Firi Weekly: Ethereum Rallies Past $4,000

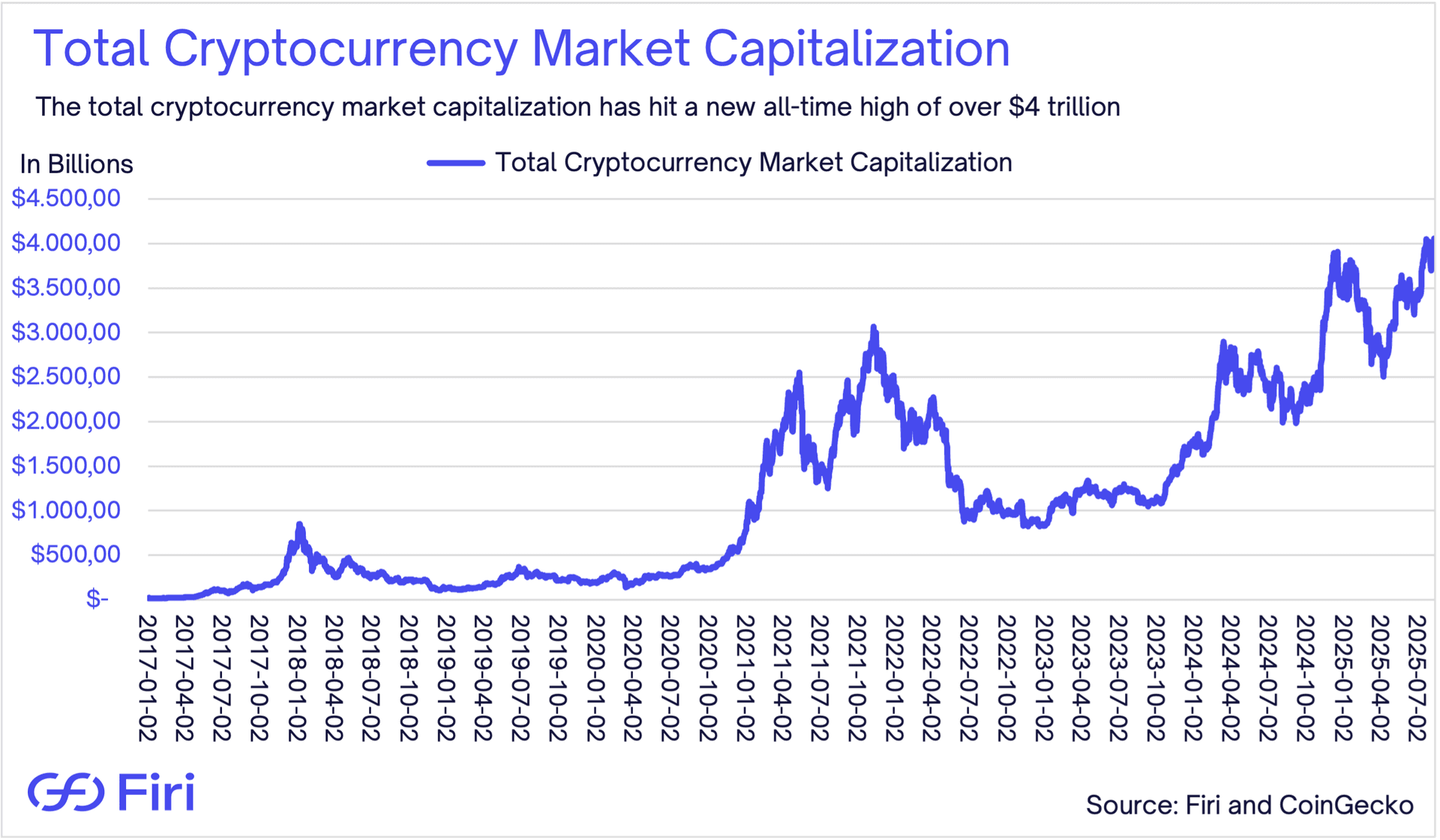

- Trump's Retirement Reform:

- The president is opening the $9 trillion 401(k) retirement market to crypto investments, potentially paving the way for massive capital inflows into the crypto market.

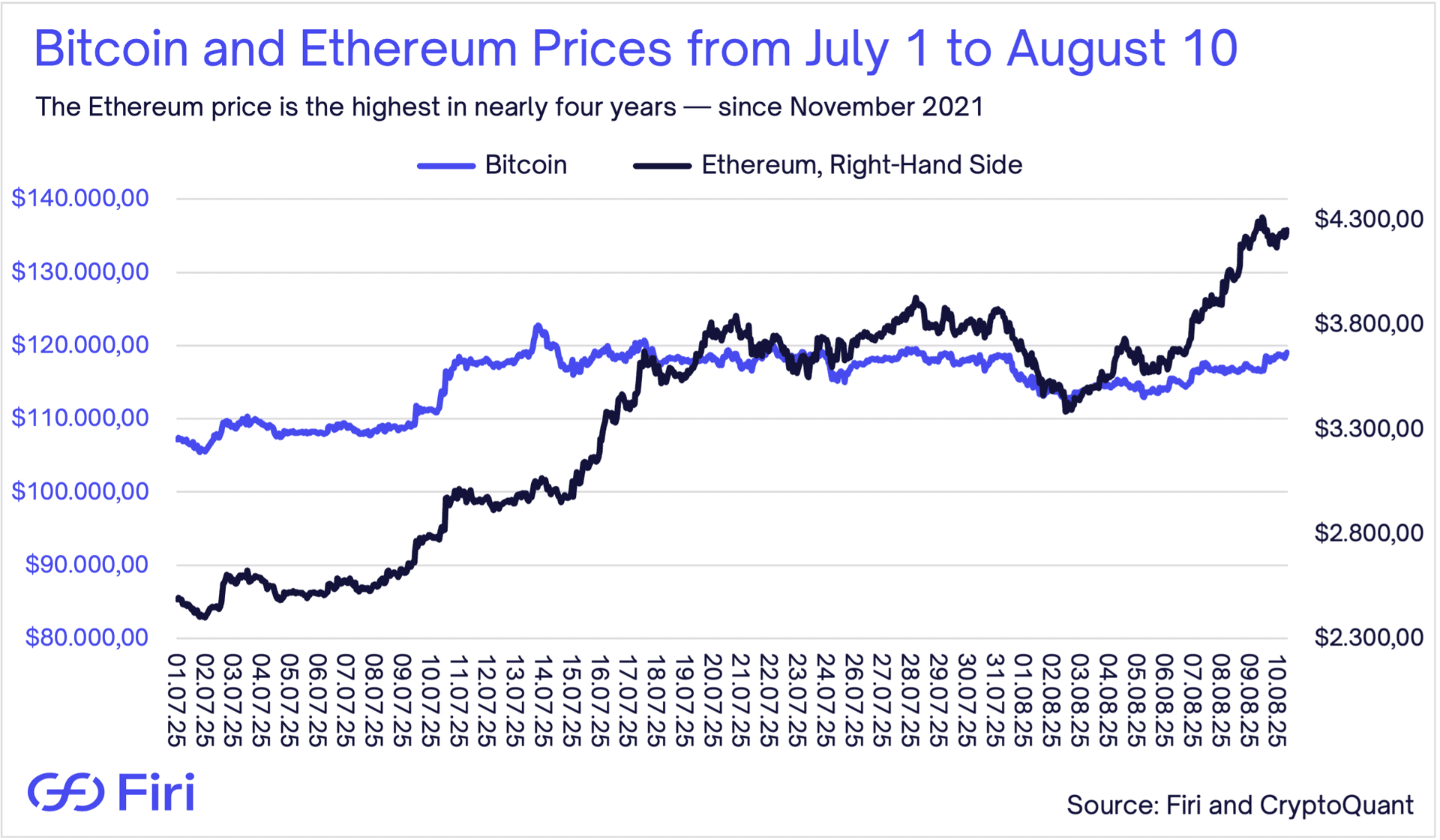

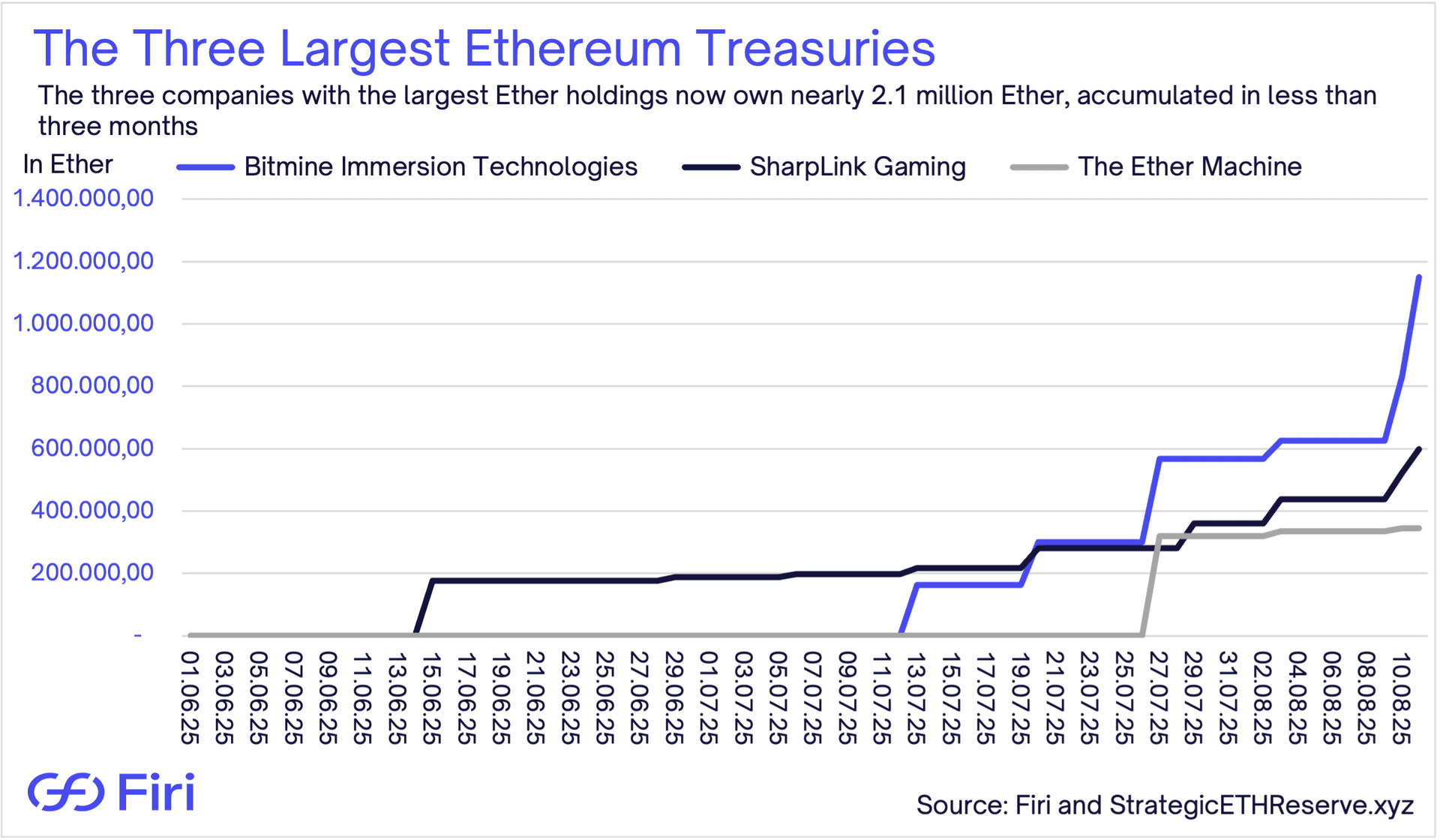

- Ethereum Hits 4-Year High:

- Ether surges past $4,000 to $4,340, reaching its highest level since November 2021 as three corporate treasuries accumulate 2.1 million Ether.

- SEC Clarifies Staking Rules:

- Liquid staking receives regulatory green light as new chairman Paul Atkins advances promise to make the U.S. the crypto capital of the world.

- DeFi Gets Wall Street Credibility:

- S&P Global makes history with first-ever credit rating for a decentralized finance (DeFi) protocol, assigning a B- rating to the $8 billion Sky stablecoin protocol.