Firi Weekly: An Exciting Week Ahead

- U.S.-China Trade Deal Progress Before November 1 Deadline:

- Trump's 100% tariff threat was reportedly removed as the nations reached a preliminary consensus, with Trump and Xi Jinping meeting Thursday in South Korea to finalize the agreement.

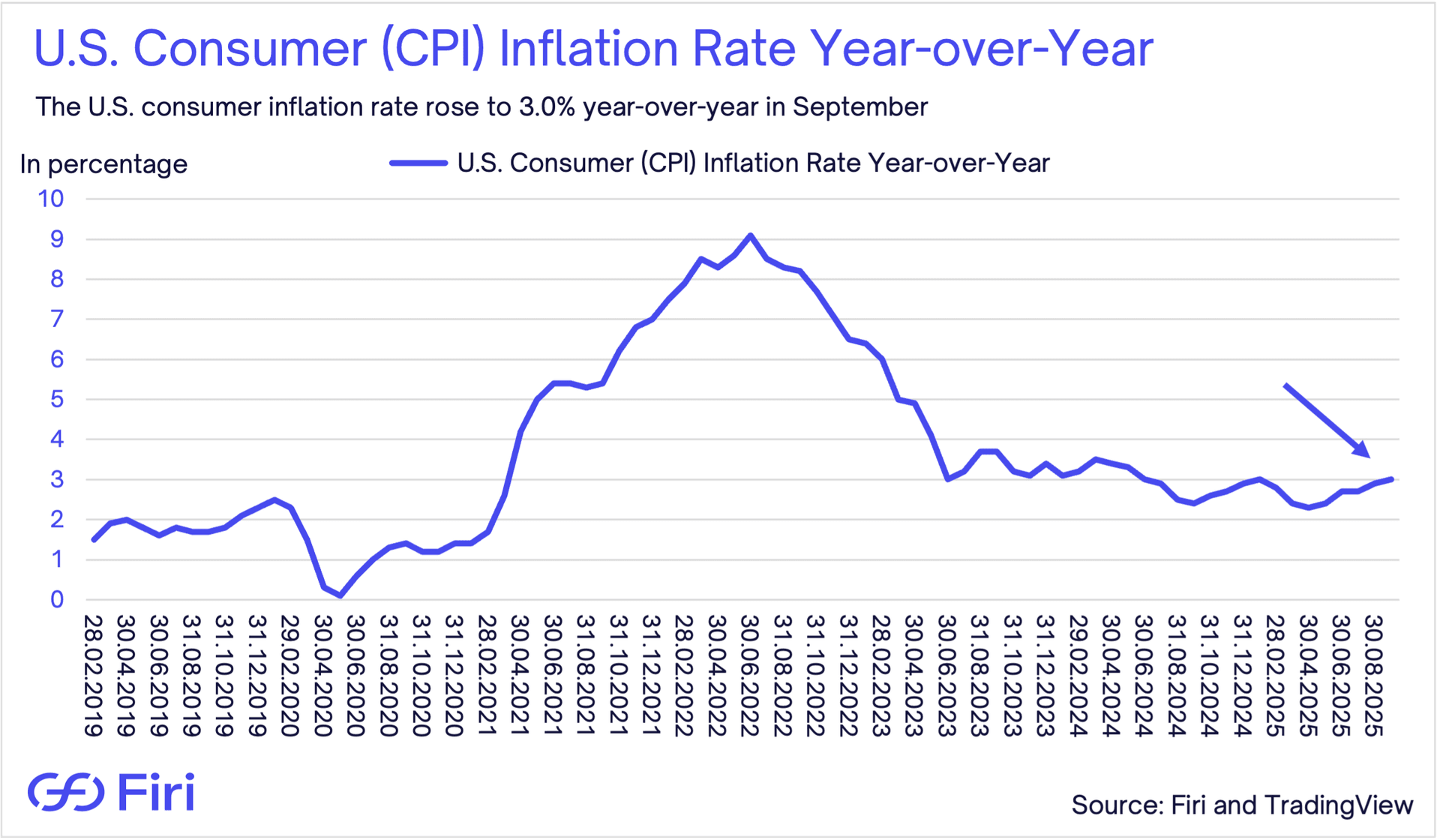

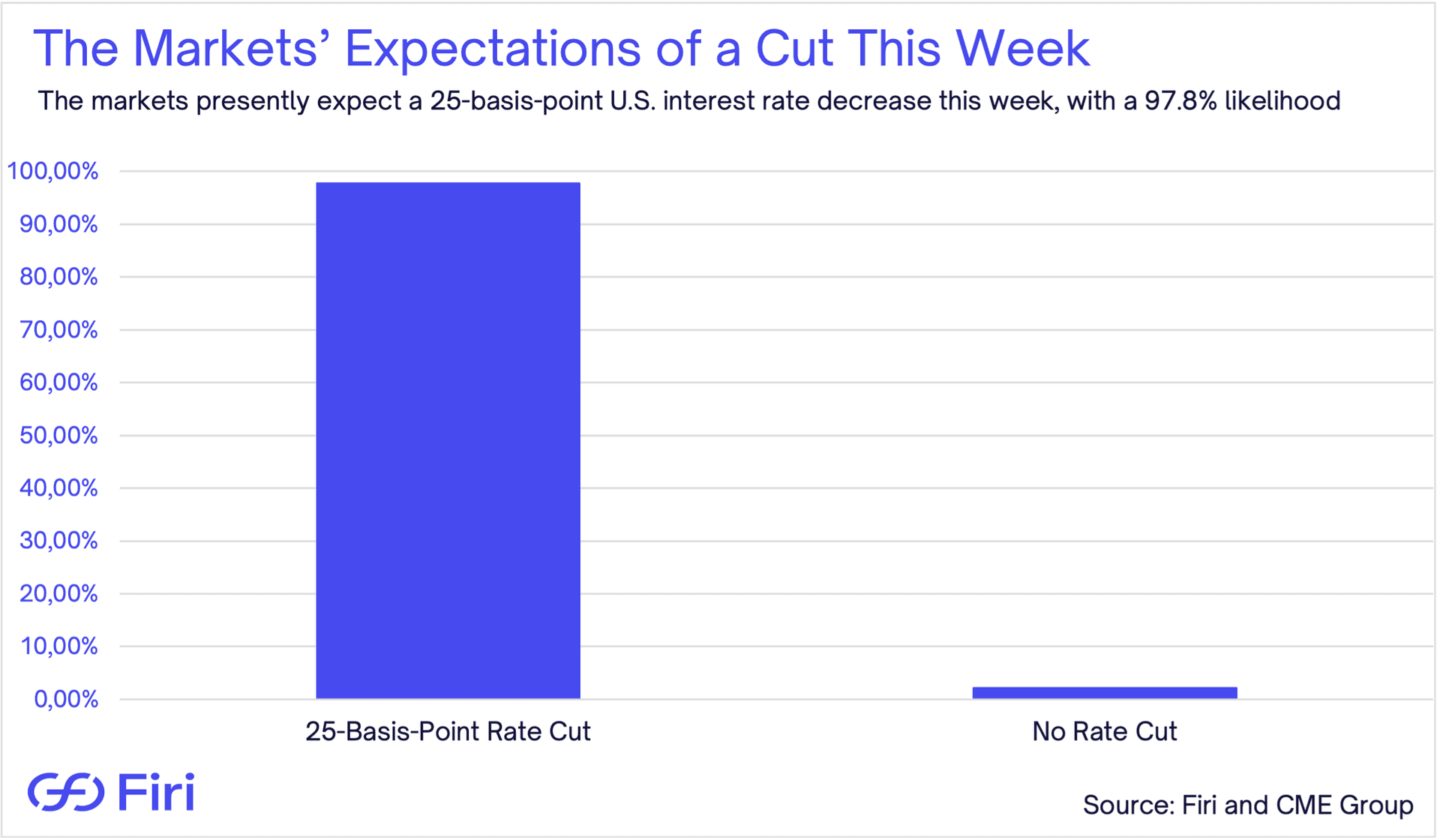

- Fed Expected to Cut Interest Rates 0.25%

- Markets show 97.8% certainty of Fed rate cut Wednesday after September inflation hit 3.0%, below the 3.1% forecast.

- JPMorgan Accepts Bitcoin and Ether as Loan Collateral:

- America's largest bank will allow institutional clients to use Bitcoin and Ether as collateral by year-end, marking major crypto adoption shift.

- Japan Launches First Yen-Backed Stablecoin:

- The JPYC startup launched Japan's first yen-backed stablecoin after receiving its license in August; the company targets $66 billion in issuance over three years.