Firi Weekly: An End to the Shutdown

- U.S. Government Shutdown Ends After 43 Days:

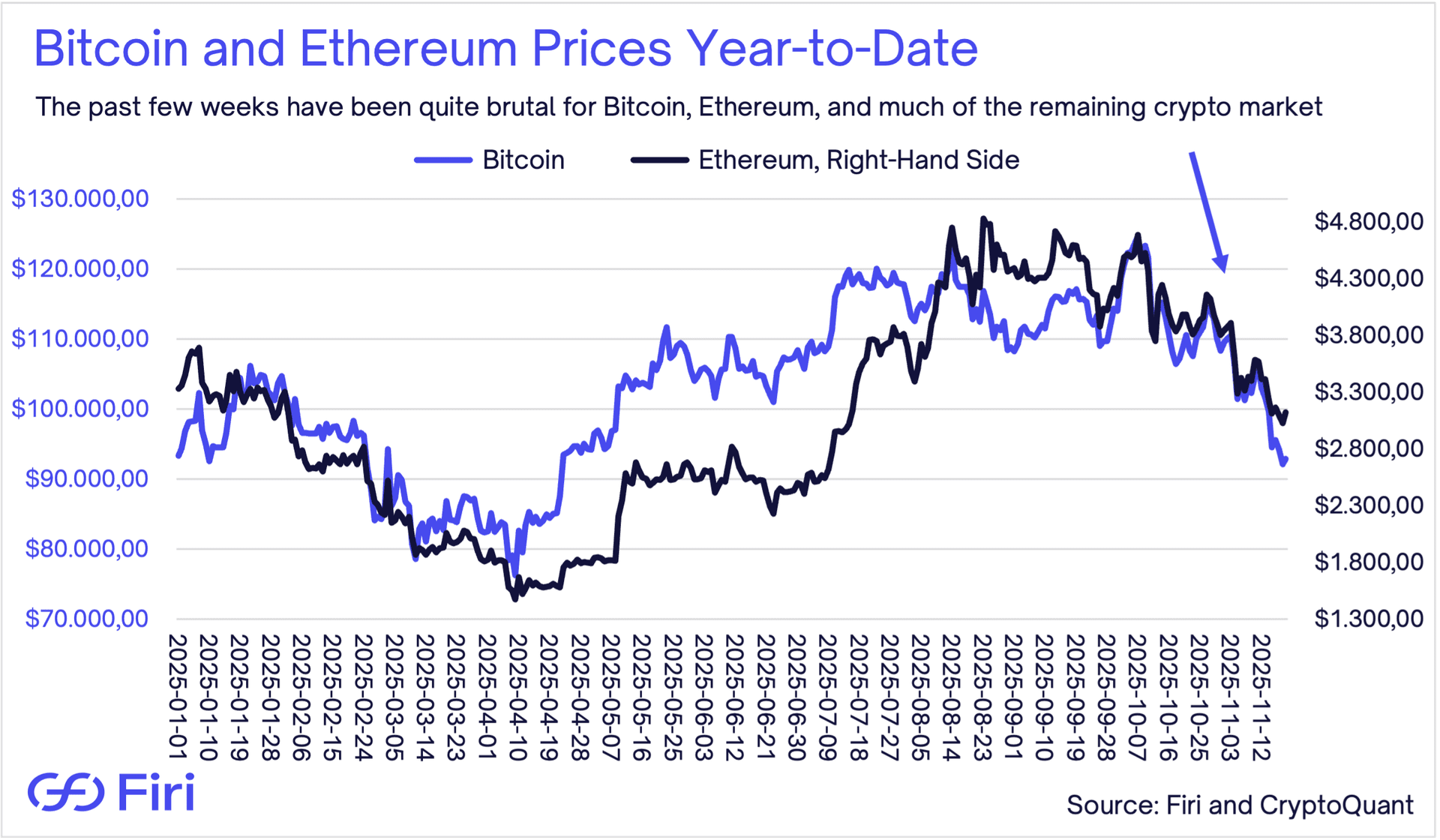

- The longest U.S. shutdown officially ended after potentially reducing GDP growth by 1.5 percentage points and driving Bitcoin to a six-month low.

- Record $2 Billion Outflow from Crypto ETFs:

- Exchange-traded crypto products experienced $2 billion in outflows last week, the highest since February, indicating traditional investors are selling amid negative market sentiment.

- JPMorgan Chase Launches Digital Dollar Token:

- America’s largest bank launched JPM Coin on Ethereum’s Base network for institutional clients, marking another step in traditional finance’s adoption of crypto.

- Czech National Bank Allocates $1 Million to Crypto:

- The Czech National Bank invested $1 million in Bitcoin and stablecoins as a test portfolio to gain practical experience with digital asset holdings.