Firi Weekly: “Buy the rumor, sell the news”

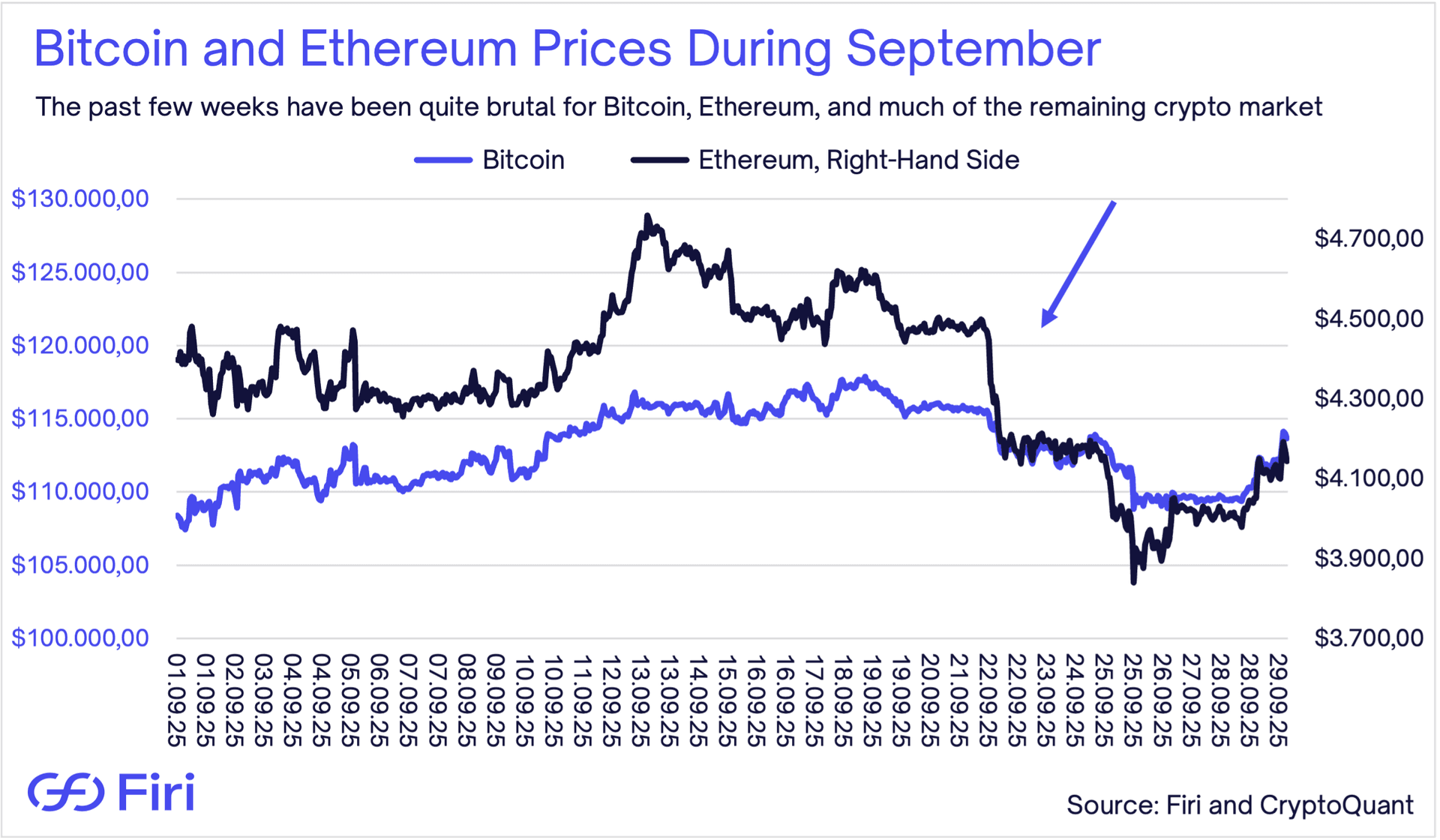

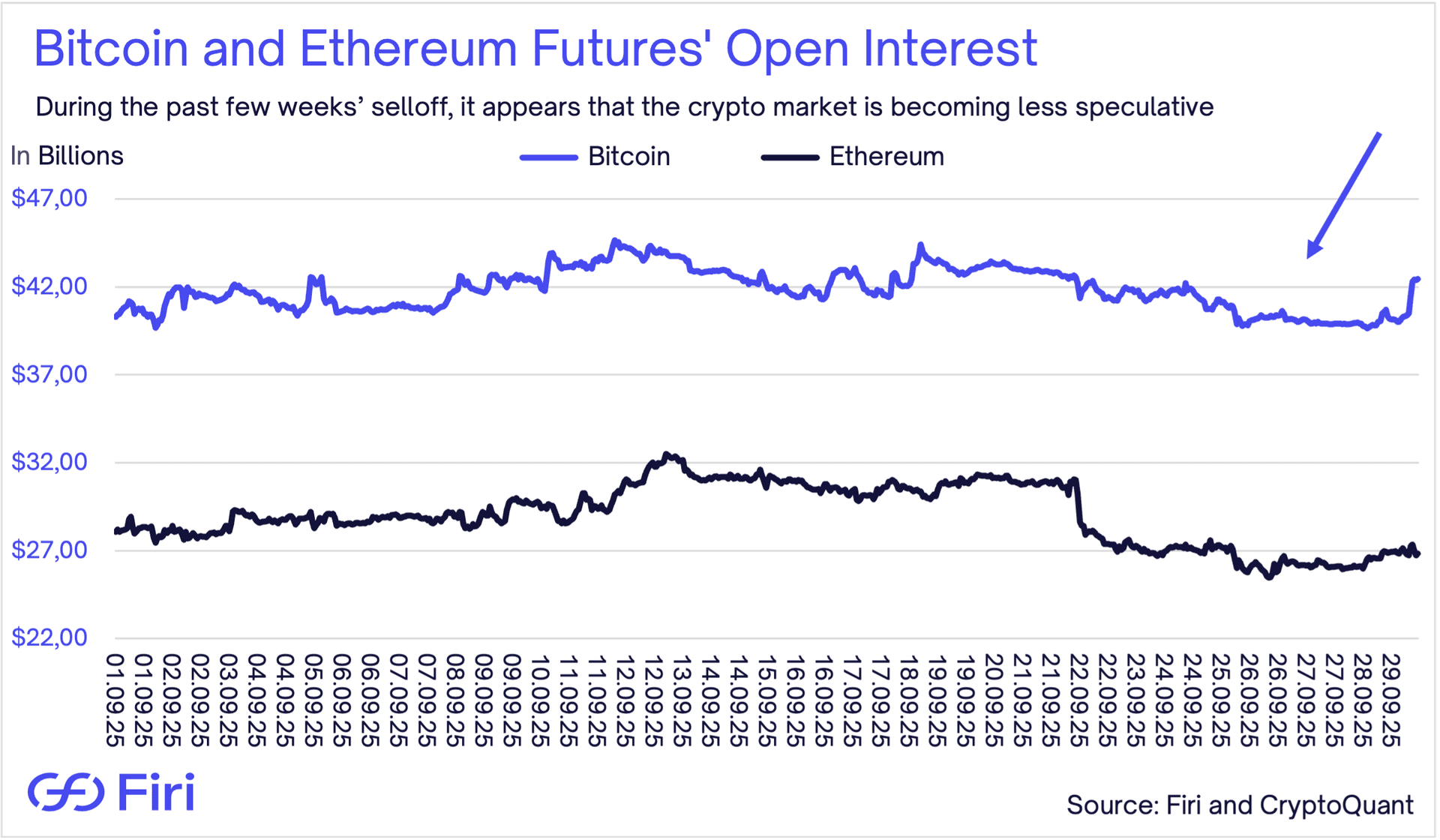

- Crypto Leverage Washout Hits Market:

- Bitcoin futures open interest dropped $4 billion and Ethereum $5.3 billion as overleveraged traders liquidated, causing healthy but brutal market correction.

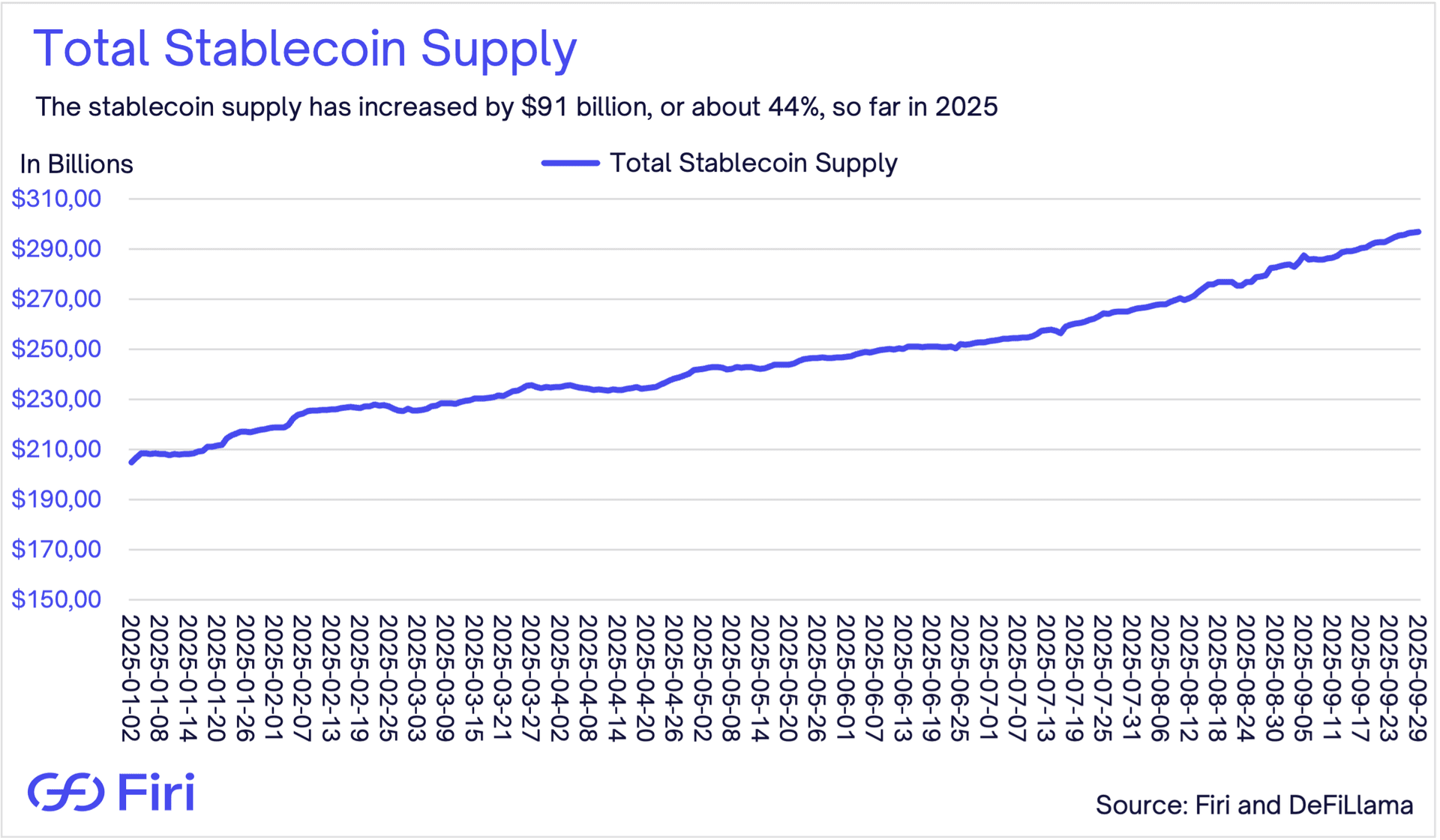

- European Banks Launch Euro Stablecoin:

- Nine major banks including Danske Bank and SEB form consortium to launch euro stablecoin by the second half of 2026, signaling traditional finance's crypto adoption.

- Morgan Stanley Offers Crypto Trading:

- E-Trade subsidiary to launch retail crypto trading in the first half of 2026, with plans for tokenizing traditional assets like stocks and bonds.

- Digital Euro Timeline Slips to 2029:

- European Central Bank targets 2029 for digital euro launch, potentially missing market opportunity as private stablecoins dominate by then.