Firi Weekly: Crypto Falls on U.S. Macro Weakness

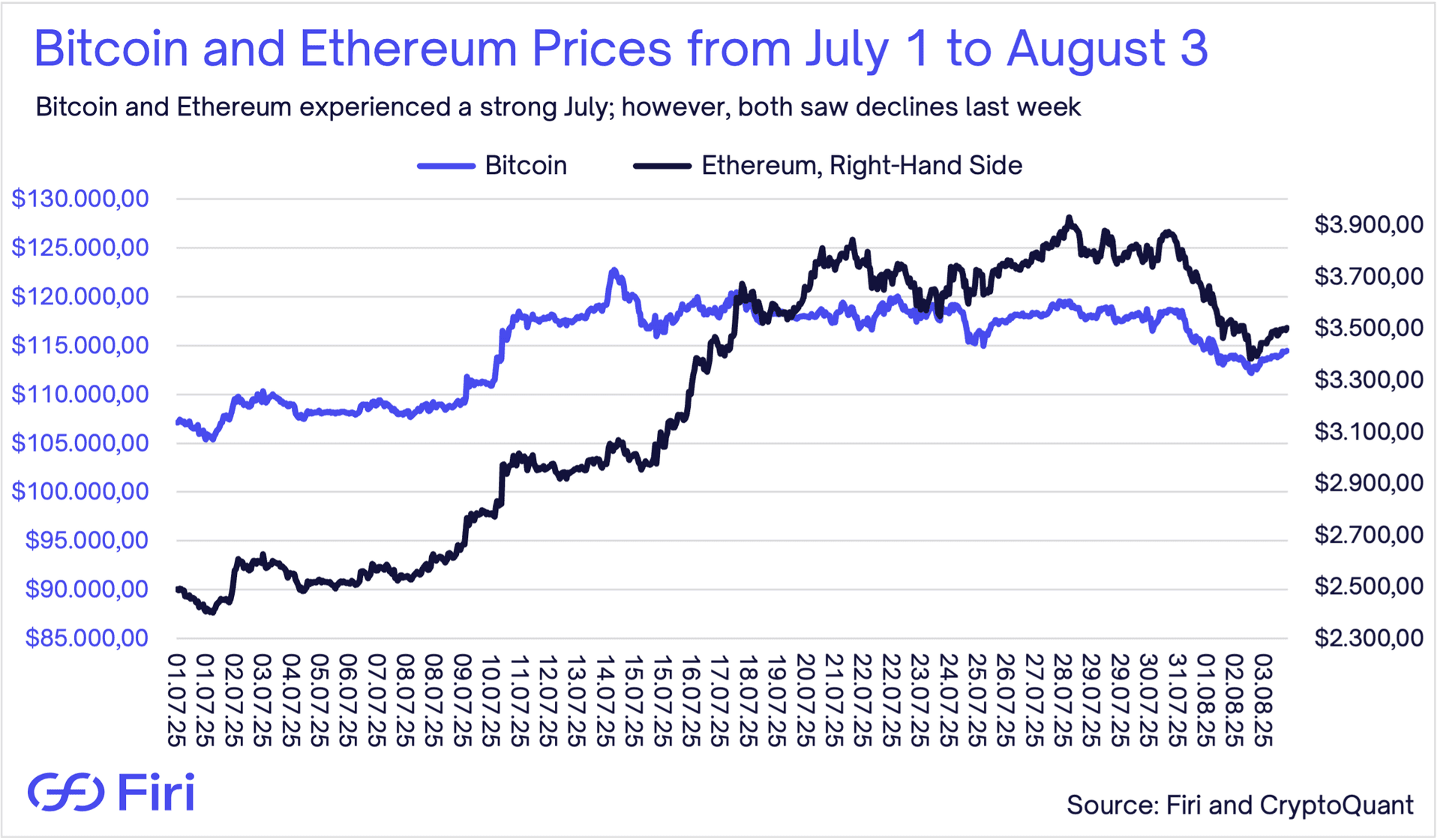

- Jobs Miss Triggers Selloff:

- The U.S. added only 73,000 jobs versus the expected 100,000, and major downward revisions reveal economic weakness. In response, Trump fired the head of labor market statistics.

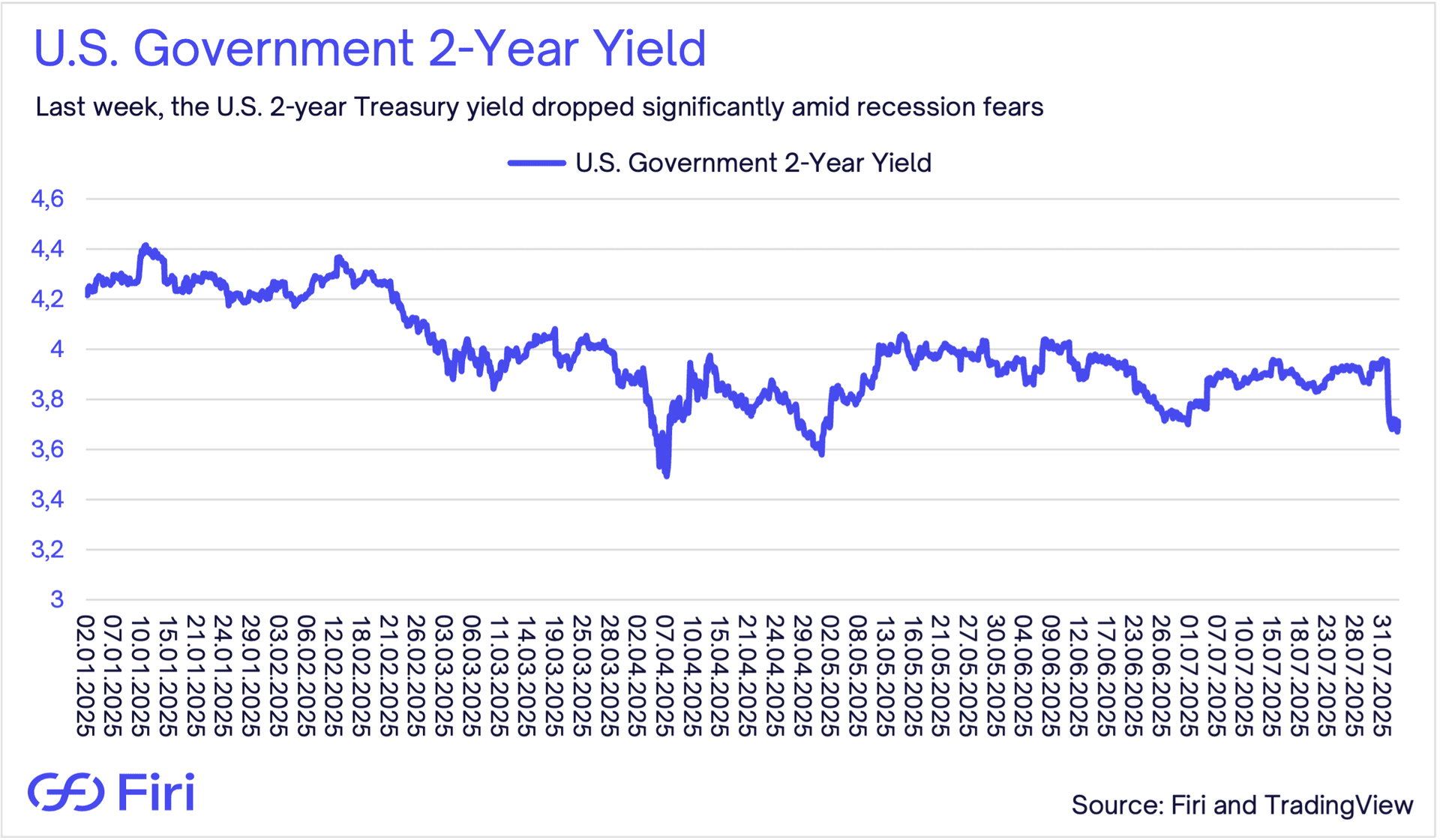

- Tariffs and Yields Signal Trouble:

- Trump’s new tariffs hit 60+ countries as U.S. bond yields plunge on recession fears, fueling market decline.

- SEC's Crypto Revolution:

- New SEC chairman unveils "Project Crypto" to make America the crypto capital, promising tokenized stocks and updated custody rules.

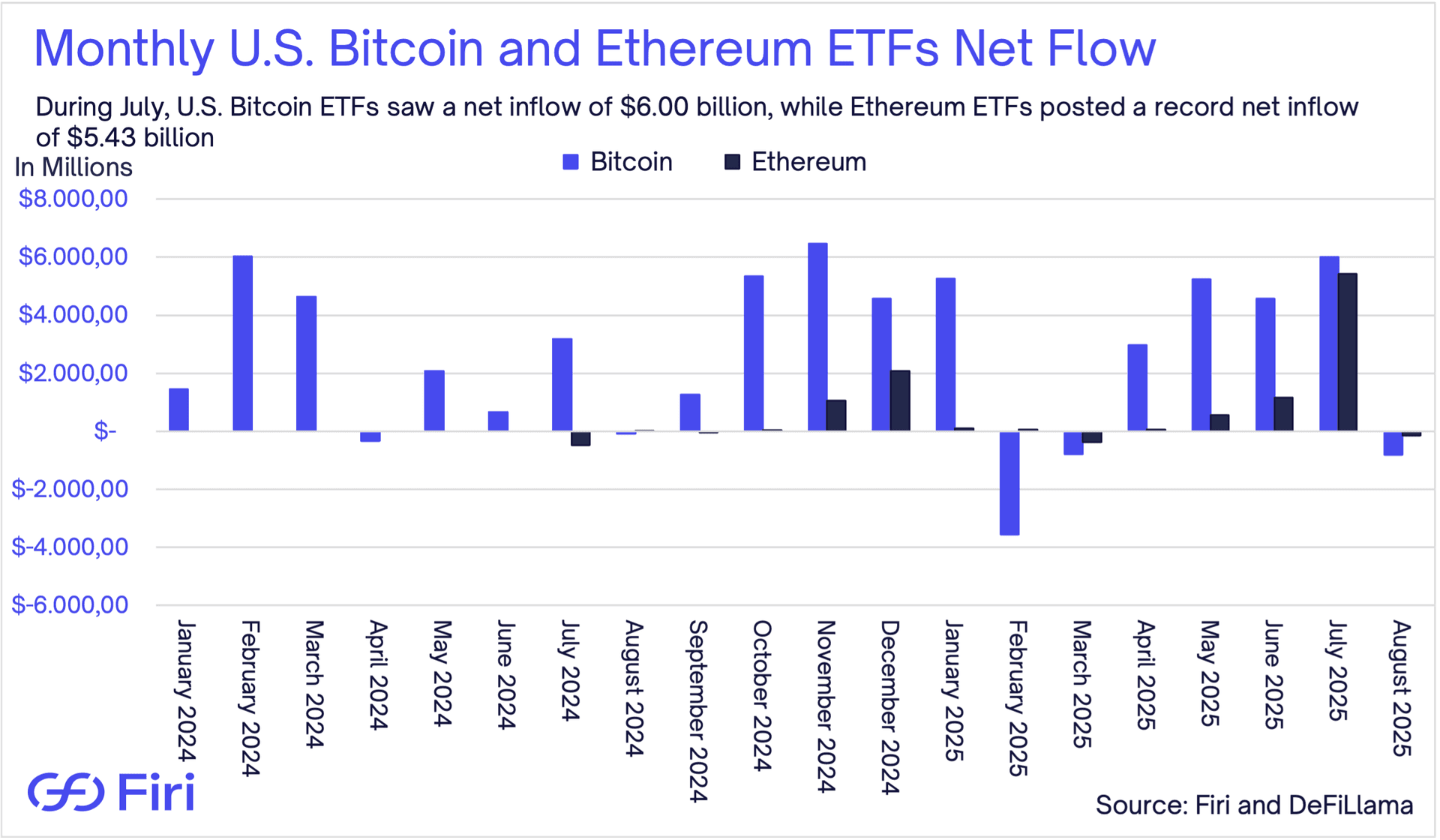

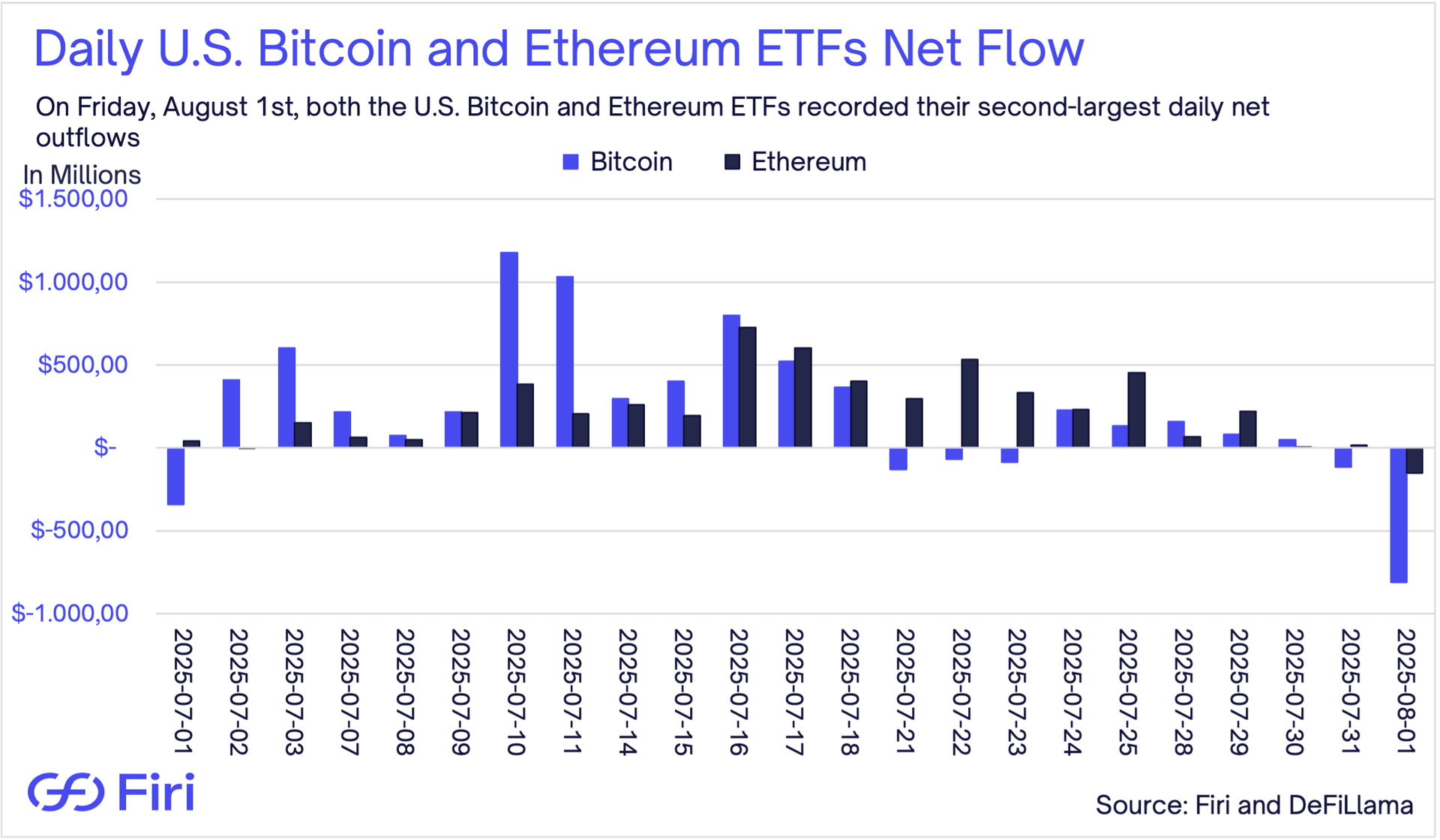

- ETF Records Before High Outflows:

- July saw $6 billion in Bitcoin and a record $5.43 billion in Ethereum ETF inflows, before August 1st marked the second-largest outflow day for both so far in 2025.