Firi Weekly: A Nordic Stablecoin

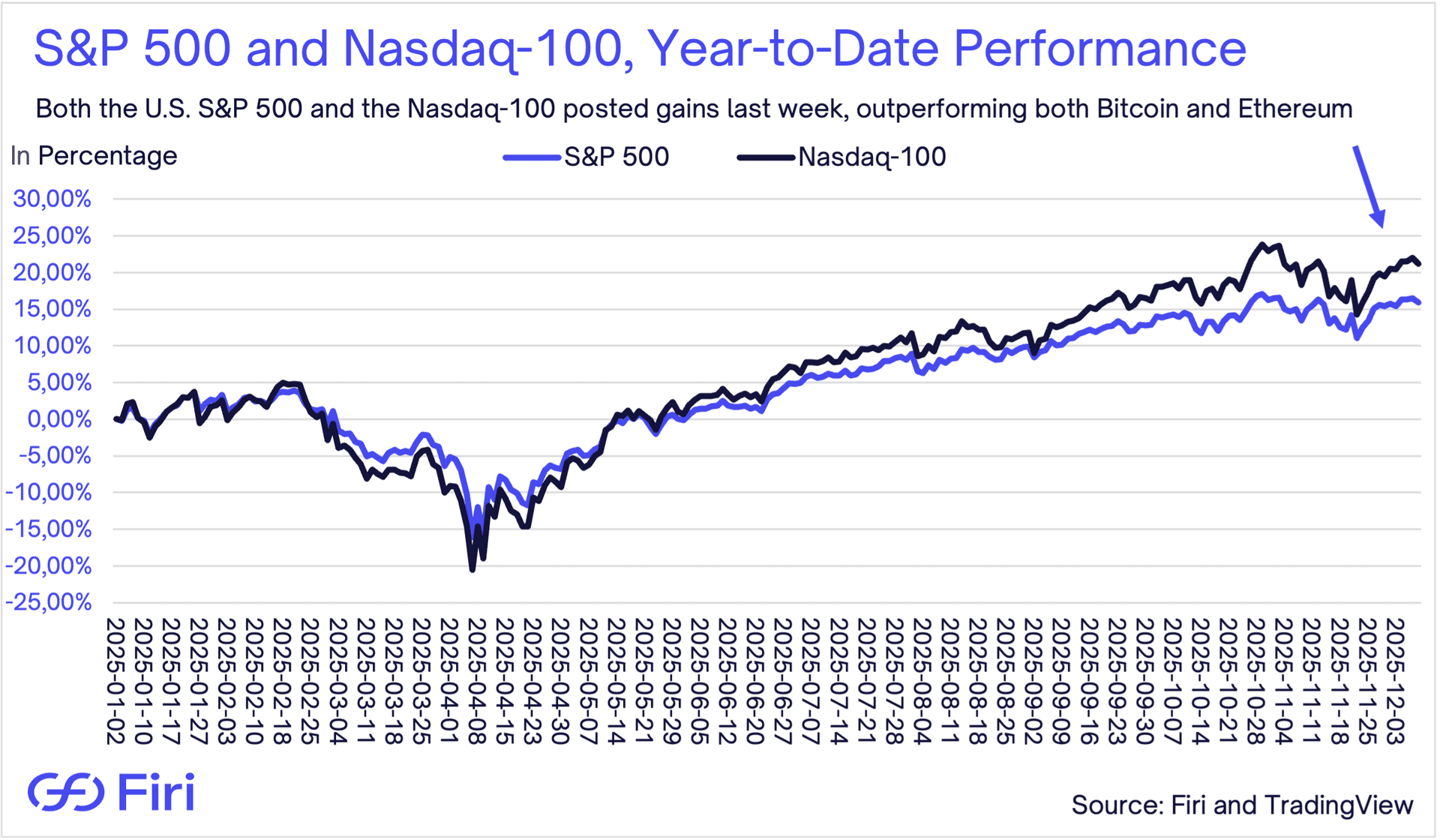

- Fed Rate Decision Expected Wednesday:

- Markets are pricing in an 89.4% probability of a 0.25-percentage-point cut. The outcome, along with the Federal Reserve's (Fed) commentary on economic conditions, will likely influence near-term sentiment across digital assets.

- European Banks Name Their Stablecoin "Qivalis":

- Ten major banks, including Danske Bank and Sweden's SEB, plan to launch this euro-denominated stablecoin in the second half of 2026. The European Central Bank (ECB) has reportedly expressed support for the initiative.

- Vanguard Reverses Course on Crypto ETFs:

- The world's second-largest asset manager now permits clients to trade Bitcoin and Ethereum exchange-traded funds (ETFs), marking a significant departure from its historically skeptical stance on digital assets.

- Record $8.6 Billion in Crypto Acquisitions:

- Industry deal activity through November has already surpassed the previous four years combined, reflecting both sector consolidation and growing institutional confidence as regulatory frameworks become clearer.