Firi Weekly: Markets Can't Decide on Inflation

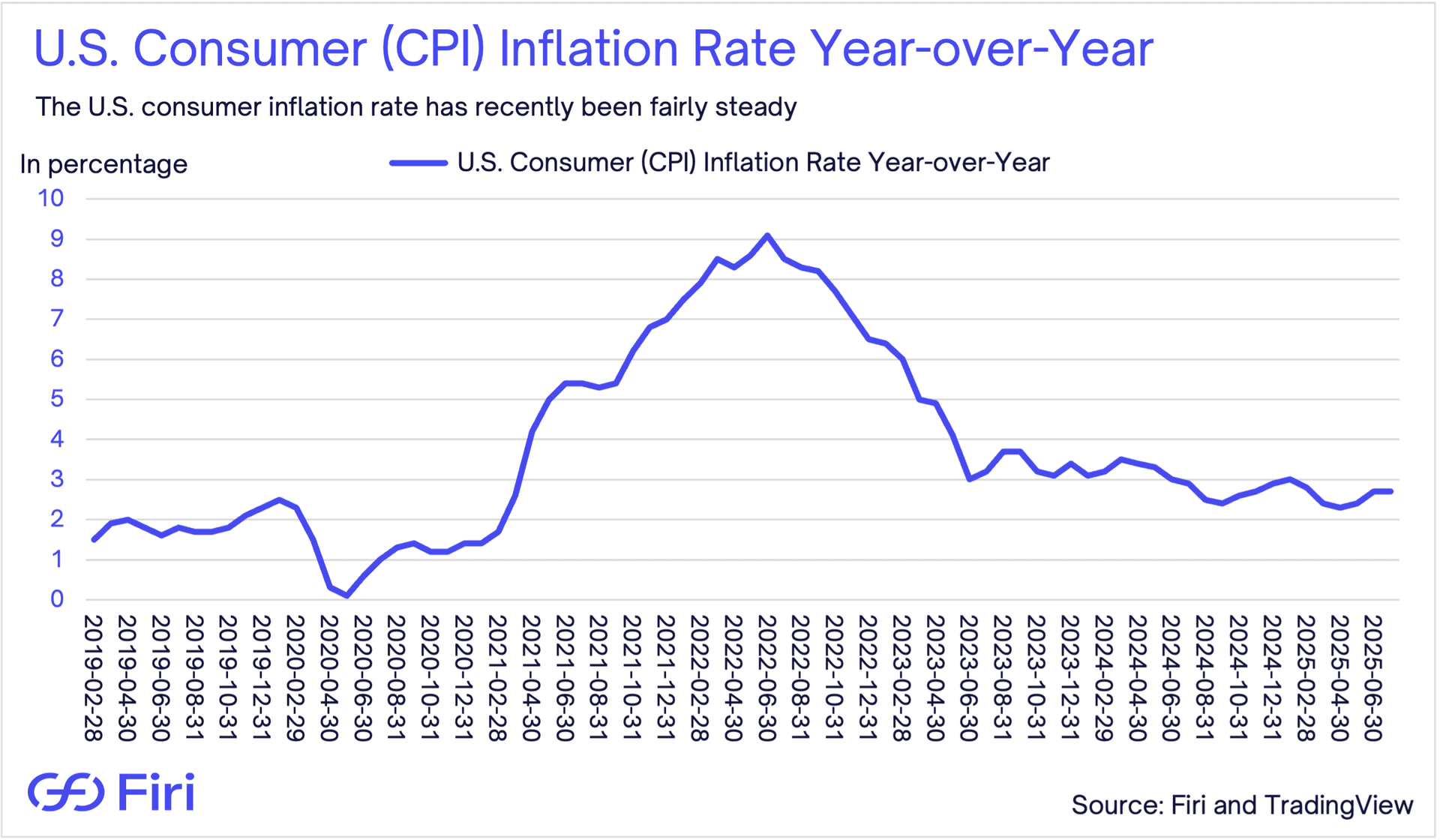

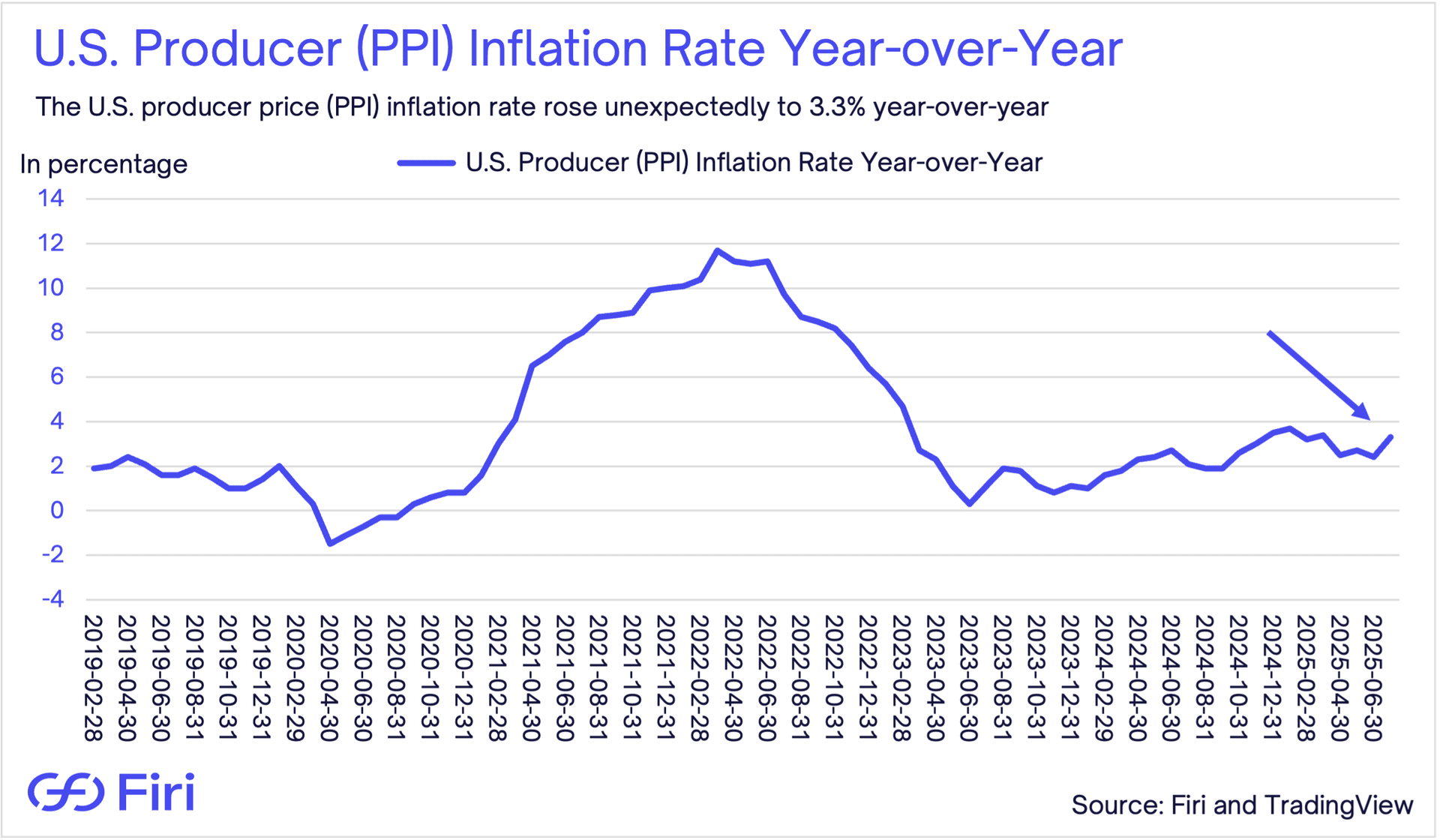

- Inflation Whiplash Rattles Crypto:

- Bitcoin rocketed to $124,300 following benign consumer price data, only to plunge when producer prices exceeded forecasts, stoking fears that tariffs could reignite inflation.

- Blockchain Giants Emerge:

- Stripe and Circle both unveiled plans for independent Layer 1 blockchains, bypassing established networks like Ethereum and Solana to control their crypto infrastructure.

- Norway's Stealth Bitcoin Play:

- The world's largest sovereign wealth fund increased its indirect Bitcoin holdings by 83%, now controlling 11,400 bitcoins through positions in Strategy and Metaplanet.

- Japan Enters Stablecoin Race:

- The first yen-backed stablecoin, JPYC, targets an autumn launch as Asia seeks to capture share in the $270+ billion stablecoin market.