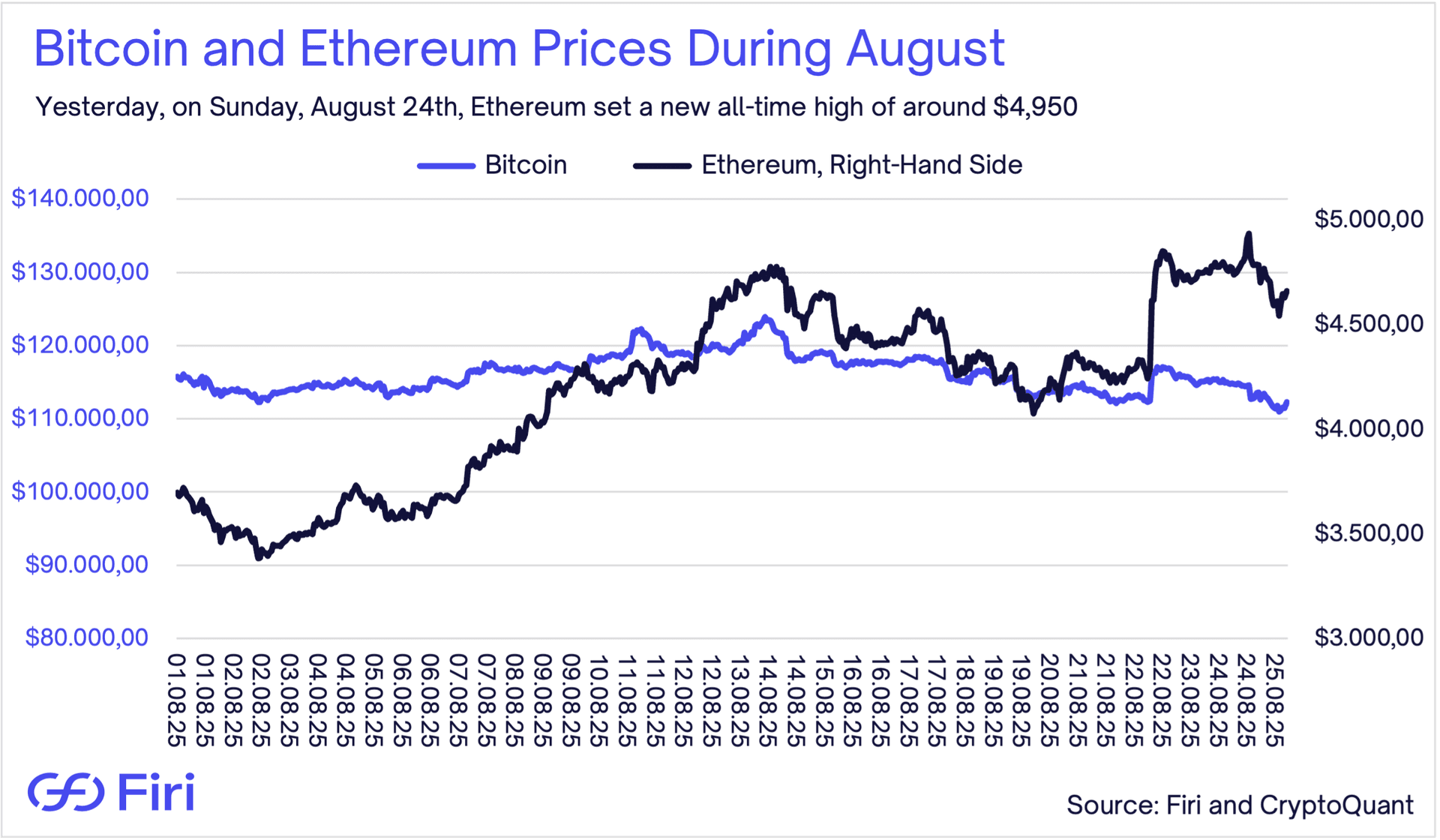

Chart 1: Bitcoin and Ethereum Prices During August

As shown above, Ethereum reached a new all-time high during the weekend of approximately $4,950, while Bitcoin actually declined during the same period and has been retreating since setting its new all-time high on August 14. Overnight, however, most crypto assets declined in value, including both Bitcoin and Ethereum, with Ethereum now trading below its previous all-time high.

Looking at the main drivers for Ethereum's outperformance—beyond the aforementioned whale rotation from Bitcoin—several factors stand out. The explosive growth of stablecoins, the majority of which are issued on the Ethereum network, continues driving demand. Additionally, Ethereum-centric treasury firms have been accumulating substantial Ether positions, and the overall macroeconomic environment has turned increasingly favorable, which we will explore in greater detail below.

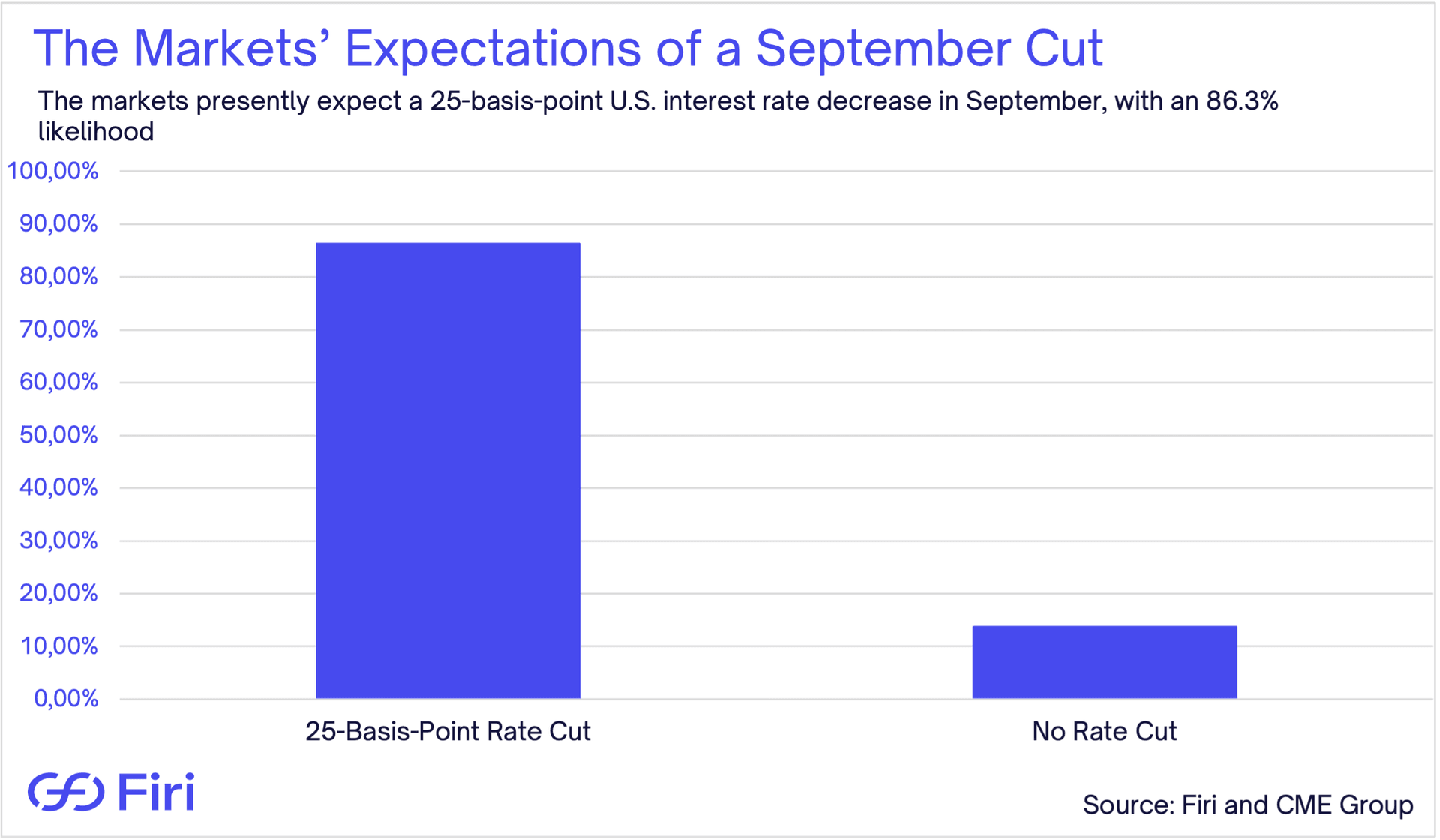

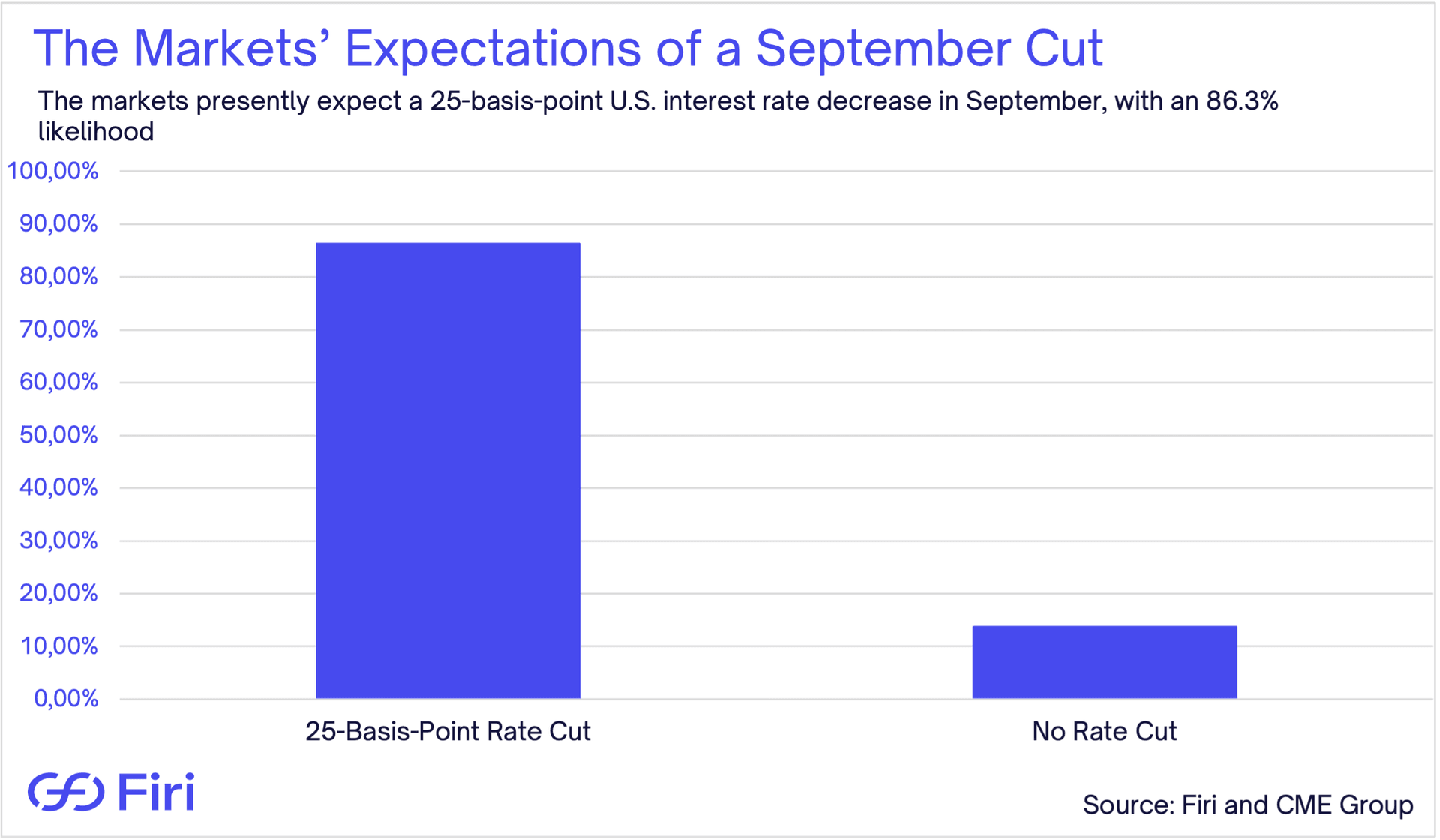

Chart 2: The Markets’ Expectations of a September Cut

Last week, the U.S. Federal Reserve (Fed) — the nation’s central bank — hosted its annual three-day Jackson Hole Economic Symposium, drawing together global financial and policy leaders to tackle long-term economic questions

On Friday, the conference's final day, Fed Chair Jerome Powell delivered a speech in which he strongly hinted that an interest rate cut for the U.S. dollar is likely at the Fed's meeting in mid-September. Before the speech, markets were pricing a 75% chance of a September rate cut, but following his remarks, that probability jumped to 86.3%. If the Fed does cut rates in September, it would generally be positive for crypto markets, as lower rates make investors more willing to allocate capital to risk assets such as digital currencies. In other words, this expectation likely contributed to crypto's weekend rally.

However, Powell stressed there remain uncertainties about whether President Donald Trump's tariffs could spur more lasting inflationary pressures, which would argue against cutting interest rates in September.

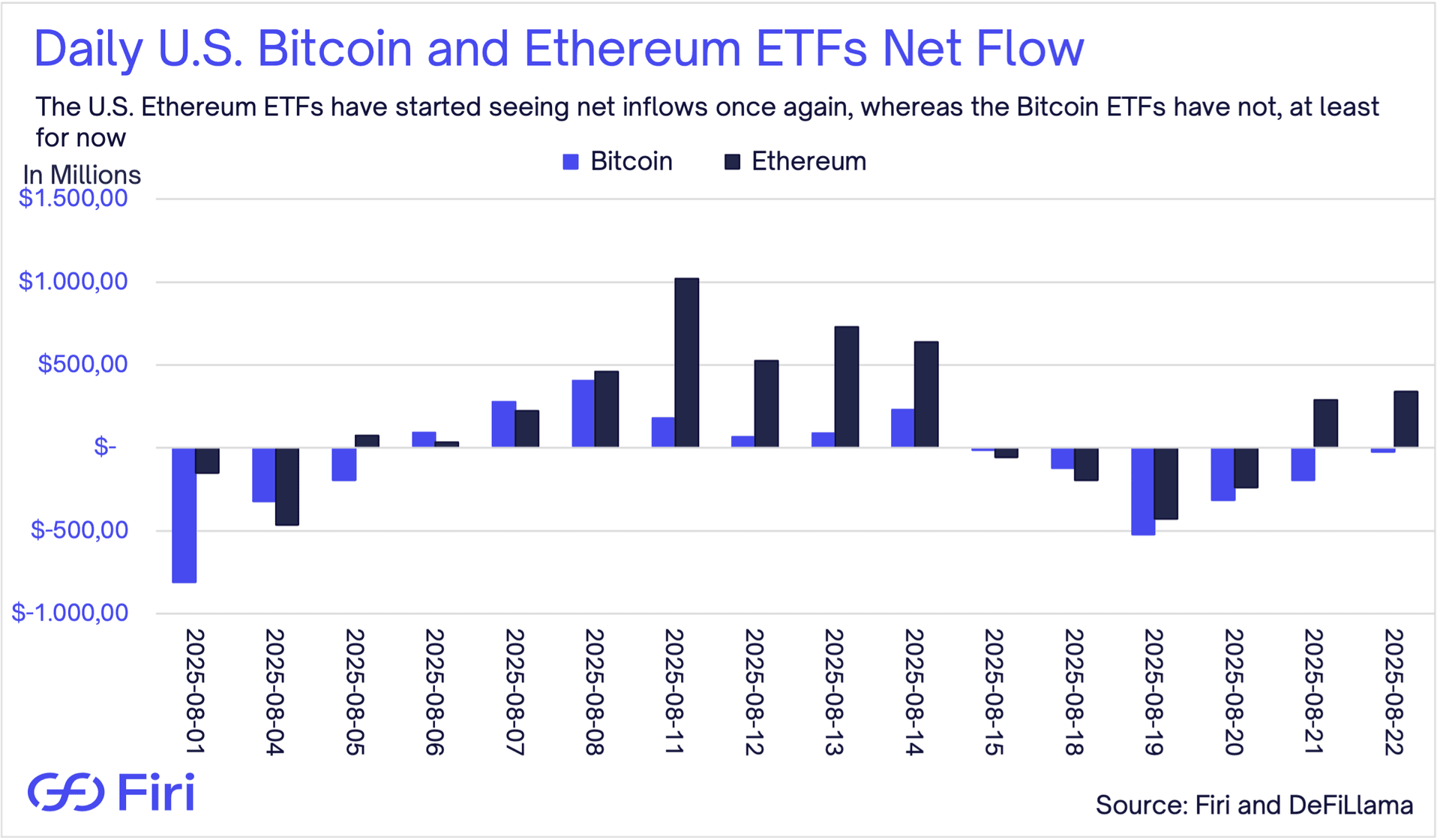

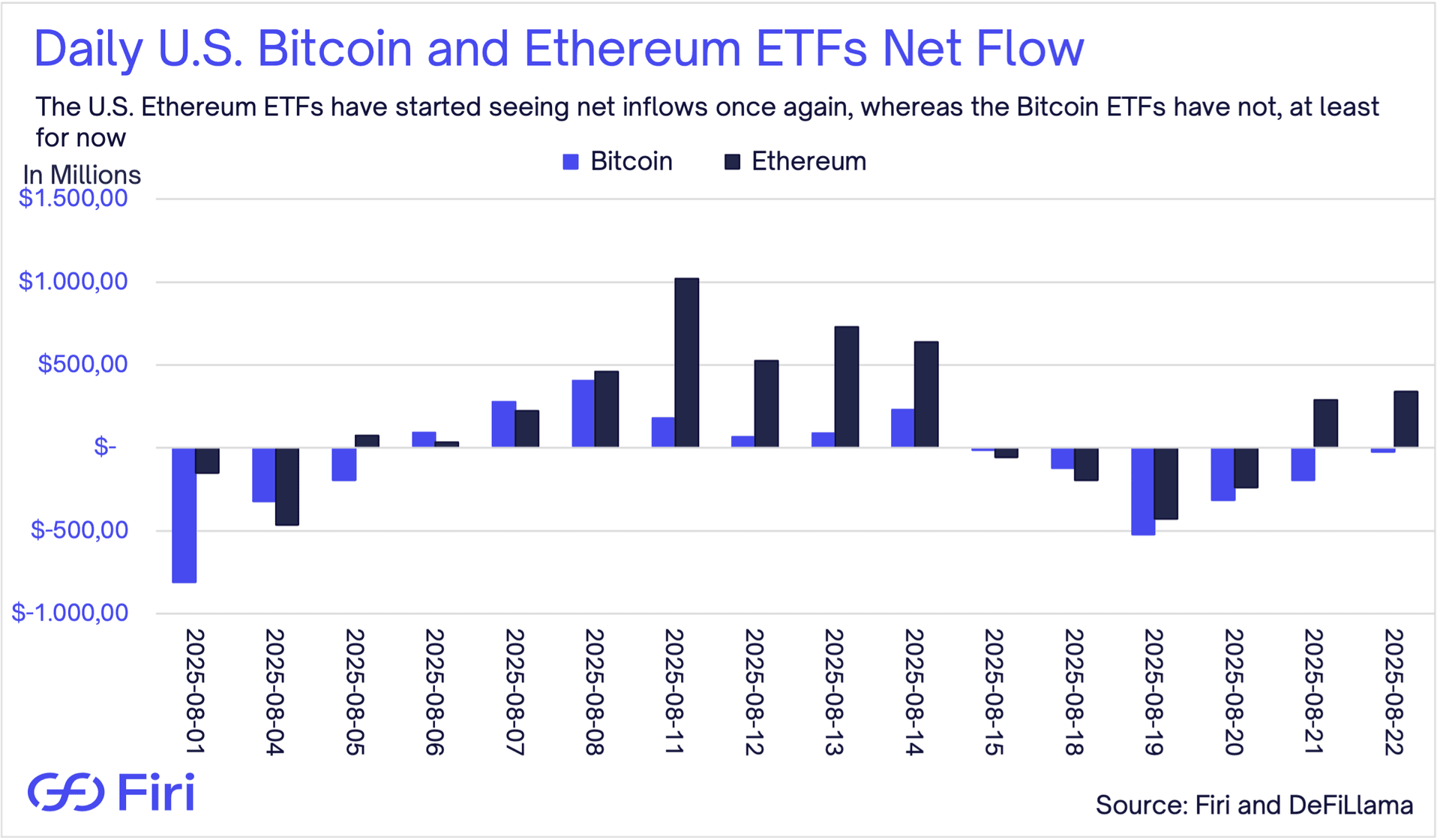

Chart 3: Daily U.S. Bitcoin and Ethereum ETFs Net Flow

The U.S. ETF flow data clearly illustrates Ethereum's recent outperformance relative to Bitcoin. From August 15, both U.S. Bitcoin and Ethereum spot ETFs started experiencing daily outflows of varying degrees.

However, on Thursday and Friday last week, Ethereum ETFs reversed course, recording daily net inflows of $287.6 million and $337.7 million, respectively, while Bitcoin ETFs continued to see net outflows of $194.4 million and $23.2 million on the same days.