremental positive surprise. At the same time, AI-linked equities may have absorbed a portion of the speculative risk budget that might otherwise have rotated into digital assets.