Firi Weekly: Weekend Record

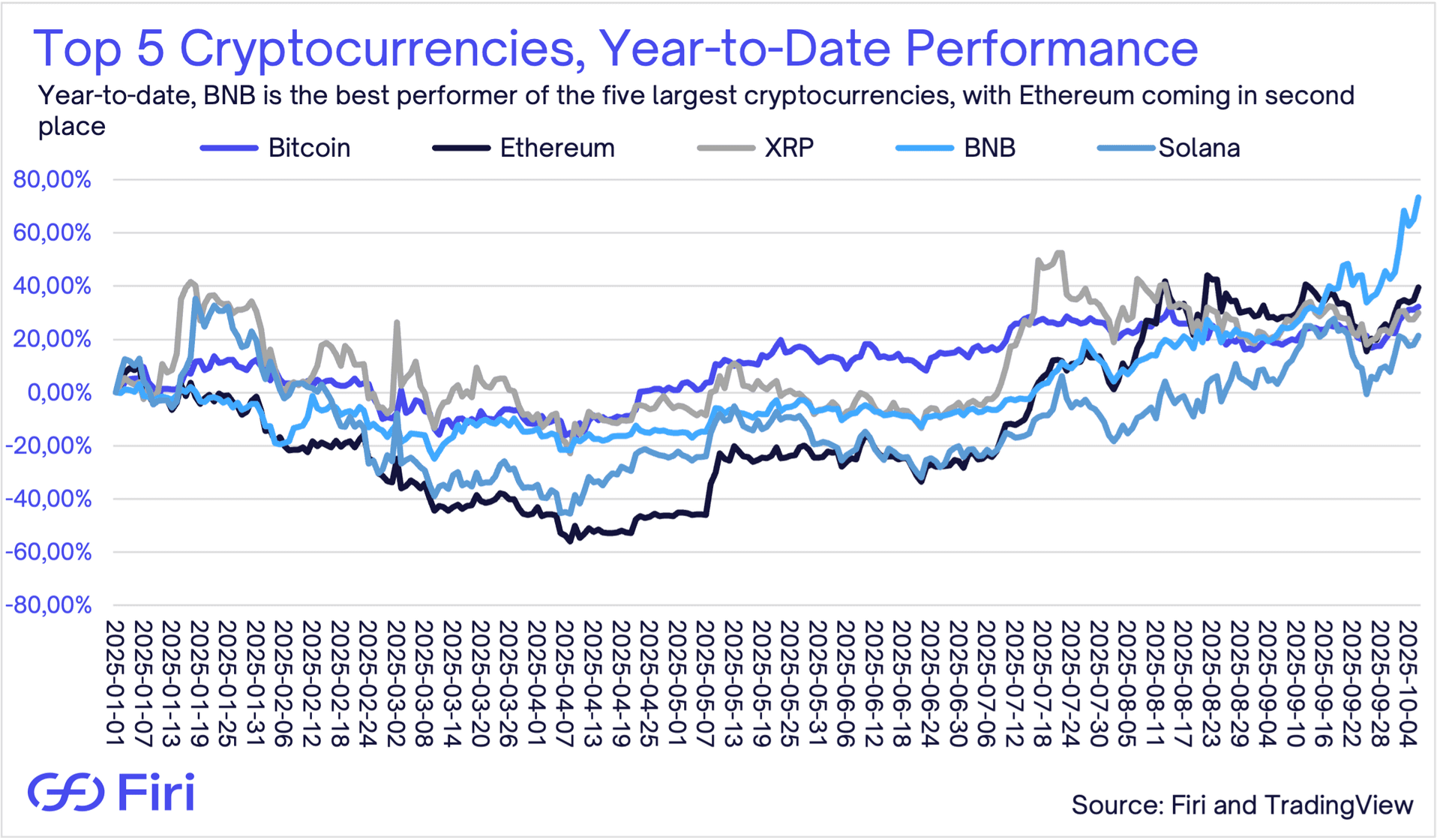

- Bitcoin Hits All-Time High:

- Bitcoin reached a record $125,700 on Sunday, driven by the recent U.S. dollar rate cut, strong equity markets, robust U.S. ETF inflows, and October’s historically positive performance for crypto, among other factors.

- U.S. Government Shutdown:

- The federal government shut down on October 1 after Congress failed to pass funding, costing $7 billion per week and halting non-essential services. So far, there has been no impact on the crypto market, though the shutdown delays potentially market-moving economic data releases.

- Swift Adopts Blockchain Technology:

- Payment giant Swift has partnered with Consensys to launch an Ethereum-based blockchain for instant, 24/7 cross-border payments.

- CME Launches 24/7 Crypto Trading:

- The world’s largest derivatives exchange will begin offering round-the-clock Bitcoin and Ethereum futures in 2026, eliminating weekend gaps for institutional traders.