There are primarily two ways you can buy DOT. You can either buy DOT via a crypto exchange, or you can buy DOT from a private individual.

Regardless of which method one uses, one must store one's DOT in a cryptocurrency digital wallet.

You can choose between creating an account at a crypto exchange and letting the crypto exchange take care of your cryptocurrencies for you, or creating a decentralized wallet that supports DOT, where you yourself are responsible for the storage and security of your DOT.

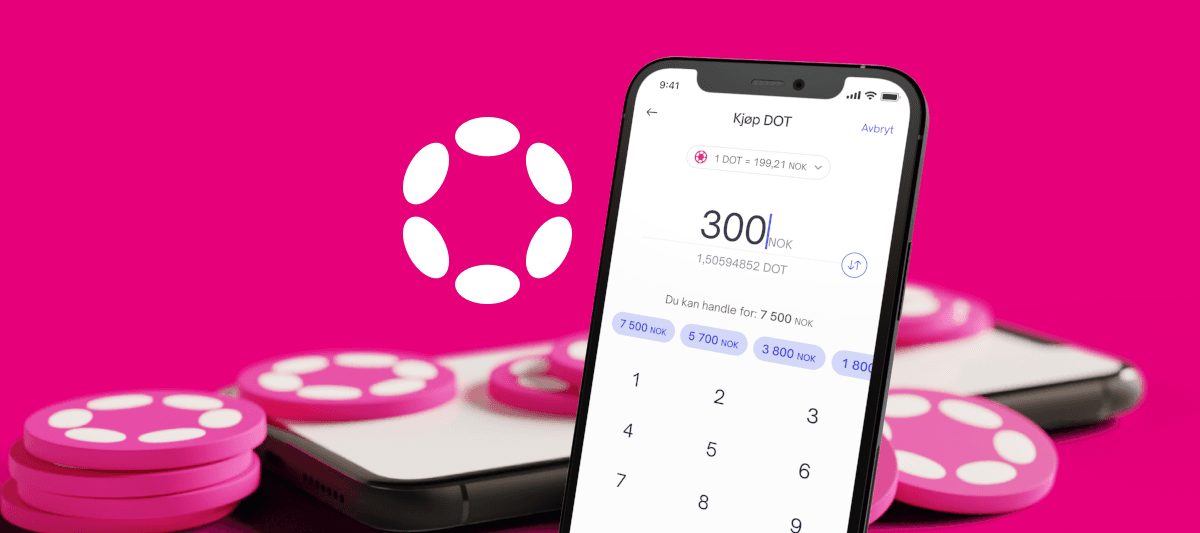

Buy and store DOT with a crypto exchange like Firi

An easy and cheap way to buy and store DOT is through a crypto exchange like Firi. Firi makes it easy to both buy, sell and store your DOT and other cryptocurrencies.

When you create an account through Firi, a Polkadot wallet is automatically generated for you. In practice, this means that Firi safely stores your DOTs for you and you don't have to worry about the security of your Polkadot wallet.

You get access to your Polkadot wallet by logging in to your user account with e-mail or Vipps, and by verifying yourself with BankID. You can easily send and receive DOT to your wallet in Firi from other exchanges or other Polkadot wallets.

Cryptocurrency can be bought 24/7, and Firi makes it easy to exchange between DOT and NOK. In less than one working day, you can also sell your DOTs for NOK and transfer to your bank account if you wish.

Store DOT in a decentralized wallet

Because Polkadot is a decentralized network, it is possible to create a separate, private wallet where you can store your DOTs.

When creating a Polkadot wallet, a public key is generated that acts as an account number and a private key that acts as a password for your wallet. If someone gets hold of your private key, they will have access to all your cryptocurrency.

No central actor can help you get your money back.

A public key can be compared to an account number for your Polkadot wallet. For example, if someone is going to send you DOT, they need access to your public key which is associated with your Polkadot wallet.

You can safely send your public key to others. A public key is a combination of letters and numbers unique to your Polkadot wallet.

A private key can be compared to the password for your digital wallet. A private key is a combination of letters and numbers unique to your Polkadot wallet.

A private key can also be generated in the form of a seed phrase, which in practice is 12 words that act as a backup copy of your private key. If someone has access to your private key or your seed phrase, they will also have access to all your cryptocurrency. It is therefore important not to share your private key with anyone.

It is important to note that a Polkadot wallet like Parity Signer for example only supports Polkadot, Kusama, parachains and Ethereum. For example, if you send DOT from a Polkadot wallet to a Bitcoin wallet, the DOT sent will be lost forever without being accessed.

It is very important that you are aware of which public key you send and receive cryptocurrency on.

After you have bought cryptocurrency from Firi, you can choose whether you want Firi to store your cryptocurrency for you, or whether you want to send it to a separate decentralized wallet.