Firi Weekly: Another Trade War?

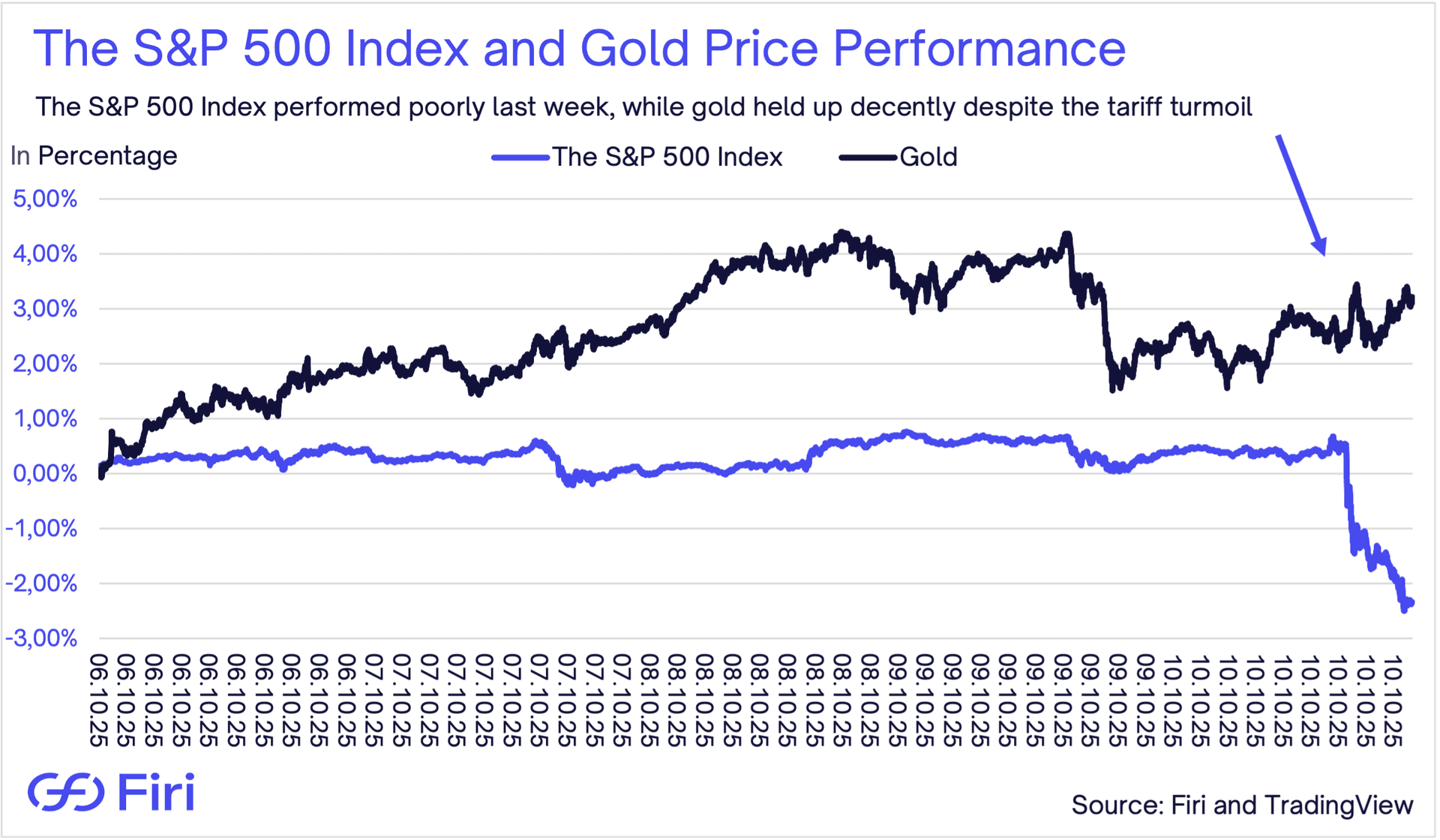

- Trump Threatens 100% China Tariffs:

- U.S. President Trump announces 100% tariffs on Chinese goods starting November 1, escalating trade tensions and triggering massive market volatility across stocks and crypto markets.

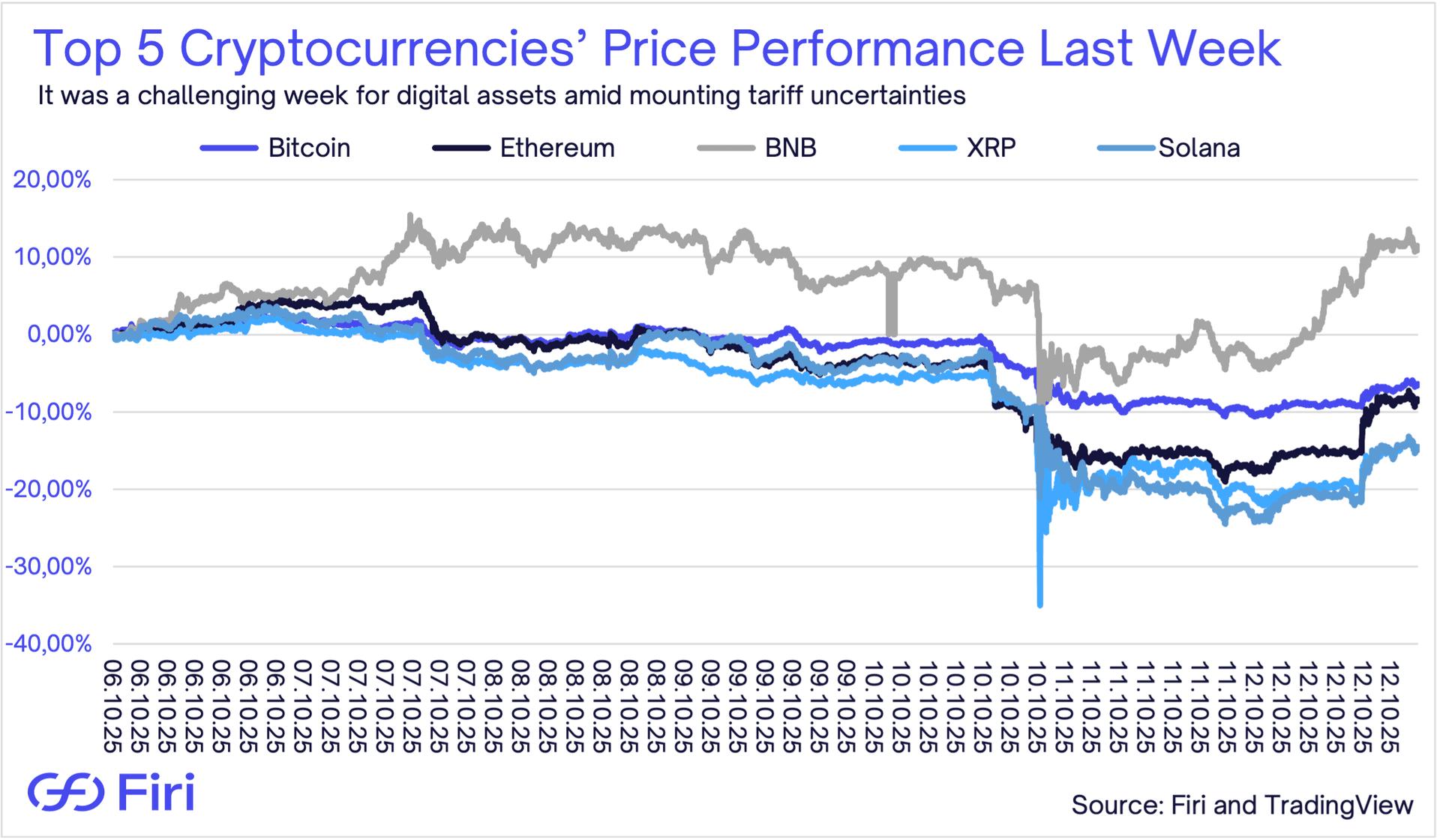

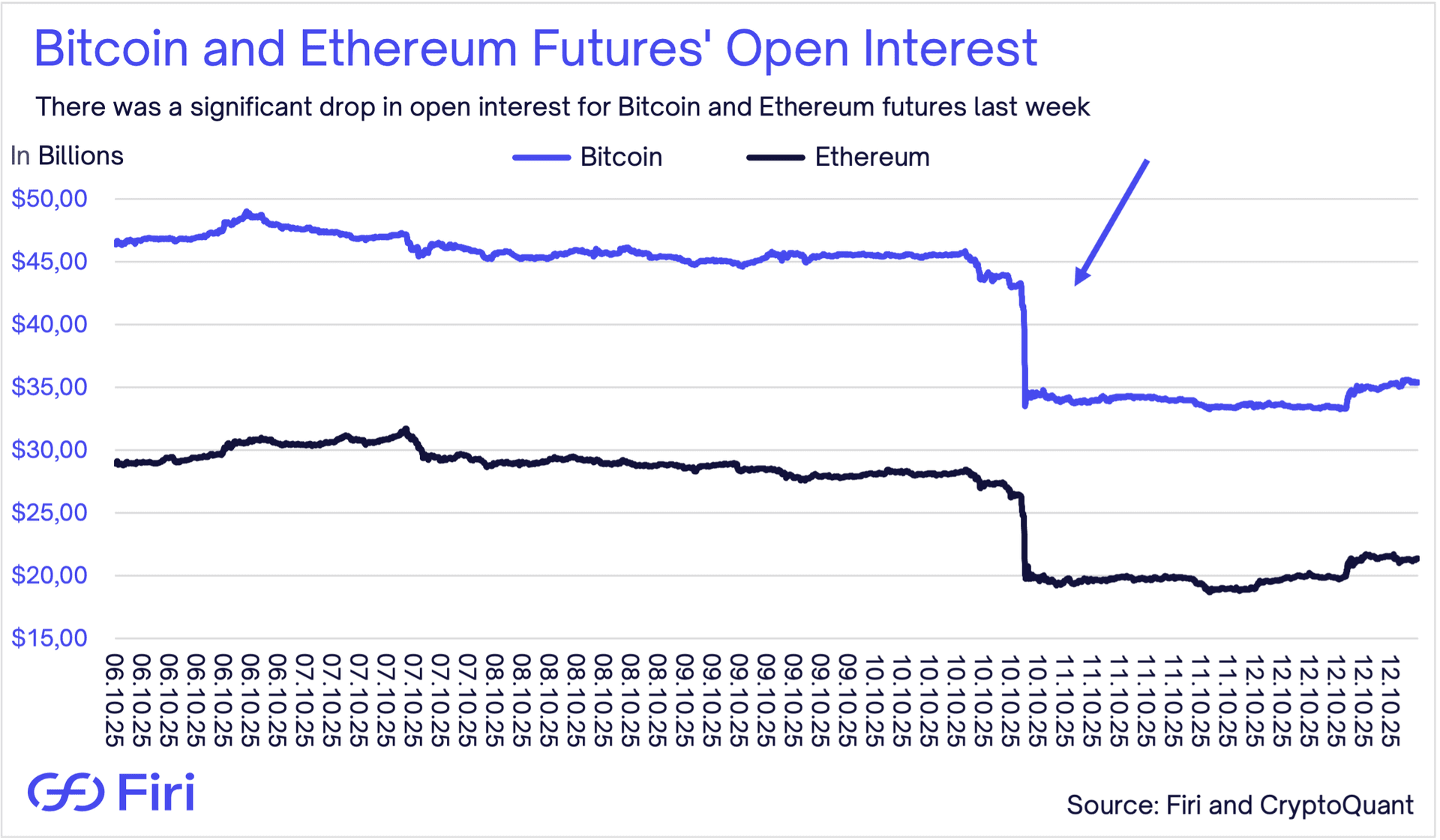

- Historic Over $19.3 Billion Crypto Liquidation:

- These tariff fears triggered the largest crypto liquidation on record on Friday, with XRP down by as much as 35% and Solana down 20% as leveraged trades unwound rapidly.

- Before Reversing Course on Trade War:

- President Trump backtracked on Sunday, saying “everything will be fine” with China, calming markets after the weekend drama and leading to a partial crypto price recovery.

- Bitcoin ETFs See $1.21 Billion Inflow:

- U.S. Bitcoin spot ETFs recorded their second-highest daily net inflow since their January 2024 launch, though the inflows came before the weekend volatility.