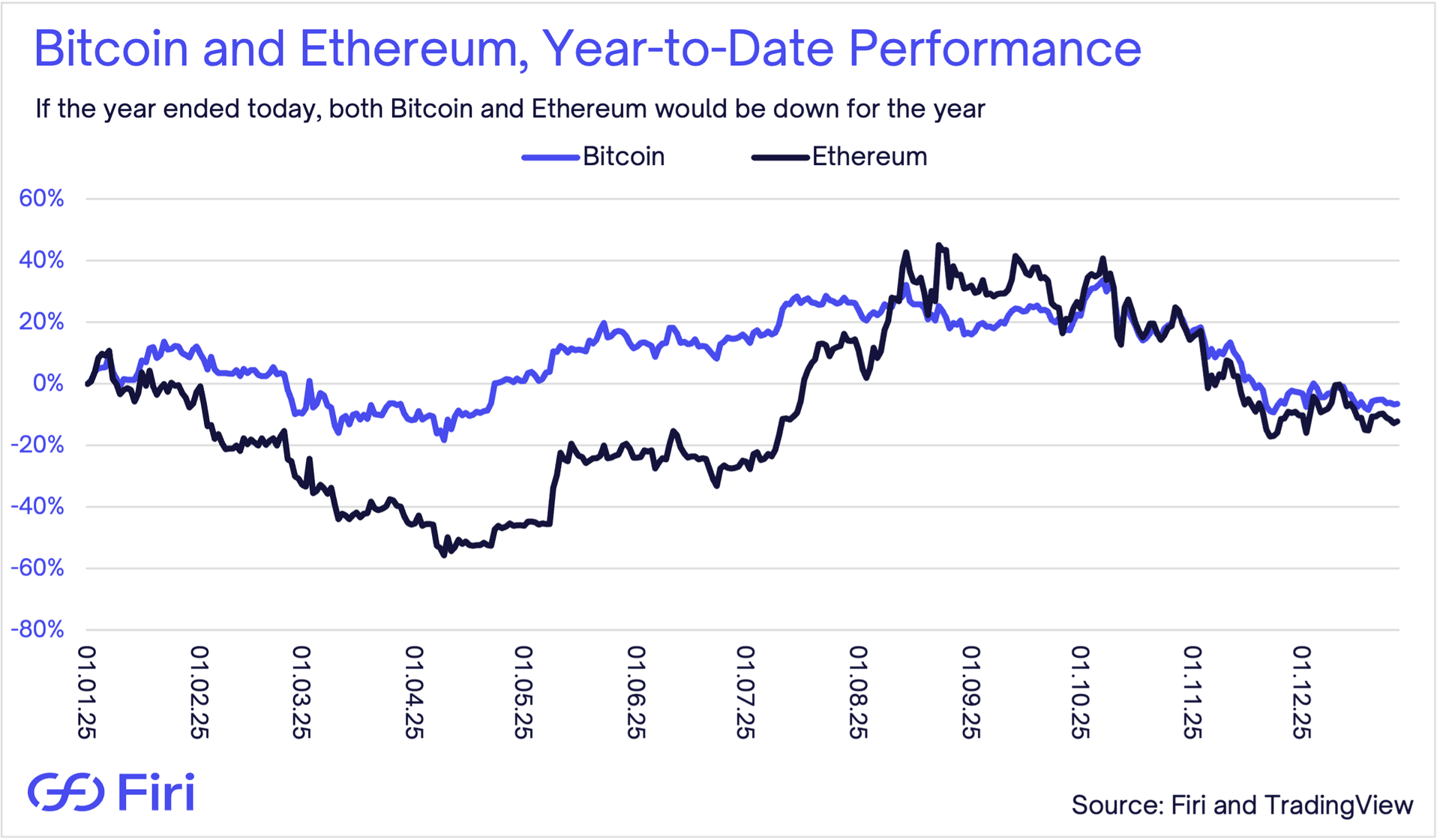

Firi Weekly: Crypto on Track to Finish the Year Below Its Start

- JPMorgan Launches Tokenized Fund on Ethereum:

- JPMorgan launched its first tokenized fund, MONY, issued on Ethereum. This suggests major banks are gradually moving real-world yield products onchain for broader utility.

- SoFi Launches Dollar Stablecoin:

- SoFi introduced SoFiUSD, a fully reserved USD stablecoin via SoFi Bank, aimed at institutional settlements.

- Fed Eases Crypto Restrictions for Smaller Banks:

- The U.S. Federal Reserve withdrew 2023 guidance that limited smaller supervised banks’ crypto activity, potentially enabling more bank-led crypto products and services.

- U.S. Inflation Surprises Positively:

- November’s U.S. inflation print came in at 2.7% versus 3.1% expected (September was 3.0%). The softer reading could shift expectations toward more rate cuts in 2026, but for now, crypto is still on track to end the year lower than it started.